- Taiwan

- /

- Semiconductors

- /

- TPEX:3227

Top Global Dividend Stocks In September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by weakening U.S. labor data and fluctuating interest rate expectations, investors are increasingly turning their attention to dividend stocks for stability and income. In an environment where economic growth is uncertain, these stocks can offer a reliable stream of income, making them an attractive option for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.65% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.30% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.69% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.88% | ★★★★★★ |

| NCD (TSE:4783) | 4.41% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.11% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.31% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

Click here to see the full list of 1314 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

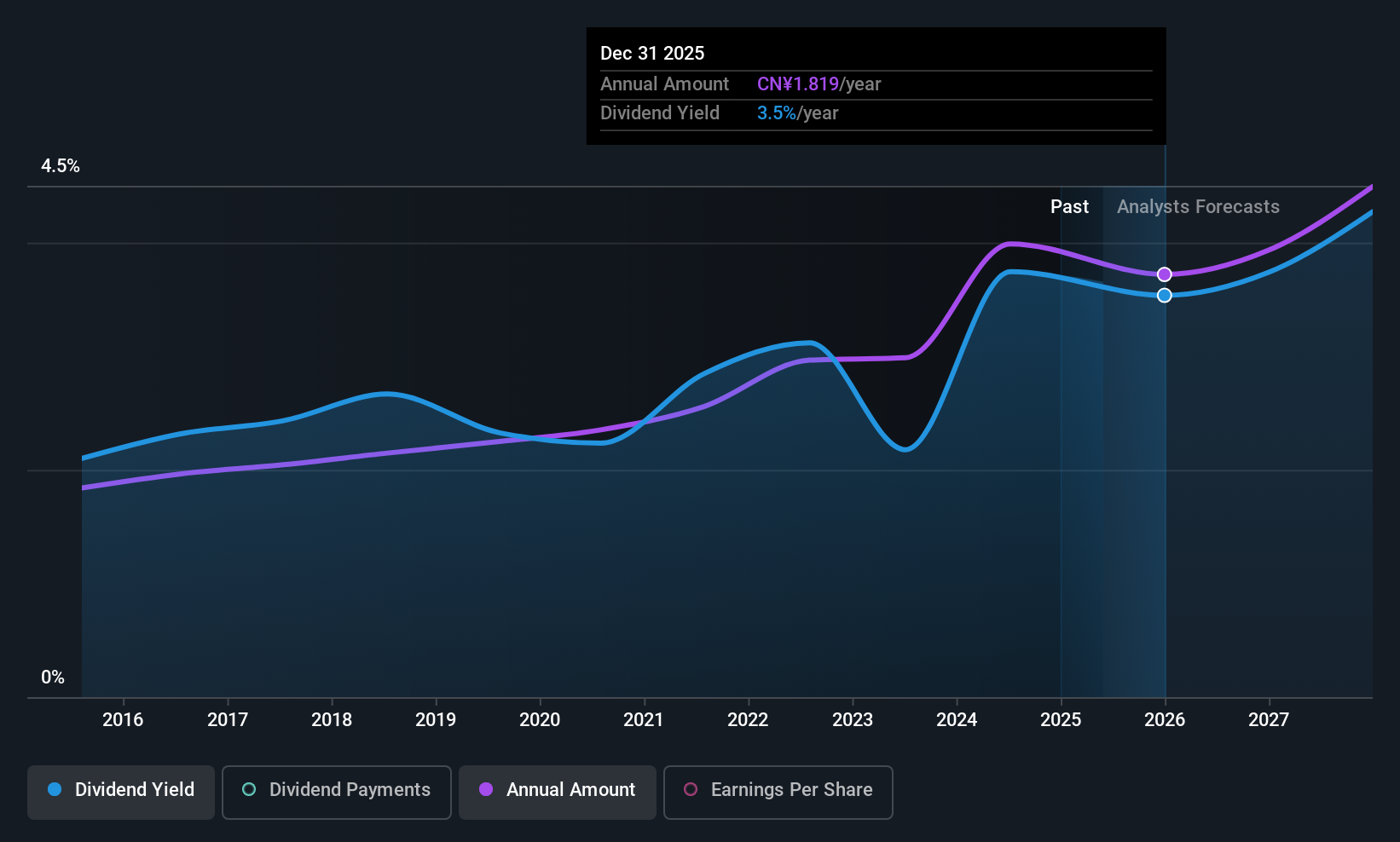

Lao Feng Xiang (SHSE:600612)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Lao Feng Xiang Co., Ltd. operates in the jewelry industry both in the People's Republic of China and internationally, with a market cap of CN¥22.50 billion.

Operations: Lao Feng Xiang Co., Ltd. generates its revenue primarily from its operations in the jewelry sector within China and on an international scale.

Dividend Yield: 3.1%

Lao Feng Xiang offers a stable dividend profile with a payout ratio of 60.7%, ensuring dividends are well-covered by earnings and cash flows. Despite recent declines in revenue and net income, the company maintains a high dividend yield of 3.09%, placing it in the top tier of CN market payers. Its price-to-earnings ratio of 16.5x suggests good value relative to peers, while its consistent dividend growth over the past decade underscores reliability for investors seeking income stability.

- Unlock comprehensive insights into our analysis of Lao Feng Xiang stock in this dividend report.

- The valuation report we've compiled suggests that Lao Feng Xiang's current price could be quite moderate.

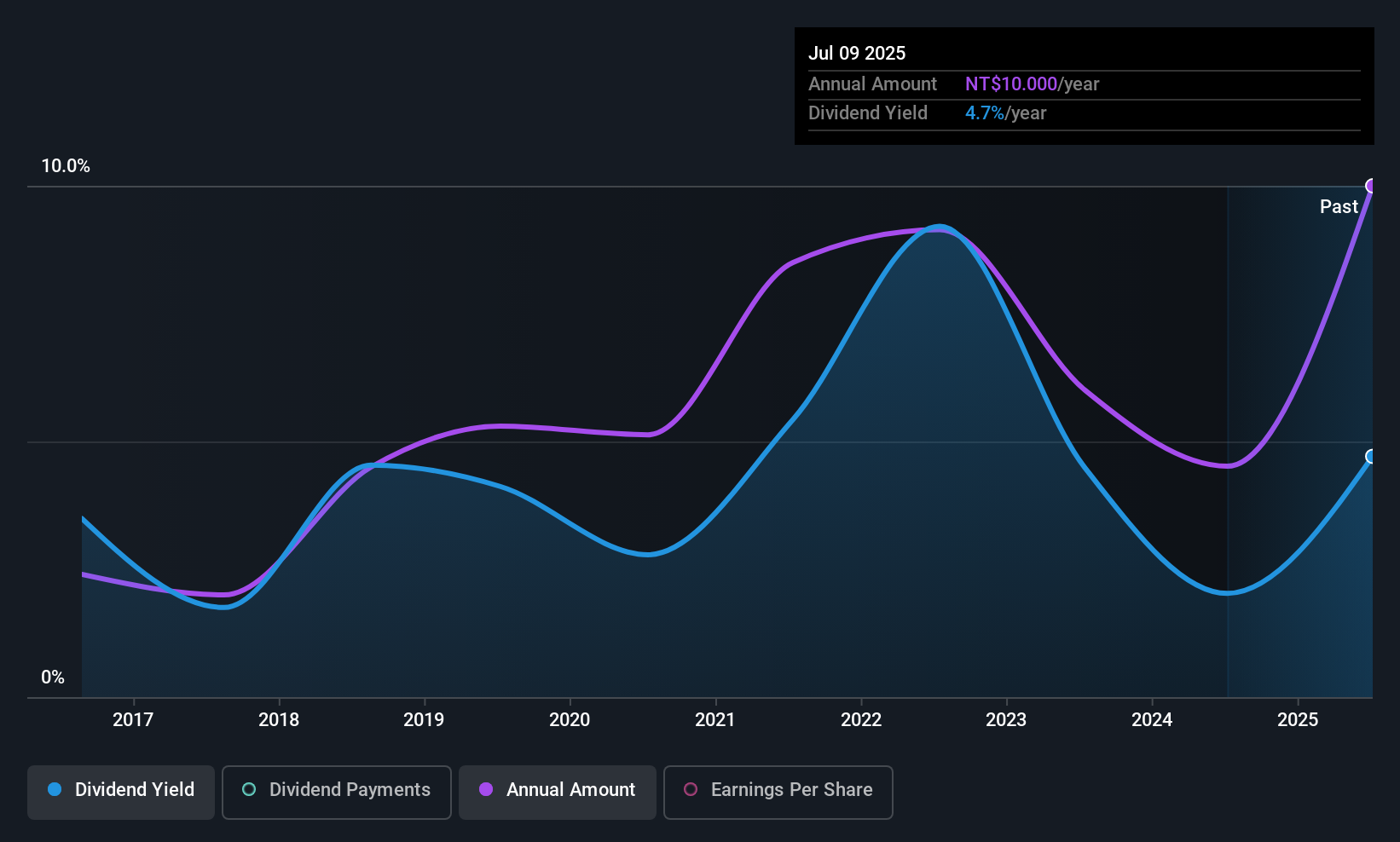

PixArt Imaging (TPEX:3227)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PixArt Imaging Inc. is engaged in the research, design, production, and sale of CMOS image sensors and related ICs across Taiwan, Hong Kong, China, Japan, and internationally with a market cap of NT$30.59 billion.

Operations: PixArt Imaging Inc.'s revenue is primarily derived from its operations involving CMOS image sensors and related integrated circuits across various international markets, including Taiwan, Hong Kong, China, and Japan.

Dividend Yield: 4.6%

PixArt Imaging's dividend payments have been volatile over the past decade, despite recent revenue growth to TWD 4.63 billion for the first half of 2025. The payout ratio of 74.7% indicates dividends are covered by earnings, and a cash payout ratio of 59.7% ensures coverage by cash flows as well. However, its dividend yield of 4.6% is below top market payers in Taiwan, and historical payment reliability remains a concern for investors prioritizing stable income streams.

- Take a closer look at PixArt Imaging's potential here in our dividend report.

- Our expertly prepared valuation report PixArt Imaging implies its share price may be lower than expected.

Lite-On Technology (TWSE:2301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lite-On Technology Corporation, with a market cap of NT$304.17 billion, operates in the research, design, development, manufacture, and sale of modules and system solutions through its subsidiaries.

Operations: Lite-On Technology Corporation generates revenue through its Optoelectronic Department (NT$28.92 billion), Cloud and Internet of Things Department (NT$60.77 billion), and Information and Consumer Electronics Sector (NT$64.06 billion).

Dividend Yield: 3.2%

Lite-On Technology's dividend payments have shown stability and growth over the past decade, but its 3.19% yield is lower than Taiwan's top dividend payers. The payout ratio of 78.9% suggests dividends are covered by earnings, though a high cash payout ratio of 98% indicates limited coverage by cash flows. Recent strategic alliances and solid earnings growth bolster its financial position, but investors should note the sustainability concerns due to cash flow constraints.

- Dive into the specifics of Lite-On Technology here with our thorough dividend report.

- The analysis detailed in our Lite-On Technology valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Take a closer look at our Top Global Dividend Stocks list of 1314 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3227

PixArt Imaging

Researches, designs, produces, and sells CMOS image sensors and related ICs in Taiwan, Hong Kong, China, Japan, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives