- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:1582

Are Syncmold Enterprise Corp.'s (TPE:1582) Mixed Financials The Reason For Its Gloomy Performance on The Stock Market?

It is hard to get excited after looking at Syncmold Enterprise's (TPE:1582) recent performance, when its stock has declined 1.5% over the past week. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. In this article, we decided to focus on Syncmold Enterprise's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Syncmold Enterprise

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Syncmold Enterprise is:

17% = NT$1.0b ÷ NT$5.8b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.17.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Syncmold Enterprise's Earnings Growth And 17% ROE

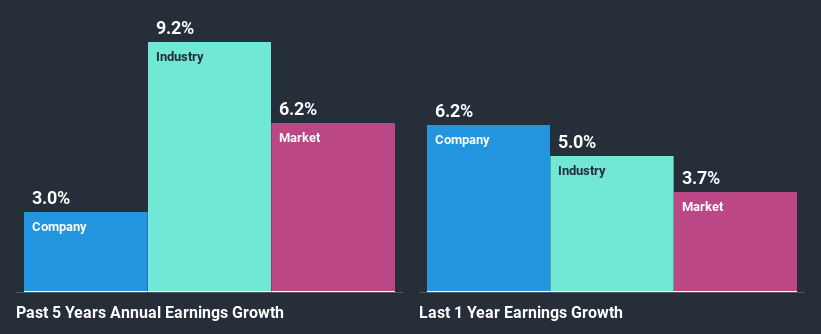

To begin with, Syncmold Enterprise seems to have a respectable ROE. Especially when compared to the industry average of 9.9% the company's ROE looks pretty impressive. However, for some reason, the higher returns aren't reflected in Syncmold Enterprise's meagre five year net income growth average of 3.0%. This is generally not the case as when a company has a high rate of return it should usually also have a high earnings growth rate. We reckon that a low growth, when returns are quite high could be the result of certain circumstances like low earnings retention or poor allocation of capital.

We then compared Syncmold Enterprise's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 9.2% in the same period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for 1582? You can find out in our latest intrinsic value infographic research report.

Is Syncmold Enterprise Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 92% (that is, the company retains only 7.7% of its income) over the past three years for Syncmold Enterprise suggests that the company's earnings growth was lower as a result of paying out a majority of its earnings.

Moreover, Syncmold Enterprise has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

On the whole, we feel that the performance shown by Syncmold Enterprise can be open to many interpretations. In spite of the high ROE, the company has failed to see growth in its earnings due to it paying out most of its profits as dividend, with almost nothing left to invest into its own business. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 1 risk we have identified for Syncmold Enterprise visit our risks dashboard for free.

If you decide to trade Syncmold Enterprise, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1582

Syncmold Enterprise

Engages in the processing, manufacturing, trading, technology authorization, import and export of various metal molds, plastic molds, and electronic parts in Taiwan.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026