- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6141

PlotechLtd (TPE:6141) Has A Pretty Healthy Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Plotech Co.,Ltd (TPE:6141) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for PlotechLtd

What Is PlotechLtd's Net Debt?

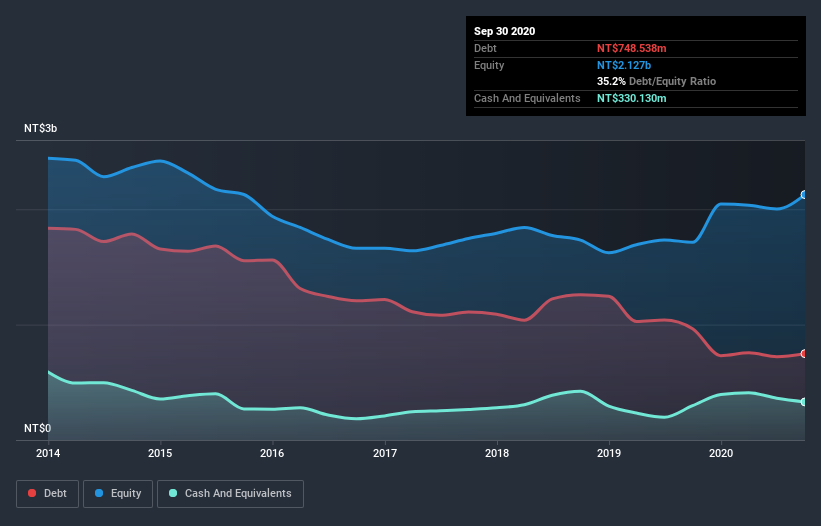

The image below, which you can click on for greater detail, shows that PlotechLtd had debt of NT$748.5m at the end of September 2020, a reduction from NT$964.6m over a year. However, it does have NT$330.1m in cash offsetting this, leading to net debt of about NT$418.4m.

How Healthy Is PlotechLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that PlotechLtd had liabilities of NT$2.06b due within 12 months and liabilities of NT$67.9m due beyond that. Offsetting these obligations, it had cash of NT$330.1m as well as receivables valued at NT$1.27b due within 12 months. So its liabilities total NT$526.7m more than the combination of its cash and short-term receivables.

Since publicly traded PlotechLtd shares are worth a total of NT$3.74b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

PlotechLtd's net debt is only 0.78 times its EBITDA. And its EBIT easily covers its interest expense, being 18.1 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that PlotechLtd grew its EBIT by 106% over twelve months. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since PlotechLtd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, PlotechLtd recorded free cash flow worth 54% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, PlotechLtd's impressive interest cover implies it has the upper hand on its debt. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Looking at the bigger picture, we think PlotechLtd's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with PlotechLtd , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade PlotechLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6141

PlotechLtd

Engages in the designing, manufacturing, processing, and sale of films, printed circuit boards (PCB’s), and electronic components in Taiwan and China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026