- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2313

Compeq Manufacturing Co., Ltd. (TWSE:2313) Might Not Be As Mispriced As It Looks

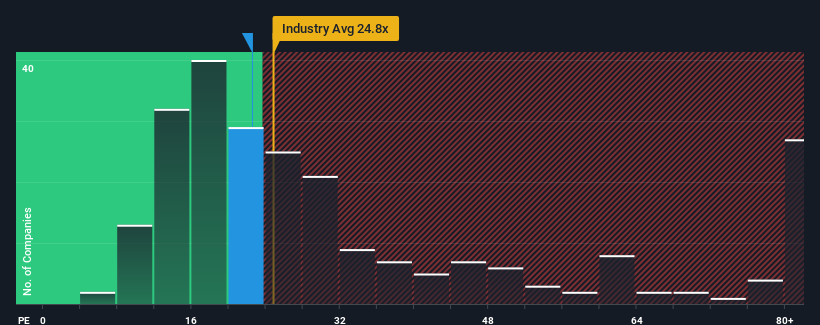

There wouldn't be many who think Compeq Manufacturing Co., Ltd.'s (TWSE:2313) price-to-earnings (or "P/E") ratio of 22.5x is worth a mention when the median P/E in Taiwan is similar at about 23x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Compeq Manufacturing has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Compeq Manufacturing

How Is Compeq Manufacturing's Growth Trending?

Compeq Manufacturing's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 48%. As a result, earnings from three years ago have also fallen 11% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 58% as estimated by the three analysts watching the company. With the market only predicted to deliver 27%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Compeq Manufacturing's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Compeq Manufacturing's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Compeq Manufacturing currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Compeq Manufacturing that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2313

Compeq Manufacturing

Manufactures and sells printed circuit boards for computers in Taiwan, the United States, rest of Asia, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives