- Taiwan

- /

- Communications

- /

- TWSE:2345

High Growth Tech Stocks to Watch in April 2025

Reviewed by Simply Wall St

As global markets navigate a tumultuous landscape marked by escalating trade tensions and fluctuating consumer sentiment, the tech sector remains a focal point for investors seeking growth opportunities. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 20.81% | 26.05% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.43% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★☆☆

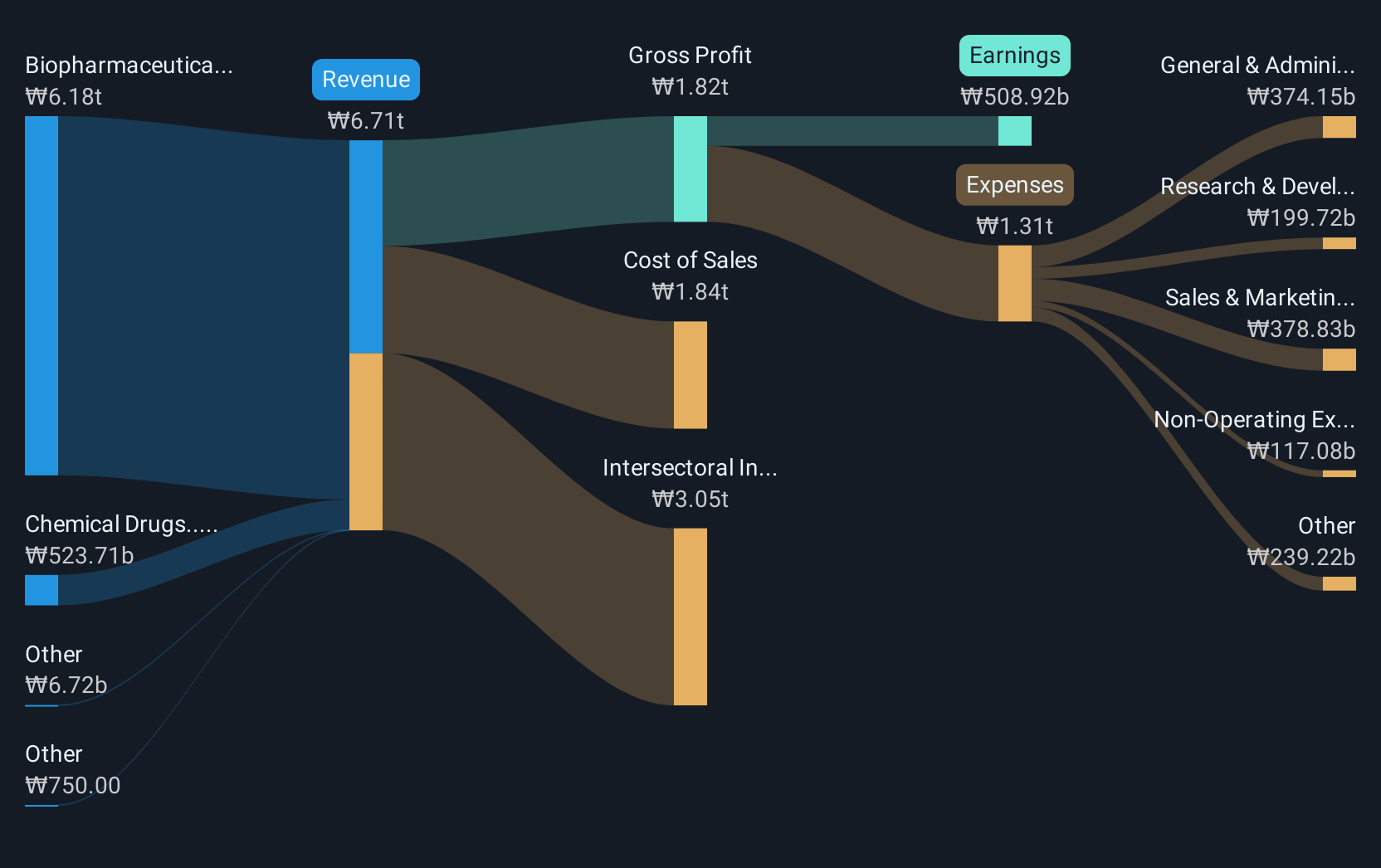

Overview: Celltrion, Inc., along with its subsidiaries, focuses on the development and production of protein-based drugs for oncology treatment in South Korea and has a market cap of ₩34.41 trillion.

Operations: The company generates revenue primarily from its biopharmaceutical segment, which accounts for ₩6.07 trillion. Chemical drugs contribute ₩531.39 billion to its revenue stream, highlighting a strong emphasis on biopharmaceuticals in its business model.

Celltrion's recent FDA approval of YUFLYMA as an interchangeable biosimilar marks a significant stride in its biopharmaceutical offerings, potentially enhancing market penetration and patient accessibility. This development complements the company's robust share repurchase activity, with 589,276 shares earmarked for buyback by July 2025 to bolster shareholder value. Despite a challenging backdrop with net profit margins receding to 11.9% from last year’s 24.6%, Celltrion is navigating forward with an anticipated earnings growth of 40.4% annually, outpacing broader market expectations. This dual strategy of expanding its therapeutic portfolio while actively managing capital returns positions Celltrion distinctively in the high-growth biotech landscape.

- Unlock comprehensive insights into our analysis of Celltrion stock in this health report.

Gain insights into Celltrion's historical performance by reviewing our past performance report.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: King Slide Works Co., Ltd., along with its subsidiaries, specializes in the R&D, design, and sale of rail kits for servers and network communication equipment in Taiwan, with a market capitalization of NT$156.29 billion.

Operations: King Slide Works Co., Ltd. generates revenue primarily from its main entity, contributing NT$2.18 billion, and its subsidiary King Slide Technology Co., Ltd., which adds NT$8.36 billion to the total revenue stream.

King Slide Works has demonstrated a robust financial performance, with its earnings more than doubling over the past year, reflecting a 127.6% increase. This growth significantly outpaces the tech industry's average of 17.1%. Additionally, the company's recent inclusion in the FTSE All-World Index underscores its expanding influence and recognition in global markets. Despite forecasts suggesting a moderate future earnings growth rate of 12.5% annually—slightly below Taiwan's market average of 14.9%—King Slide maintains an impressive forecasted annual revenue growth rate of 21.4%, which is more than double the national market forecast of 9.9%. This positions King Slide favorably within a competitive landscape, particularly as it continues to capitalize on high-quality earnings and positive free cash flow dynamics.

- Click to explore a detailed breakdown of our findings in King Slide Works' health report.

Understand King Slide Works' track record by examining our Past report.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★★

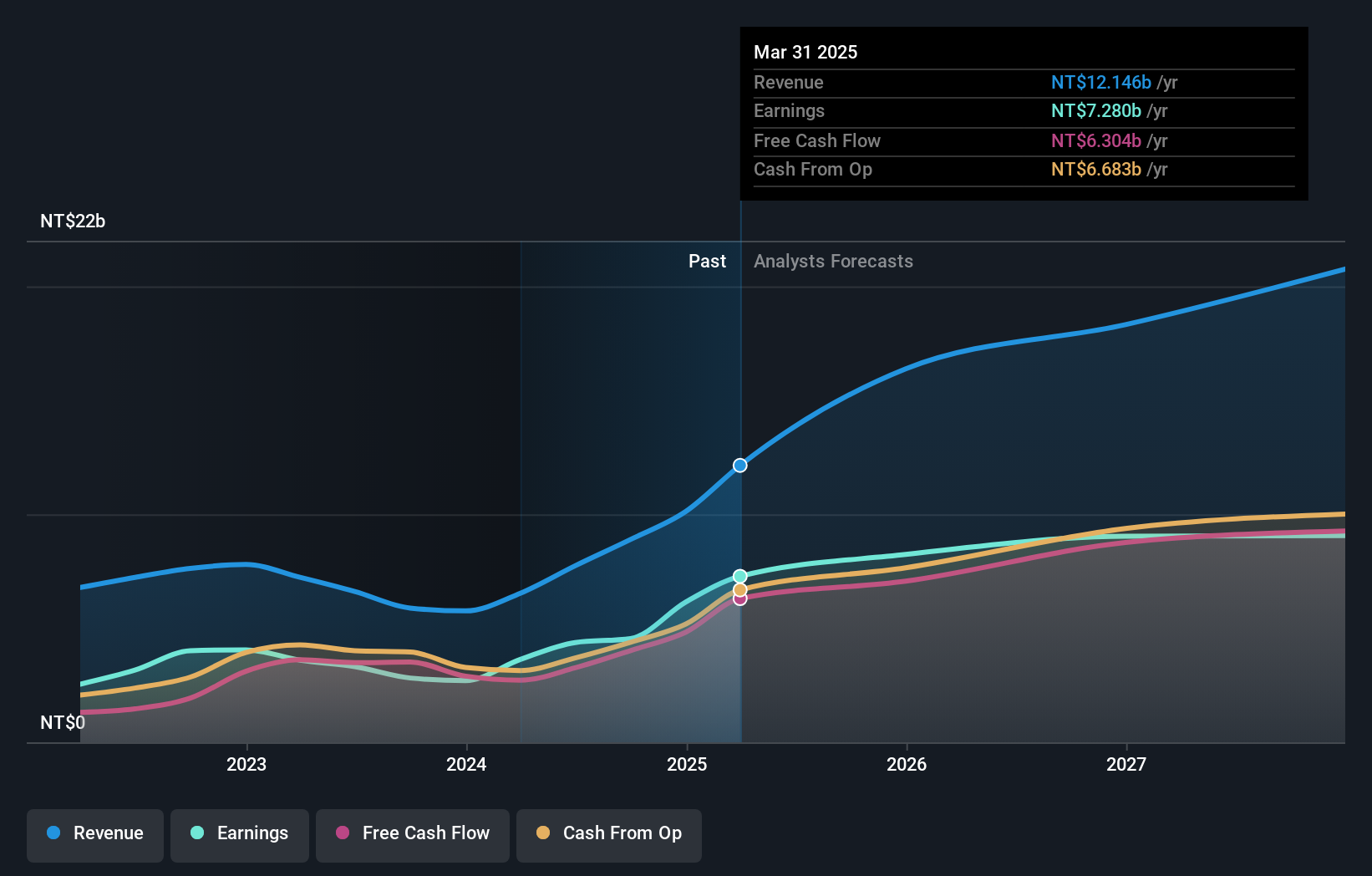

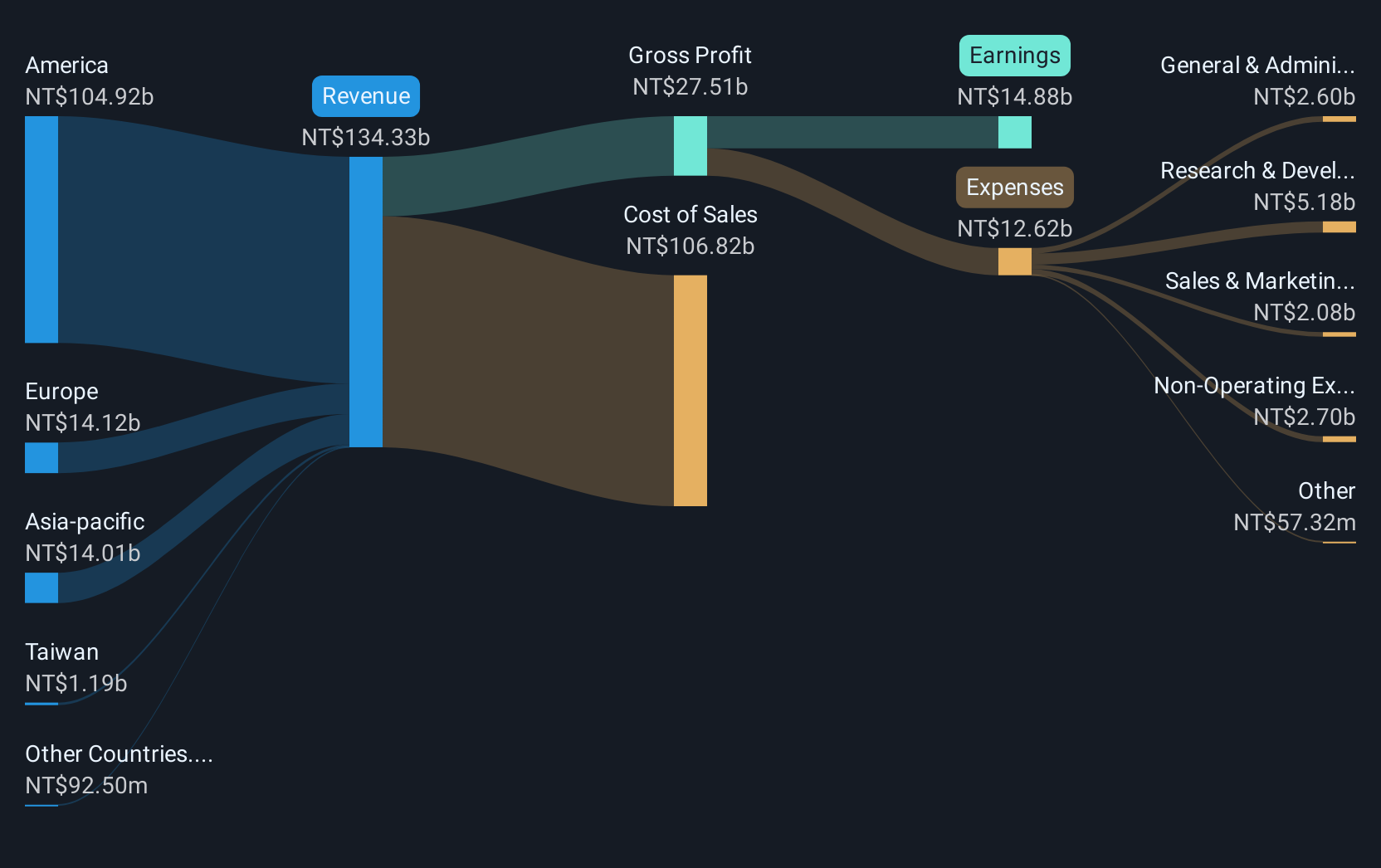

Overview: Accton Technology Corporation engages in the research, development, manufacturing, and sale of network communication equipment globally and has a market capitalization of approximately NT$305.16 billion.

Operations: Accton Technology generates revenue primarily from its Computer Networks segment, which reported NT$110.42 billion. The company focuses on the research, development, manufacturing, and sale of network communication equipment across various regions including Taiwan, America, Asia, and Europe.

Accton Technology's recent financial performance underscores its robust position in the tech sector, with a significant year-over-year sales increase from TWD 84.19 billion to TWD 110.42 billion and net income growth from TWD 8.92 billion to TWD 11.99 billion. These results reflect a solid earnings per share improvement, marking a rise from TWD 15.99 to TWD 21.49 in basic EPS and from TWD 15.86 to TWD 21.35 in diluted EPS, highlighting the company's effective operational execution and profitability enhancements amidst competitive market dynamics. Additionally, Accton's strategic expansion through the new rental plan of its Taoyuan Factory & Office indicates forward-thinking management practices aimed at sustaining growth momentum by optimizing operational efficiencies and expanding production capabilities.

- Click here and access our complete health analysis report to understand the dynamics of Accton Technology.

Evaluate Accton Technology's historical performance by accessing our past performance report.

Make It Happen

- Click here to access our complete index of 756 Global High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2345

Accton Technology

Researches and develops, manufactures, and sells network communication equipment in Taiwan, America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives