- Taiwan

- /

- Communications

- /

- TWSE:2314

Does Microelectronics Technology's (TPE:2314) CEO Salary Compare Well With Industry Peers?

Allen Yen has been the CEO of Microelectronics Technology Inc. (TPE:2314) since 2007, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Microelectronics Technology

How Does Total Compensation For Allen Yen Compare With Other Companies In The Industry?

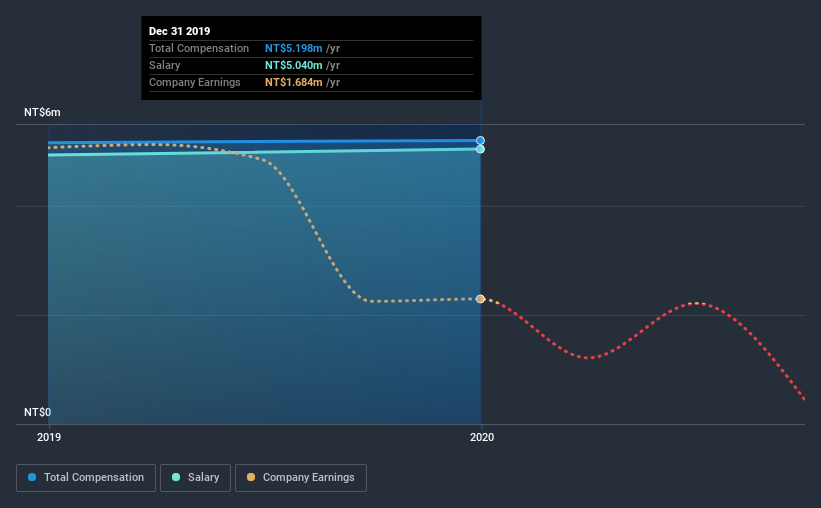

According to our data, Microelectronics Technology Inc. has a market capitalization of NT$6.6b, and paid its CEO total annual compensation worth NT$5.2m over the year to December 2019. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at NT$5.04m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations ranging from NT$2.9b to NT$11b, the reported median CEO total compensation was NT$7.3m. This suggests that Microelectronics Technology remunerates its CEO largely in line with the industry average.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | NT$5.0m | NT$4.9m | 97% |

| Other | NT$158k | NT$227k | 3% |

| Total Compensation | NT$5.2m | NT$5.2m | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. Investors will find it interesting that Microelectronics Technology pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Microelectronics Technology Inc.'s Growth Numbers

Over the last three years, Microelectronics Technology Inc. has shrunk its earnings per share by 109% per year. It saw its revenue drop 33% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Microelectronics Technology Inc. Been A Good Investment?

Since shareholders would have lost about 12% over three years, some Microelectronics Technology Inc. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Allen receives almost all of their compensation through a salary. As we noted earlier, Microelectronics Technology pays its CEO in line with similar-sized companies belonging to the same industry. Meanwhile, EPS growth and shareholder returns have been in the red for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Microelectronics Technology that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Microelectronics Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2314

Microelectronics Technology

Designs, manufactures, and sells terrestrial microwave, satellite communication system, and customized products in the United States, Mainland China, and internationally.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

The Architect of Sovereignty: Palantir’s Premium Paradox at $149

BYLOT: Re-Rating Potential Tempered by UK Tax Drag and Speculative-Grade Debt Dynamics – Neutral (Hold)

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion