- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3530

Should You Rely On Silicon Optronics's (TPE:3530) Earnings Growth?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Silicon Optronics' (TPE:3530) statutory profits are a good guide to its underlying earnings.

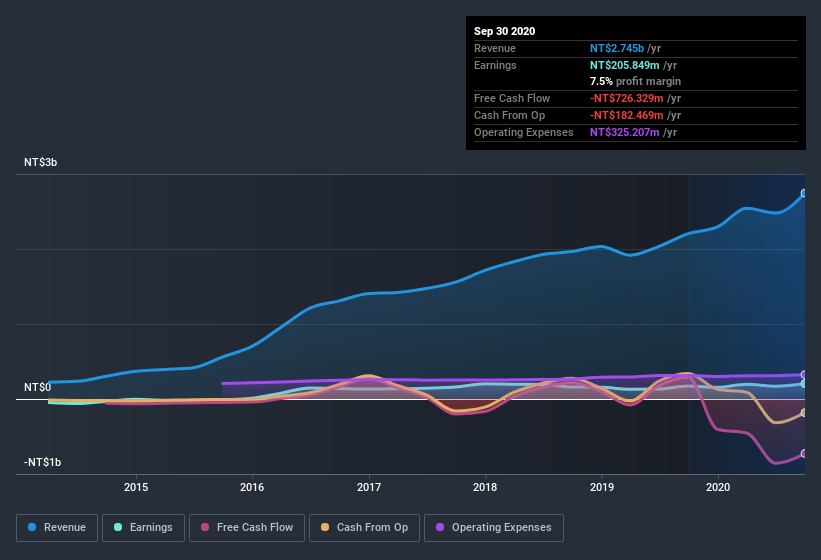

While Silicon Optronics was able to generate revenue of NT$2.75b in the last twelve months, we think its profit result of NT$205.8m was more important. One positive is that it has grown both its profit and its revenue, over the last few years.

See our latest analysis for Silicon Optronics

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a result, we think it's well worth considering what Silicon Optronics' cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Silicon Optronics' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Silicon Optronics has an accrual ratio of 0.81 for the year to September 2020. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of NT$205.8m, a look at free cash flow indicates it actually burnt through NT$726m in the last year. It's worth noting that Silicon Optronics generated positive FCF of NT$281m a year ago, so at least they've done it in the past. The good news for shareholders is that Silicon Optronics' accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Our Take On Silicon Optronics' Profit Performance

As we have made quite clear, we're a bit worried that Silicon Optronics didn't back up the last year's profit with free cashflow. For this reason, we think that Silicon Optronics' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But at least holders can take some solace from the 12% per annum growth in EPS for the last three. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, Silicon Optronics has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

Today we've zoomed in on a single data point to better understand the nature of Silicon Optronics' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Silicon Optronics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3530

Silicon Optronics

Designs, develops, and sells CMOS image sensors in Taiwan, Hong Kong, China, and internationally.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion