Stock Analysis

- Japan

- /

- Entertainment

- /

- TSE:5253

High Growth Tech Stocks To Watch For Promising Expansion

Reviewed by Simply Wall St

Amidst a backdrop of robust market performance, with the Russell 2000 Index reaching new highs and major indices like the S&P 500 continuing their upward trajectory, small-cap stocks are gaining attention as investors navigate domestic policy shifts and geopolitical developments. In this dynamic environment, identifying high-growth tech stocks involves evaluating companies that demonstrate strong innovation potential and resilience to economic fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Arabian Contracting Services (SASE:4071)

Simply Wall St Growth Rating: ★★★★★★

Overview: Arabian Contracting Services Company, with a market cap of SAR7.93 billion, operates in the printing business across Saudi Arabia and Egypt through its subsidiaries.

Operations: The company generates revenue primarily from its advertising segment, amounting to SAR1.52 billion. The business operates through subsidiaries in Saudi Arabia and Egypt, focusing on the printing industry.

Arabian Contracting Services has demonstrated robust financial performance with a notable increase in sales, reaching SAR 352.88 million this quarter from SAR 303.99 million the previous year, though net income dipped to SAR 44.31 million from SAR 62.93 million in the same period. The company's strategic maneuvers include a recent M&A activity where a stake of 4.90% was sold for SAR 416.5 million, reflecting its tactical financial adjustments amidst market shifts. With an expected revenue growth rate of 23.1% per annum and forecasted earnings growth at an impressive rate of 30.3%, Arabian Contracting Services is positioning itself strongly against market averages, despite challenges such as lower profit margins and non-cash high earnings levels impacting its immediate financial standing.

- Delve into the full analysis health report here for a deeper understanding of Arabian Contracting Services.

Gain insights into Arabian Contracting Services' past trends and performance with our Past report.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. is a company that focuses on the research, development, manufacturing, and sales of electronic paper display panels globally, with a market capitalization of NT$327.44 billion.

Operations: E Ink Holdings primarily generates revenue through the sale of electronic components and parts, amounting to NT$28.32 billion. The company operates within the electronic paper display industry, focusing on innovative display technologies for various applications.

E Ink Holdings, amid a dynamic tech landscape, is poised with a revenue growth forecast of 29.5% annually, outpacing the TW market's 12.1%. This surge is underscored by its robust R&D commitment which has catalyzed significant advancements in electronic ink technology. Despite a dip in net income from TWD 2,399.97 million to TWD 2,005.43 million year-over-year for Q3, the firm continues to innovate aggressively—evident from its latest earnings call revelations and strategic board meetings focused on financial reports and technological strides. With earnings expected to climb by 39.7% per year, E Ink's trajectory suggests an evolving role in reshaping display technologies while navigating market fluctuations effectively.

- Click here to discover the nuances of E Ink Holdings with our detailed analytical health report.

Gain insights into E Ink Holdings' historical performance by reviewing our past performance report.

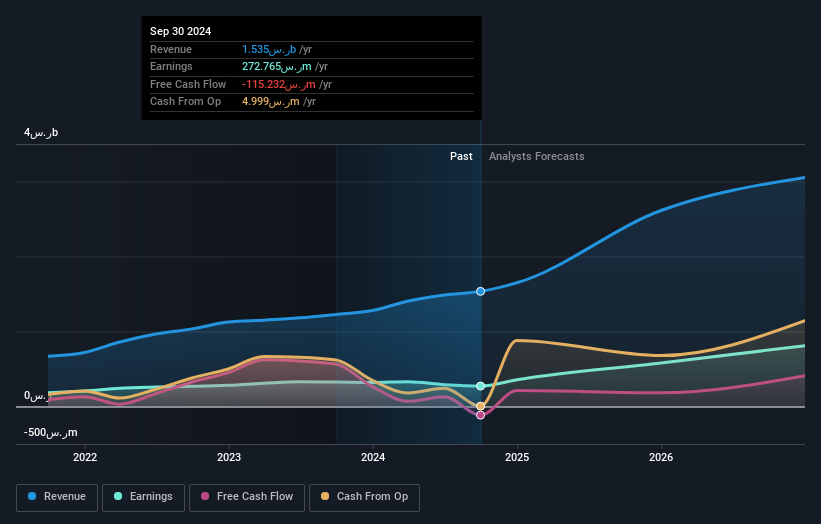

COVER (TSE:5253)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market capitalization of ¥143.42 billion.

Operations: The company focuses on generating revenue through its virtual platform, VTuber production, and media mix businesses. With a market capitalization of ¥143.42 billion, it leverages these segments to create diverse income streams.

COVER Corporation, amidst a volatile tech sector, is navigating its growth trajectory with an 18.8% annual increase in revenue, slightly under the high-growth benchmark of 20%. This performance is bolstered by a significant R&D investment focus, aligning with industry trends towards enhanced technological capabilities. Notably, its earnings have surged by 35.2% over the past year and are projected to expand at an impressive rate of 27% annually. The company's strategic emphasis on innovation and market adaptation is evident from its latest financial disclosures and the anticipation surrounding its upcoming Q2 results announcement on November 12, 2024. This approach not only underscores COVER's commitment to maintaining a competitive edge but also positions it well for potential future market share expansion within the tech landscape.

- Unlock comprehensive insights into our analysis of COVER stock in this health report.

Assess COVER's past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 1284 High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5253

COVER

Engages in the virtual platform, VTuber production, and media mix businesses.