- Singapore

- /

- Hospitality

- /

- SGX:G13

Compagnie Du Mont-Blanc And Two Reliable Dividend Stocks For Steady Income

Reviewed by Simply Wall St

In a week marked by volatility and competitive pressures in the AI sector, global markets have seen mixed performances, with the Dow Jones Industrial Average managing modest gains while technology stocks faced significant sell-offs. As central banks navigate interest rate adjustments and inflation concerns persist, investors are increasingly looking towards dividend stocks as a source of steady income amid market fluctuations. In this context, reliable dividend-paying companies can offer stability and consistent returns through regular payouts, making them an attractive option for those seeking to balance risk in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.81% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.96% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.96% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

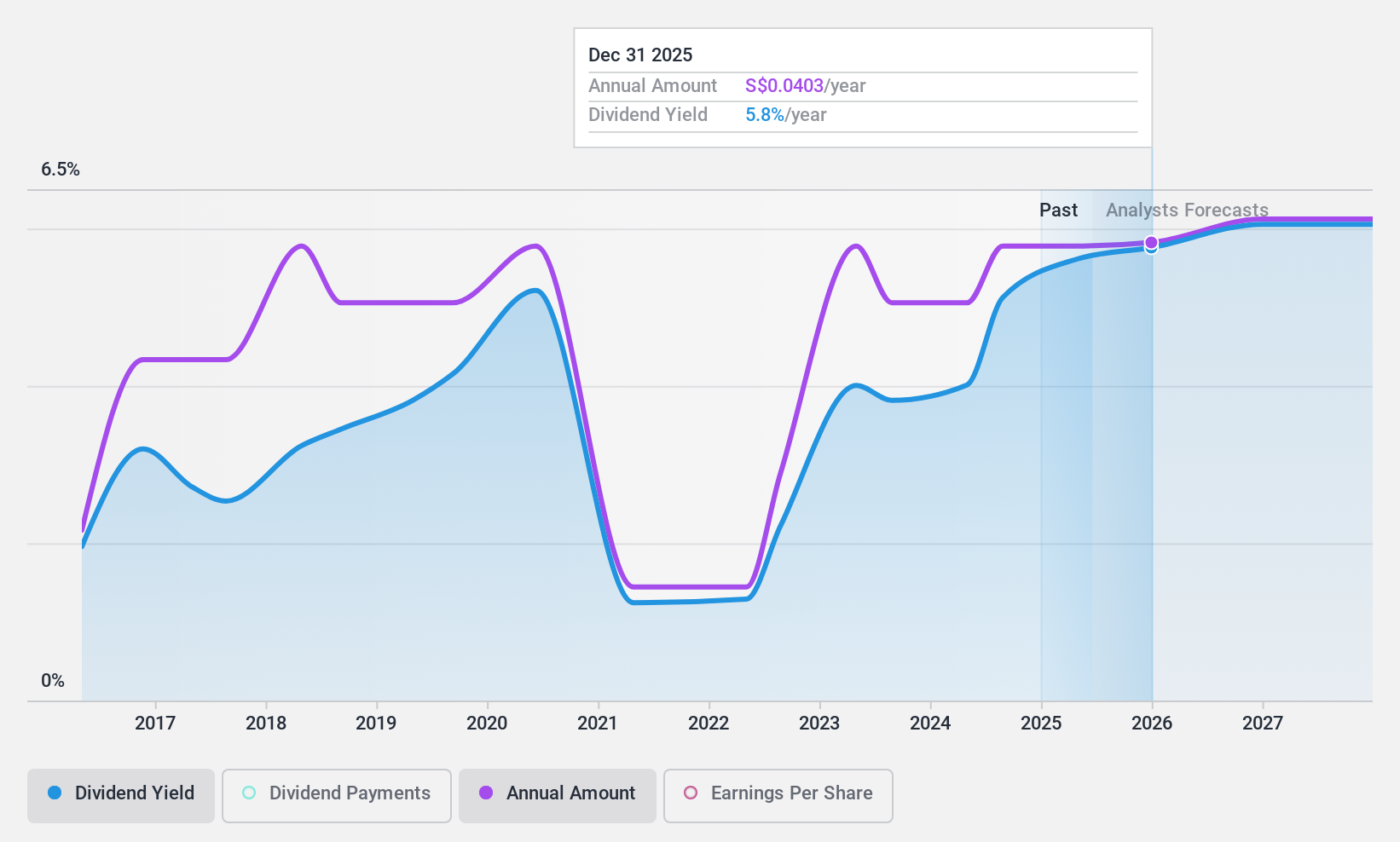

Compagnie Du Mont-Blanc (ENXTPA:MLCMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Du Mont-Blanc operates as a ski lift company in France with a market cap of €124.13 million.

Operations: Compagnie Du Mont-Blanc generates revenue from its Sports Lift segment (€143.40 million) and Restaurants and Stores segment (€4.73 million).

Dividend Yield: 5.7%

Compagnie Du Mont-Blanc's dividend payments have been volatile and unreliable over the past decade, despite a low payout ratio of 35.7%. While the dividend yield of 5.71% places it in the top 25% of French market payers, it is not well covered by free cash flows. Recent earnings growth and a low price-to-earnings ratio suggest potential value; however, sustainability concerns remain due to insufficient free cash flow coverage.

- Take a closer look at Compagnie Du Mont-Blanc's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Compagnie Du Mont-Blanc is priced higher than what may be justified by its financials.

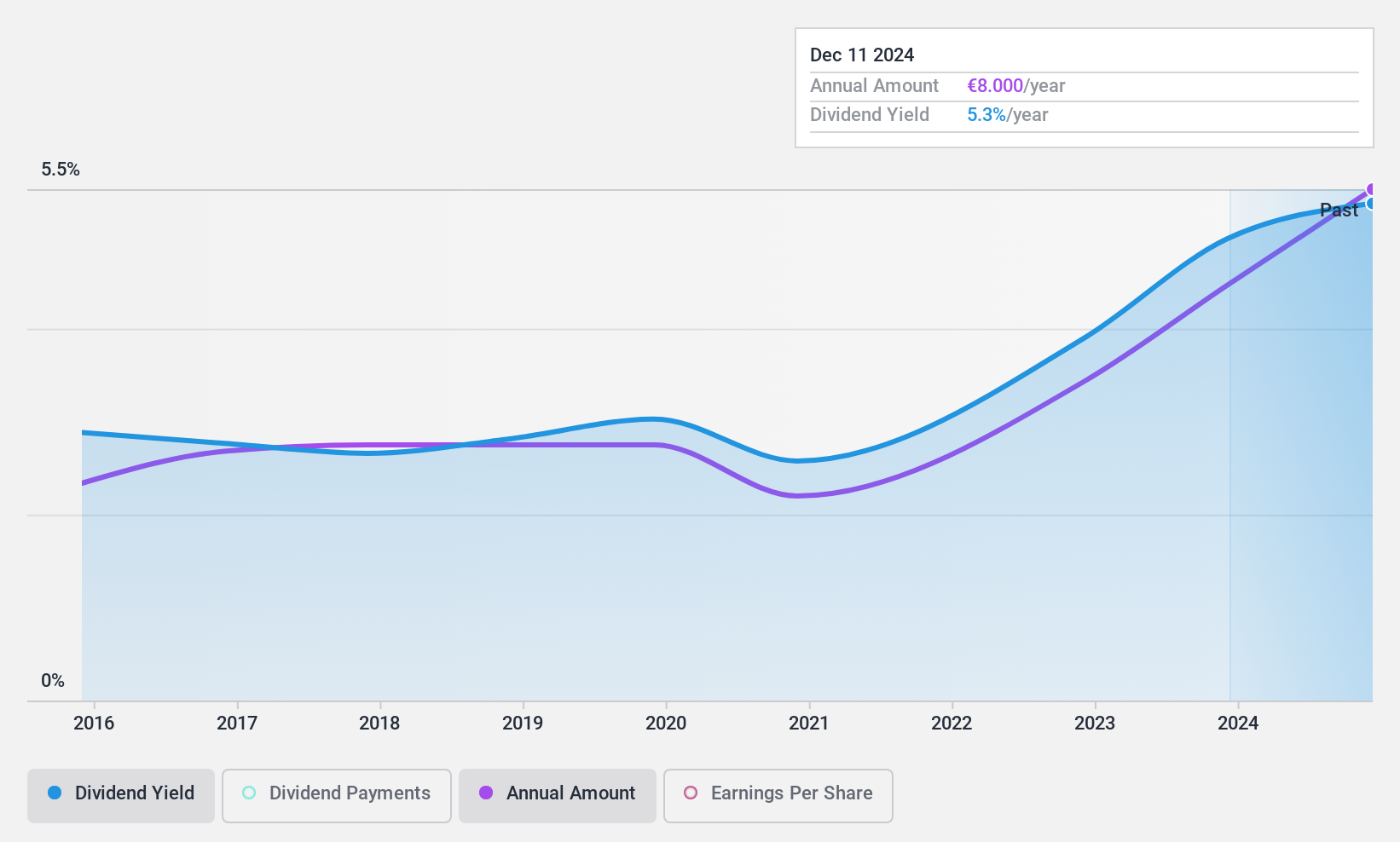

Genting Singapore (SGX:G13)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genting Singapore Limited is an investment holding company focused on the construction, development, and operation of integrated resort destinations in Asia with a market cap of SGD9.05 billion.

Operations: Genting Singapore Limited generates its revenue primarily from its integrated resort operations in Asia.

Dividend Yield: 5.3%

Genting Singapore's dividend yield of 5.33% is below the top 25% in Singapore, yet its payout ratio of 69.8% indicates dividends are covered by earnings and cash flows. Despite a decade of volatile payments, recent earnings growth and a favorable price-to-earnings ratio suggest value potential. However, the unstable dividend track record poses sustainability concerns despite analyst optimism for future stock price increases.

- Delve into the full analysis dividend report here for a deeper understanding of Genting Singapore.

- Our valuation report unveils the possibility Genting Singapore's shares may be trading at a discount.

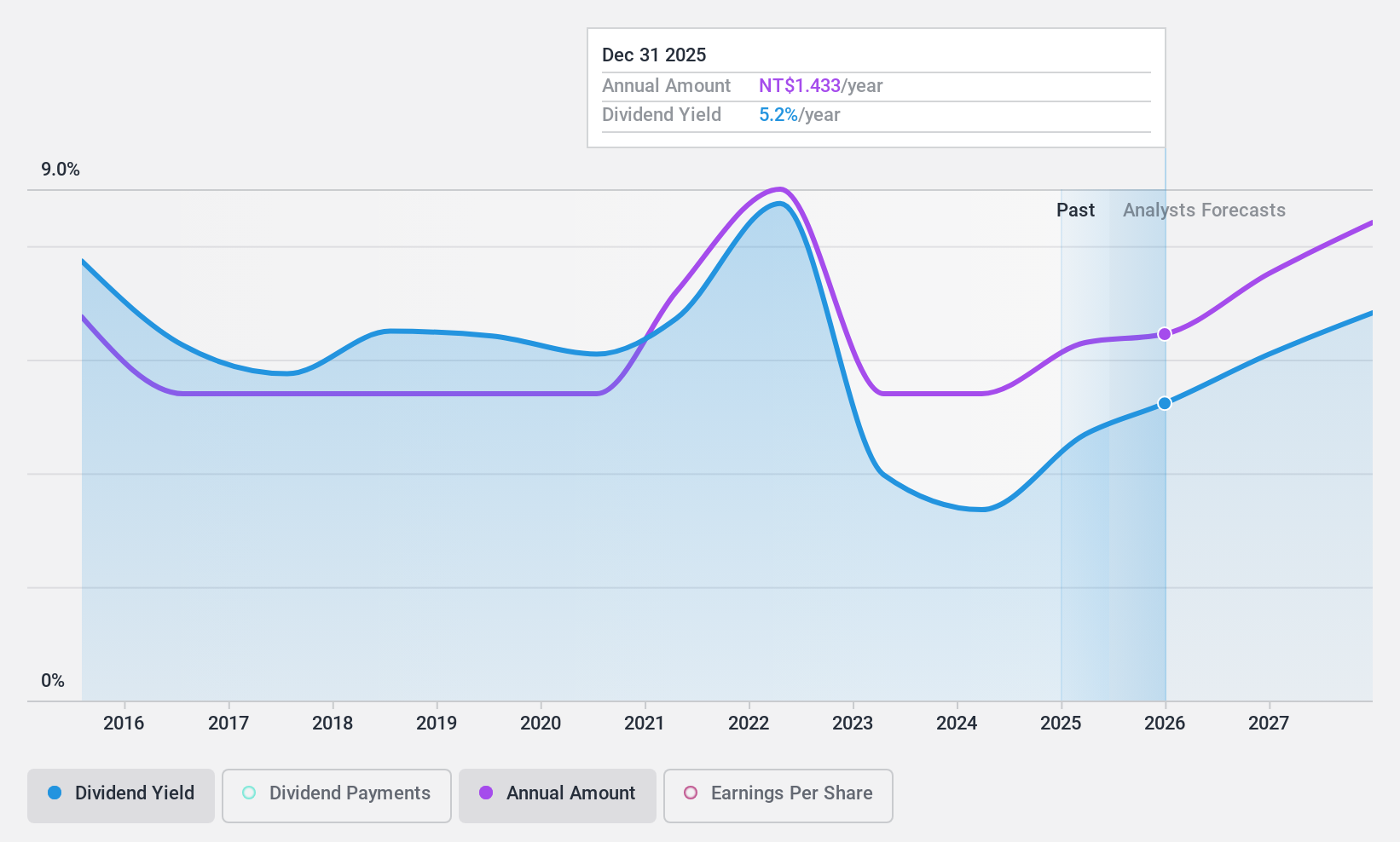

Compal Electronics (TWSE:2324)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compal Electronics, Inc. is a company that manufactures and sells notebook PCs, monitors, LCD TVs, mobile phones, and various components and peripherals globally with a market cap of approximately NT$162.09 billion.

Operations: Compal Electronics generates revenue primarily from its Information Technology products segment, totaling NT$872.05 billion, and its Strategy Integration Product Segment, which contributes NT$51.01 billion.

Dividend Yield: 3.2%

Compal Electronics' dividend yield of 3.23% is below the top 25% in Taiwan, with a payout ratio of 52.9%, indicating dividends are covered by earnings and cash flows. Despite recent earnings growth, its dividend history has been volatile over the past decade, affecting reliability perceptions. However, its price-to-earnings ratio of 16.4x suggests it trades at a good value compared to the market average, offering potential for investors seeking undervalued stocks with covered dividends.

- Dive into the specifics of Compal Electronics here with our thorough dividend report.

- Our expertly prepared valuation report Compal Electronics implies its share price may be lower than expected.

Next Steps

- Click this link to deep-dive into the 1984 companies within our Top Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:G13

Genting Singapore

An investment holding company, primarily engages in the development, management, and operation of integrated resort destinations in Asia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives