- Taiwan

- /

- Communications

- /

- TWSE:2345

Asian Value Stocks Estimated Below Intrinsic Worth

Reviewed by Simply Wall St

As global markets navigate a complex landscape, the Asian financial scene is drawing attention with its potential for value investing, particularly as China's economic indicators suggest room for further stimulus and Japan's moderate recovery continues. In this environment, identifying stocks that are trading below their intrinsic worth can be an effective strategy, offering opportunities to capitalize on market inefficiencies while mitigating risk through thorough analysis.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.99 | CN¥76.64 | 49.1% |

| Taiyo Yuden (TSE:6976) | ¥2411.50 | ¥4741.52 | 49.1% |

| Livero (TSE:9245) | ¥1692.00 | ¥3352.54 | 49.5% |

| Kanto Denka Kogyo (TSE:4047) | ¥841.00 | ¥1677.13 | 49.9% |

| Hangzhou Zhongtai Cryogenic Technology (SZSE:300435) | CN¥16.67 | CN¥33.21 | 49.8% |

| Gushengtang Holdings (SEHK:2273) | HK$38.35 | HK$76.50 | 49.9% |

| Fuji (TSE:6134) | ¥2253.50 | ¥4448.27 | 49.3% |

| Everest Medicines (SEHK:1952) | HK$54.55 | HK$107.01 | 49% |

| Brangista (TSE:6176) | ¥597.00 | ¥1180.86 | 49.4% |

| Boditech Med (KOSDAQ:A206640) | ₩15850.00 | ₩31439.92 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

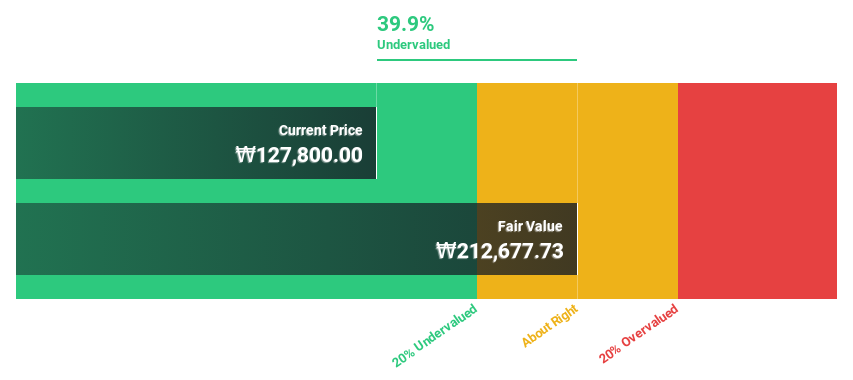

Yuhan (KOSE:A000100)

Overview: Yuhan Corporation is a South Korean company that manufactures and sells prescription drugs, over-the-counter drugs, veterinary drugs, and household goods both domestically and internationally, with a market cap of ₩8.04 trillion.

Operations: The company's revenue segments include biotechnology startups, which contribute ₩2.11 billion to its overall earnings.

Estimated Discount To Fair Value: 22.4%

Yuhan's current trading price of ₩107,300 is significantly below its estimated fair value of ₩138,269.28, suggesting it may be undervalued based on cash flows. Despite a forecasted 44% annual earnings growth outpacing the Korean market average, recent financials show declining profit margins and net income compared to the previous year. The company has engaged in substantial share buybacks over time but reported no repurchases in early 2025.

- Our comprehensive growth report raises the possibility that Yuhan is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Yuhan.

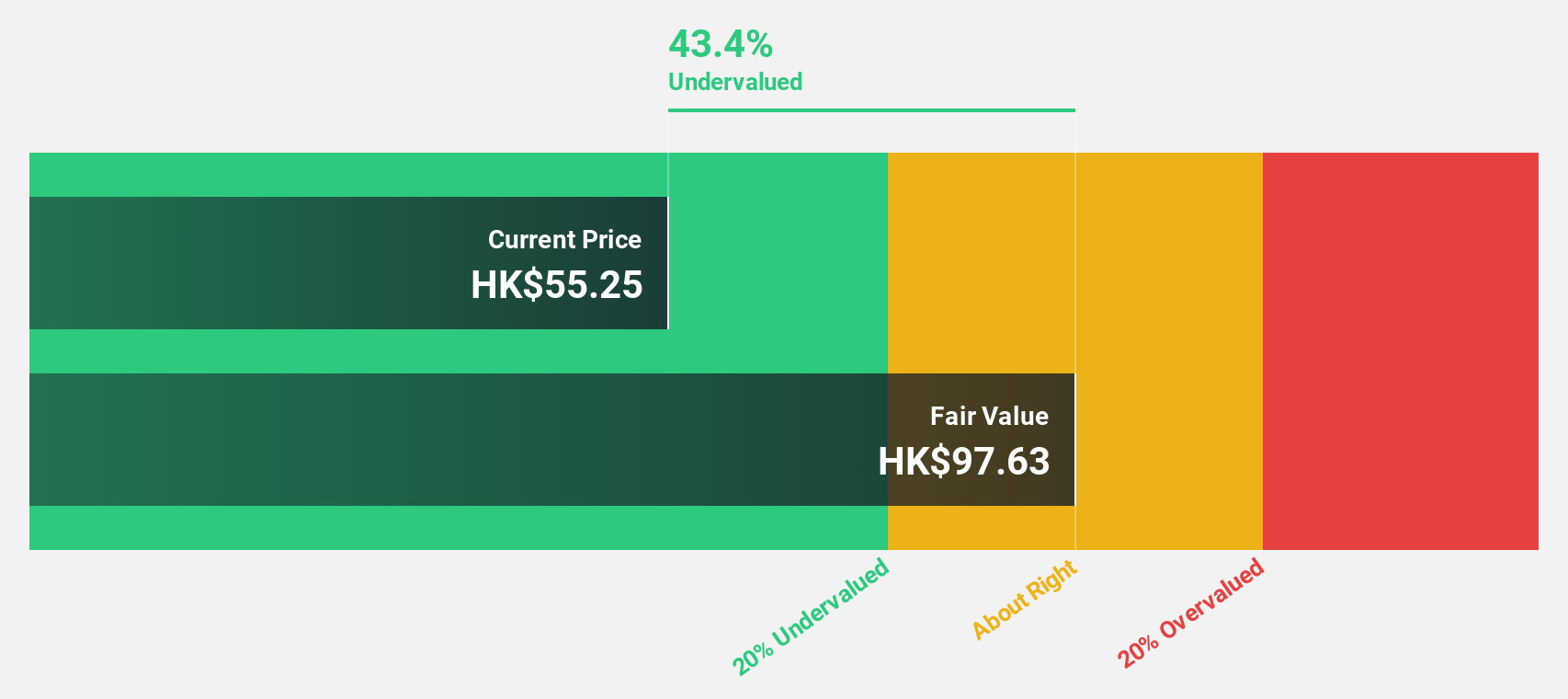

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company that designs, manufactures, and markets machines, tools, and materials for the semiconductor and electronics assembly industries globally, with a market cap of HK$23.74 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Solutions segment, which generated HK$7.42 billion, and its Surface Mount Technology (SMT) Solutions segment, contributing HK$5.79 billion.

Estimated Discount To Fair Value: 41.9%

ASMPT's current trading price of HK$57 is significantly below its estimated fair value of HK$98.04, highlighting potential undervaluation based on cash flows. Despite a decrease in profit margins and net income compared to the previous year, ASMPT anticipates revenue growth between US$410 million and US$470 million for Q2 2025, driven by seasonal factors and strong bookings. The company declared a special dividend of HKD 0.25 per share but reduced its final dividend to HKD 0.07 per share for 2024.

- The analysis detailed in our ASMPT growth report hints at robust future financial performance.

- Get an in-depth perspective on ASMPT's balance sheet by reading our health report here.

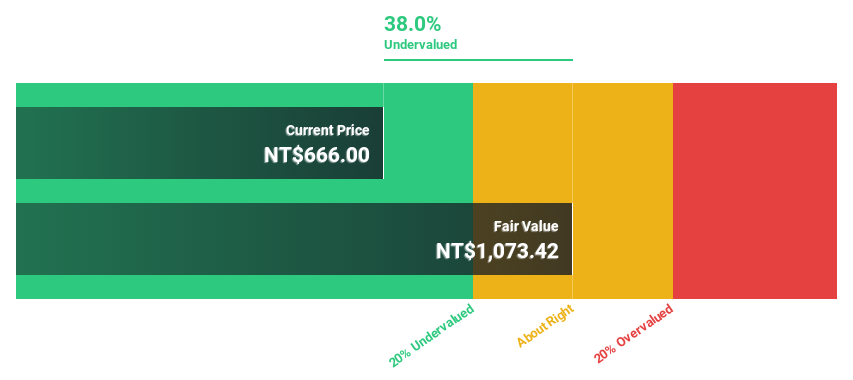

Accton Technology (TWSE:2345)

Overview: Accton Technology Corporation is engaged in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and other international markets with a market cap of NT$411.92 billion.

Operations: The company's revenue primarily comes from its Computer Networks segment, which generated NT$134.33 billion.

Estimated Discount To Fair Value: 33.9%

Accton Technology's current trading price of NT$737 is substantially below its estimated fair value of NT$1115.68, suggesting undervaluation based on cash flows. The company reported significant earnings growth for Q1 2025, with net income rising to TWD 5.13 billion from TWD 2.24 billion a year earlier. Despite high non-cash earnings, Accton's projected revenue and profit growth rates exceed Taiwan's market averages, indicating robust future performance potential despite moderate annual profit growth forecasts.

- Our earnings growth report unveils the potential for significant increases in Accton Technology's future results.

- Click to explore a detailed breakdown of our findings in Accton Technology's balance sheet health report.

Turning Ideas Into Actions

- Access the full spectrum of 302 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2345

Accton Technology

Researches and develops, manufactures, and sells network communication equipment in Taiwan, America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives