- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6230

Chaun-Choung Technology Corp. (TPE:6230) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?

It is hard to get excited after looking at Chaun-Choung Technology's (TPE:6230) recent performance, when its stock has declined 10% over the past three months. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to Chaun-Choung Technology's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Chaun-Choung Technology

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chaun-Choung Technology is:

16% = NT$667m ÷ NT$4.1b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.16 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Chaun-Choung Technology's Earnings Growth And 16% ROE

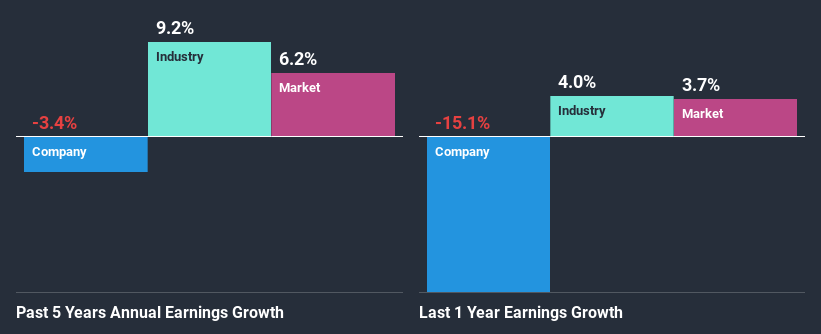

To start with, Chaun-Choung Technology's ROE looks acceptable. Especially when compared to the industry average of 9.9% the company's ROE looks pretty impressive. For this reason, Chaun-Choung Technology's five year net income decline of 3.4% raises the question as to why the high ROE didn't translate into earnings growth. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

That being said, we compared Chaun-Choung Technology's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 9.2% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Chaun-Choung Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Chaun-Choung Technology Efficiently Re-investing Its Profits?

Chaun-Choung Technology's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 65% (or a retention ratio of 35%). With only very little left to reinvest into the business, growth in earnings is far from likely.

In addition, Chaun-Choung Technology has been paying dividends over a period of eight years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 60%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 19%.

Summary

Overall, we feel that Chaun-Choung Technology certainly does have some positive factors to consider. However, while the company does have a high ROE, its earnings growth number is quite disappointing. This can be blamed on the fact that it reinvests only a small portion of its profits and pays out the rest as dividends. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade Chaun-Choung Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nidec Chaun-Choung Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6230

Nidec Chaun-Choung Technology

Processes, manufactures, and trades heat dissipation components for computer industry and related peripheral products in Taiwan, Mainland China, Singapore, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion