- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2347

3 Dividend Stocks To Consider With Up To 5.7% Yield

Reviewed by Simply Wall St

In the wake of recent political shifts and economic policy adjustments, global markets have experienced notable rallies, with U.S. indices reaching record highs fueled by expectations of growth-friendly policies. Amidst these dynamic market conditions, investors often turn to dividend stocks as a potential source of steady income and stability, especially when navigating uncertain economic landscapes. A good dividend stock typically offers a reliable yield and demonstrates resilience in varied market environments, making them an attractive consideration for those seeking consistent returns amidst fluctuating economic indicators.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

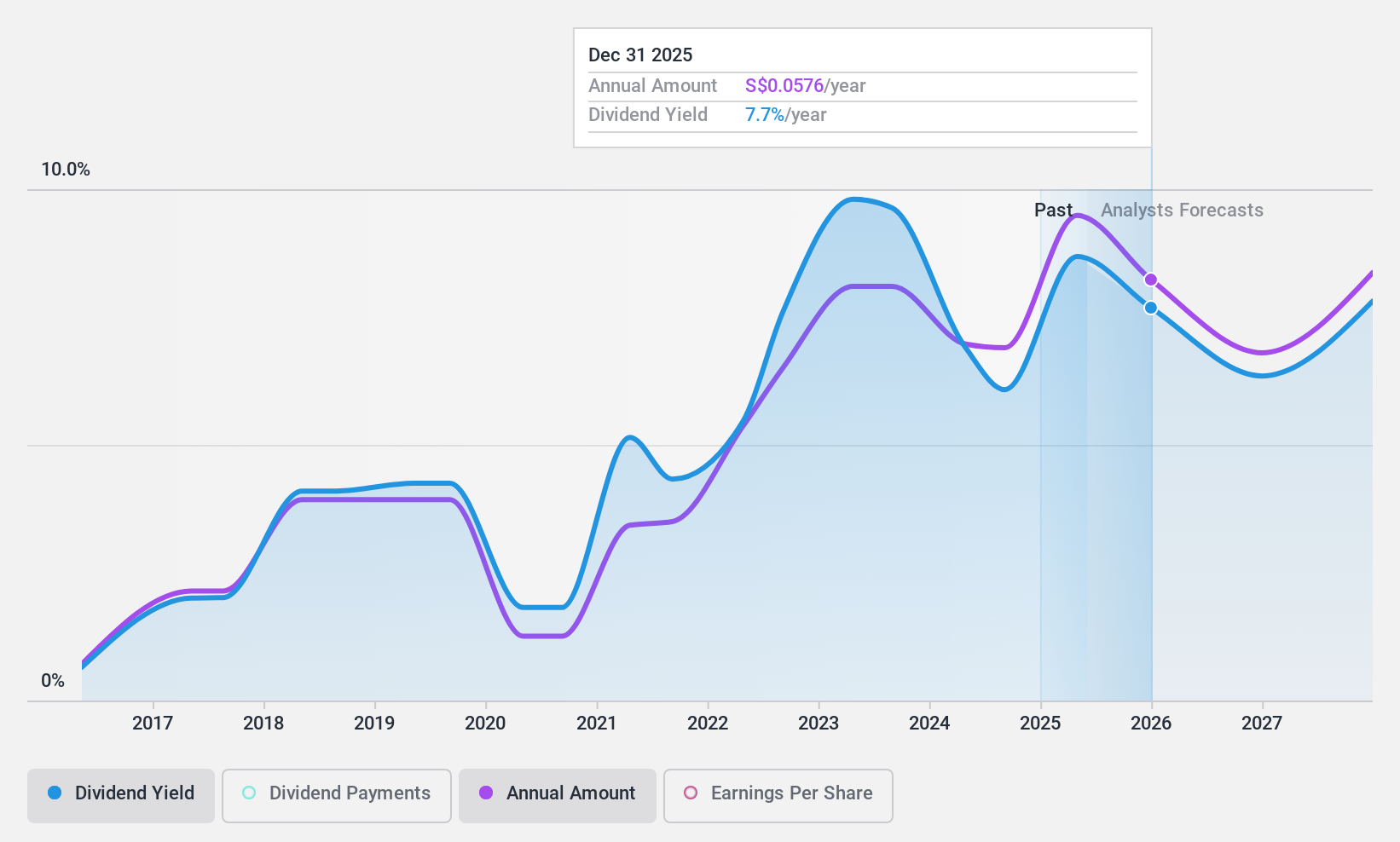

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market cap of SGD1.44 billion.

Operations: Bumitama Agri Ltd. generates revenue from its Plantations and Palm Oil Mills segment, amounting to IDR15.55 trillion.

Dividend Yield: 5.8%

Bumitama Agri's dividend payments have been volatile over the past decade, though they have shown growth. The dividends are well-covered by both earnings and cash flows, with payout ratios of 47.2% and 54.8%, respectively. Despite trading at a significant discount to its estimated fair value, its dividend yield of 5.79% is slightly below the top quartile in Singapore's market. Recent earnings show a decrease in net income compared to last year, potentially impacting future payouts.

- Dive into the specifics of Bumitama Agri here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Bumitama Agri is priced lower than what may be justified by its financials.

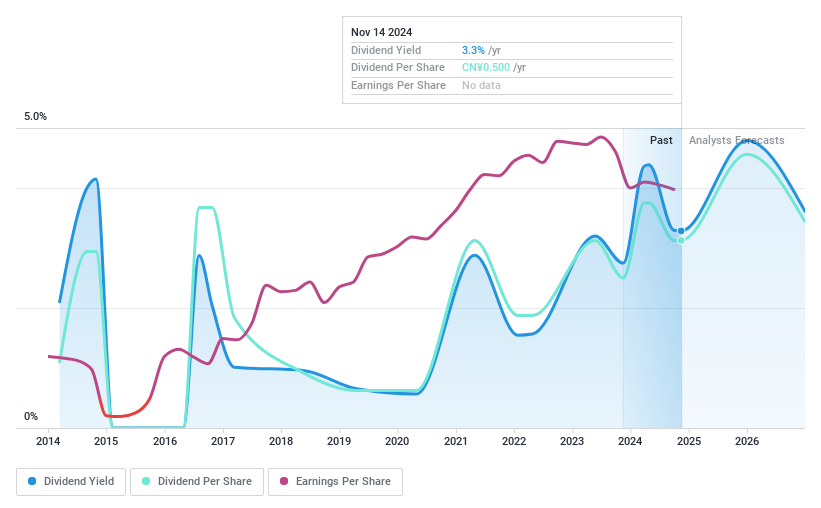

Wangneng EnvironmentLtd (SZSE:002034)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wangneng Environment Co., Ltd offers solid waste solutions in China with a market cap of CN¥6.64 billion.

Operations: Wangneng Environment Co., Ltd's revenue from the Ecological Protection and Environmental Governance Industry is CN¥3.21 billion.

Dividend Yield: 3.2%

Wangneng Environment Ltd's dividend payments have been volatile over the past decade, but they are well-covered by earnings and cash flows with payout ratios of 36% and 30.3%, respectively. The company offers a competitive dividend yield of 3.24%, placing it in the top quartile of China's market. Despite a slight decrease in recent net income, the firm maintains strong coverage for its dividends, supported by ongoing share buybacks and stable revenue growth.

- Take a closer look at Wangneng EnvironmentLtd's potential here in our dividend report.

- The valuation report we've compiled suggests that Wangneng EnvironmentLtd's current price could be quite moderate.

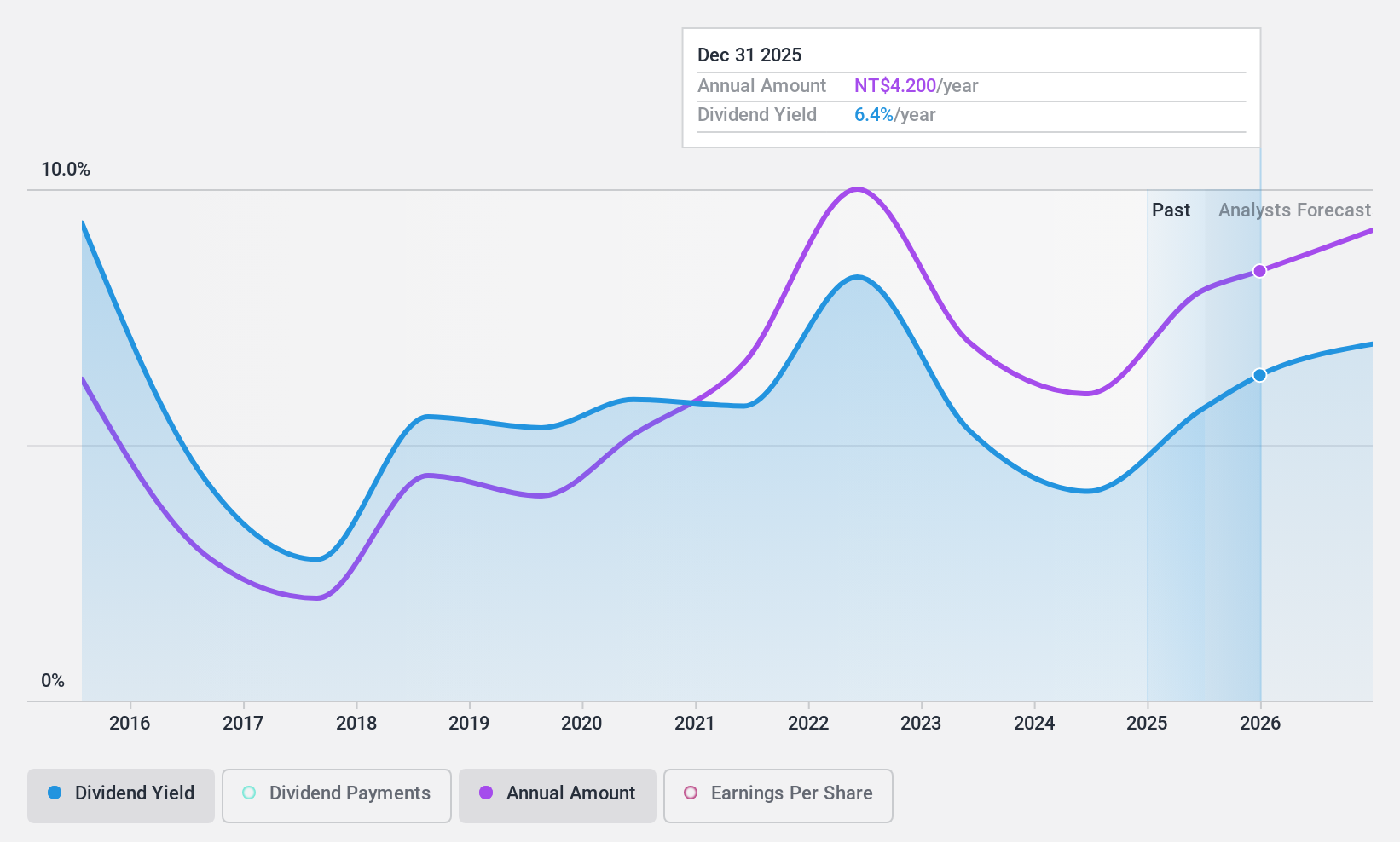

Synnex Technology International (TWSE:2347)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Synnex Technology International Corporation, along with its subsidiaries, distributes information systems, communication, consumer, and semiconductor products and has a market cap of NT$123.09 billion.

Operations: Synnex Technology International Corporation's revenue is primarily derived from its Distribution Business Group, which accounts for NT$281.46 billion, and its Semiconductor Business Group, contributing NT$170.54 billion.

Dividend Yield: 4.1%

Synnex Technology International's dividends are covered by earnings and cash flows, with payout ratios of 59.3% and 53.6%, respectively, despite a volatile dividend history over the past decade. The company reported strong financial results for Q3 2024, with sales reaching TWD 108.80 billion and net income at TWD 2.26 billion, reflecting growth from the previous year. However, its dividend yield of 4.07% is below Taiwan's top quartile payers.

- Navigate through the intricacies of Synnex Technology International with our comprehensive dividend report here.

- According our valuation report, there's an indication that Synnex Technology International's share price might be on the cheaper side.

Seize The Opportunity

- Explore the 1940 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2347

Synnex Technology International

Distributes information system, communication, consumer, and semiconductor products.

Solid track record with adequate balance sheet and pays a dividend.