- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2354

Investors Still Aren't Entirely Convinced By Foxconn Technology Co., Ltd.'s (TWSE:2354) Earnings Despite 27% Price Jump

Foxconn Technology Co., Ltd. (TWSE:2354) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

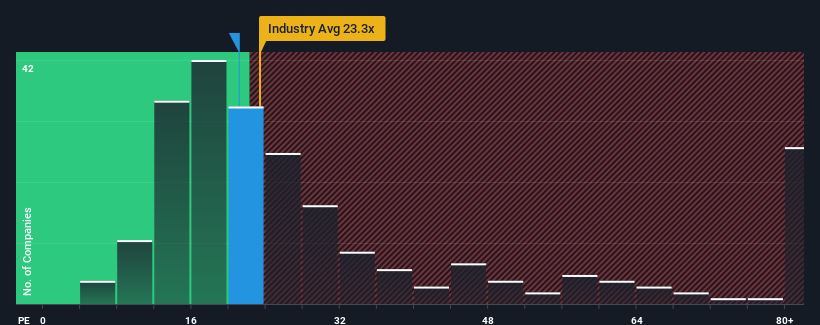

Although its price has surged higher, there still wouldn't be many who think Foxconn Technology's price-to-earnings (or "P/E") ratio of 21.1x is worth a mention when the median P/E in Taiwan is similar at about 23x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Foxconn Technology has been doing a reasonable job lately as its earnings haven't declined as much as most other companies. One possibility is that the P/E is moderate because investors think this relatively better earnings performance might be about to evaporate. You'd much rather the company wasn't bleeding earnings if you still believe in the business. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Foxconn Technology

Does Growth Match The P/E?

In order to justify its P/E ratio, Foxconn Technology would need to produce growth that's similar to the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 9.7% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 80% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 24% growth forecast for the broader market.

With this information, we find it interesting that Foxconn Technology is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Foxconn Technology's P/E?

Its shares have lifted substantially and now Foxconn Technology's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Foxconn Technology currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Foxconn Technology (1 is a bit concerning!) that we have uncovered.

Of course, you might also be able to find a better stock than Foxconn Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2354

Foxconn Technology

Manufactures, processes, and sells cases, heat dissipation modules, and consumer electronics products.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives