- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3702

Rainbows and Unicorns: The WPG Holdings Limited (TPE:3702) Analyst Just Became A Lot More Optimistic

WPG Holdings Limited (TPE:3702) shareholders will have a reason to smile today, with the covering analyst making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analyst modelling a real improvement in business performance.

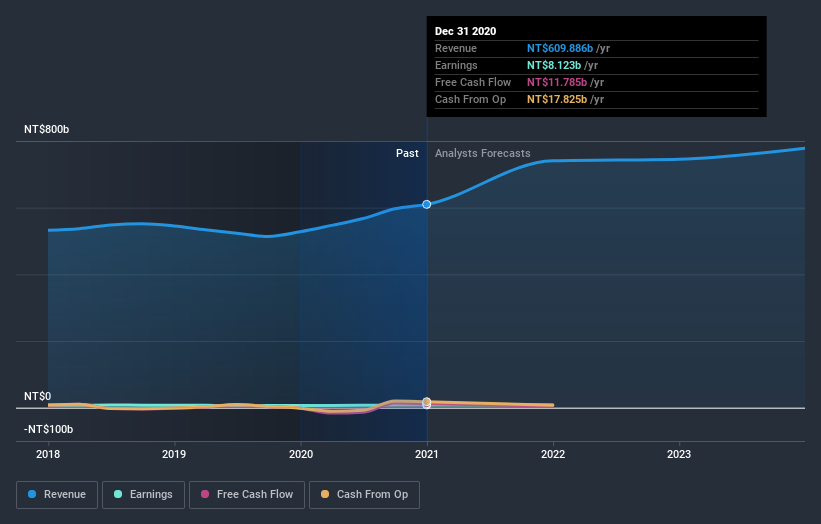

After this upgrade, WPG Holdings' lone analyst is now forecasting revenues of NT$741b in 2021. This would be a huge 21% improvement in sales compared to the last 12 months. Per-share earnings are expected to ascend 13% to NT$5.40. Prior to this update, the analyst had been forecasting revenues of NT$649b and earnings per share (EPS) of NT$4.73 in 2021. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

See our latest analysis for WPG Holdings

Although the analyst has upgraded their earnings estimates, there was no change to the consensus price target of NT$48.17, suggesting that the forecast performance does not have a long term impact on the company's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic WPG Holdings analyst has a price target of NT$50.00 per share, while the most pessimistic values it at NT$45.00. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the WPG Holdings' past performance and to peers in the same industry. It's clear from the latest estimates that WPG Holdings' rate of growth is expected to accelerate meaningfully, with the forecast 21% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 1.6% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 8.4% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect WPG Holdings to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that the analyst upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, the analyst also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to this year's earnings expectations, it might be time to take another look at WPG Holdings.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for WPG Holdings going out as far as 2023, and you can see them free on our platform here.

We also provide an overview of the WPG Holdings Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

If you decide to trade WPG Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WPG Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3702

WPG Holdings

Distributes and sells electronic and electrical components, computer software, and electrical products in Taiwan, Mainland China, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion