- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:5215

Is Ko Ja (Cayman) Co., Ltd.'s (TPE:5215) 6.0% Dividend Worth Your Time?

Is Ko Ja (Cayman) Co., Ltd. (TPE:5215) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

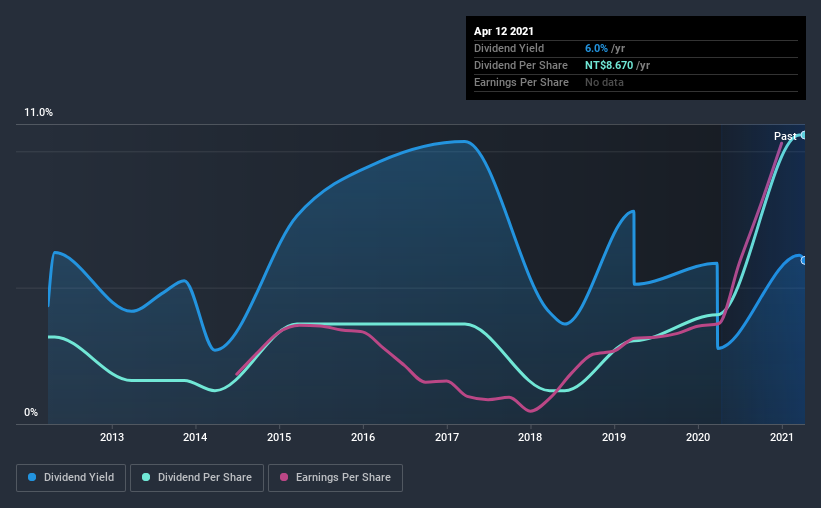

In this case, Ko Ja (Cayman) likely looks attractive to dividend investors, given its 6.0% dividend yield and nine-year payment history. It sure looks interesting on these metrics - but there's always more to the story. Some simple analysis can reduce the risk of holding Ko Ja (Cayman) for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Ko Ja (Cayman) paid out 66% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Ko Ja (Cayman) paid out 112% of its free cash flow last year, which we think is concerning if cash flows do not improve. Ko Ja (Cayman) paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Were it to repeatedly pay dividends that were not well covered by cash flow, this could be a risk to Ko Ja (Cayman)'s ability to maintain its dividend.

With a strong net cash balance, Ko Ja (Cayman) investors may not have much to worry about in the near term from a dividend perspective.

Remember, you can always get a snapshot of Ko Ja (Cayman)'s latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The first recorded dividend for Ko Ja (Cayman), in the last decade, was nine years ago. It's good to see that Ko Ja (Cayman) has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past nine-year period, the first annual payment was NT$2.6 in 2012, compared to NT$8.7 last year. Dividends per share have grown at approximately 14% per year over this time. Ko Ja (Cayman)'s dividend payments have fluctuated, so it hasn't grown 14% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Ko Ja (Cayman) has grown its earnings per share at 25% per annum over the past five years. Earnings per share are sharply up, but we wonder if paying out more than half its earnings (leaving less for reinvestment) is an implicit signal that Ko Ja (Cayman)'s growth will be slower in the future.

We'd also point out that Ko Ja (Cayman) issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Ko Ja (Cayman) gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Ultimately, Ko Ja (Cayman) comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come accross 3 warning signs for Ko Ja (Cayman) you should be aware of, and 1 of them is concerning.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Ko Ja (Cayman) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ko Ja (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5215

Ko Ja (Cayman)

Designs and manufactures service of membrane touch switches, back light modules, light guide plates and silicone rubber domes in Mainland China, Taiwan, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion