3 Global Stocks Estimated To Be Up To 49.3% Undervalued Offering A 31.4% Discount Opportunity

Reviewed by Simply Wall St

Amidst escalating geopolitical tensions in the Middle East and mixed economic signals, global markets have experienced volatility, with U.S. stocks reversing early gains and European indices facing renewed uncertainties. In such an environment, identifying undervalued stocks that offer significant discounts can be a prudent strategy for investors looking to capitalize on market fluctuations while potentially benefiting from long-term growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN518.00 | PLN1023.50 | 49.4% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK365.74 | 49.9% |

| PixArt Imaging (TPEX:3227) | NT$219.00 | NT$436.53 | 49.8% |

| Montana Aerospace (SWX:AERO) | CHF19.58 | CHF38.95 | 49.7% |

| J&T Global Express (SEHK:1519) | HK$6.67 | HK$13.29 | 49.8% |

| Guangdong Zhongsheng Pharmaceutical (SZSE:002317) | CN¥15.90 | CN¥31.12 | 48.9% |

| Good Will Instrument (TWSE:2423) | NT$43.90 | NT$87.32 | 49.7% |

| Food & Life Companies (TSE:3563) | ¥6586.00 | ¥13042.82 | 49.5% |

| Dive (TSE:151A) | ¥921.00 | ¥1832.25 | 49.7% |

| BigBen Interactive (ENXTPA:BIG) | €1.06 | €2.11 | 49.7% |

Here's a peek at a few of the choices from the screener.

Shenzhen Envicool Technology (SZSE:002837)

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control and energy savings solutions in China, with a market cap of CN¥26.23 billion.

Operations: The company's revenue primarily comes from its Precision Temperature Control Energy Saving Equipment segment, which generated CN¥4.78 billion.

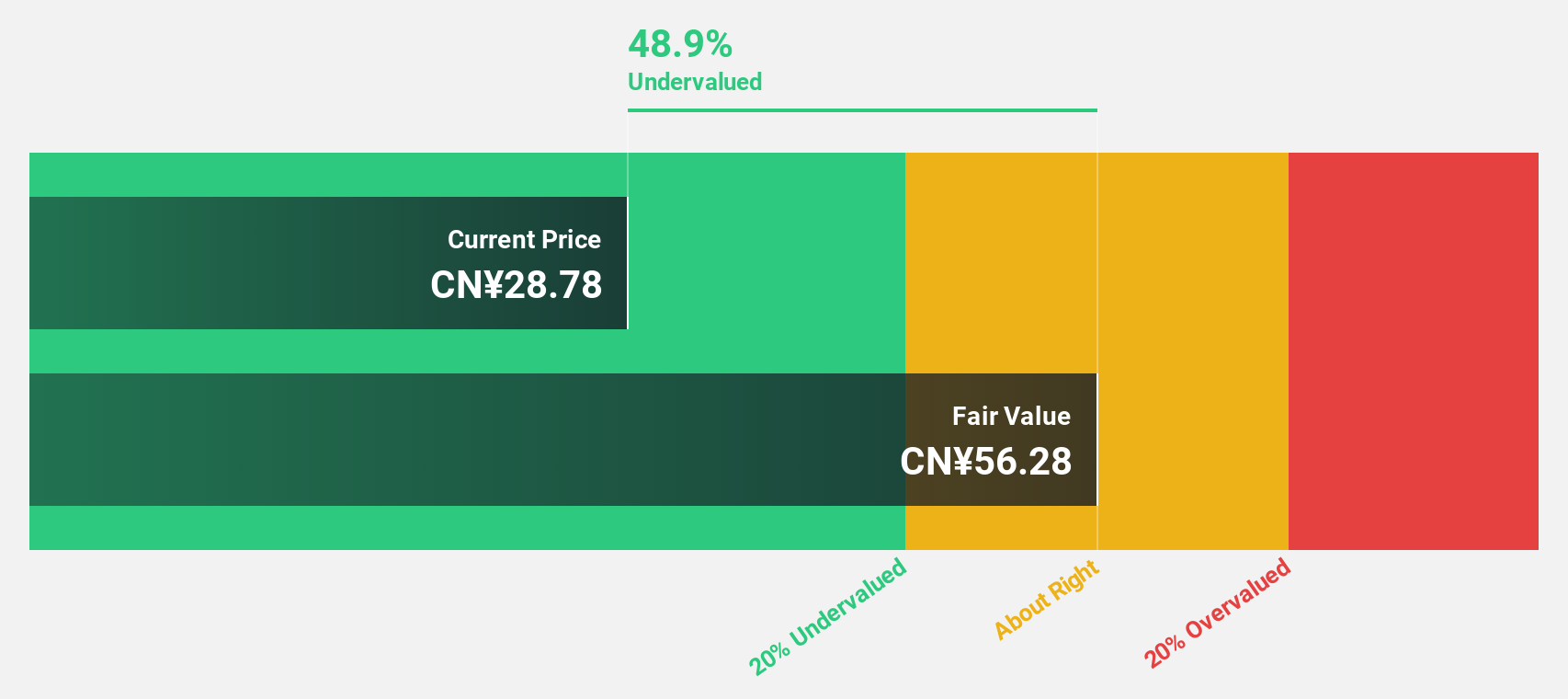

Estimated Discount To Fair Value: 49.3%

Shenzhen Envicool Technology is trading at CN¥28.78, significantly below its estimated fair value of CN¥56.75, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow substantially over the next three years, outpacing the Chinese market average. However, despite strong revenue growth forecasts of 25.1% annually, recent quarterly net income declined year-over-year to CN¥48.01 million from CN¥61.98 million due to high non-cash earnings levels and a modest dividend yield not well covered by free cash flows.

- The analysis detailed in our Shenzhen Envicool Technology growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Shenzhen Envicool Technology.

E Ink Holdings (TPEX:8069)

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels globally, with a market cap of NT$248.38 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, which generated NT$34.58 billion.

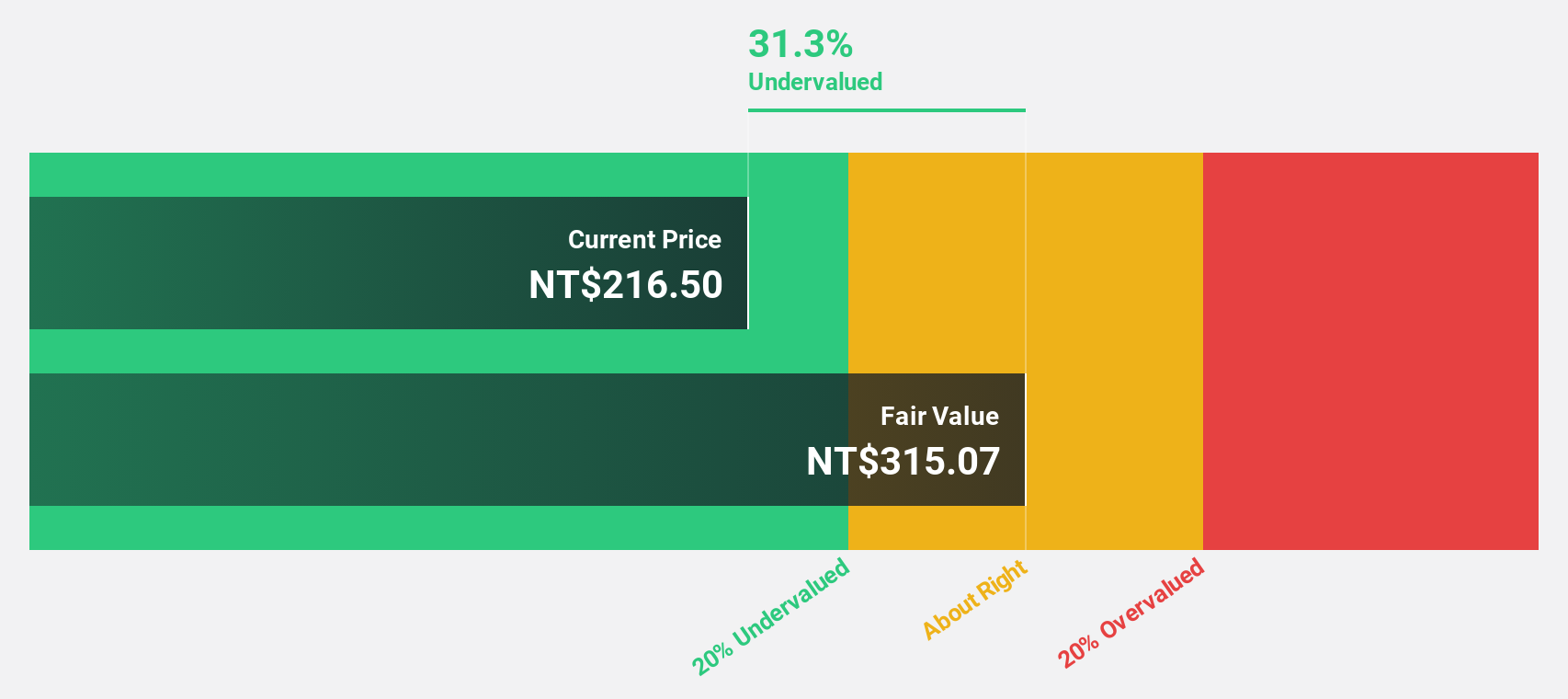

Estimated Discount To Fair Value: 31.4%

E Ink Holdings, trading at NT$216, is significantly below its estimated fair value of NT$315.04. The company's earnings grew by 31.9% last year and are expected to increase by 23.1% annually, surpassing the Taiwanese market average. Despite strong revenue growth forecasts and a recent cash dividend approval of TWD 5 per share, the dividend yield remains inadequately covered by free cash flows, highlighting potential concerns for income-focused investors amidst its high volatility in recent months.

- Upon reviewing our latest growth report, E Ink Holdings' projected financial performance appears quite optimistic.

- Get an in-depth perspective on E Ink Holdings' balance sheet by reading our health report here.

COVER (TSE:5253)

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market capitalization of ¥137.87 billion.

Operations: Revenue segments for COVER Corporation include its virtual platform, VTuber production, and media mix businesses.

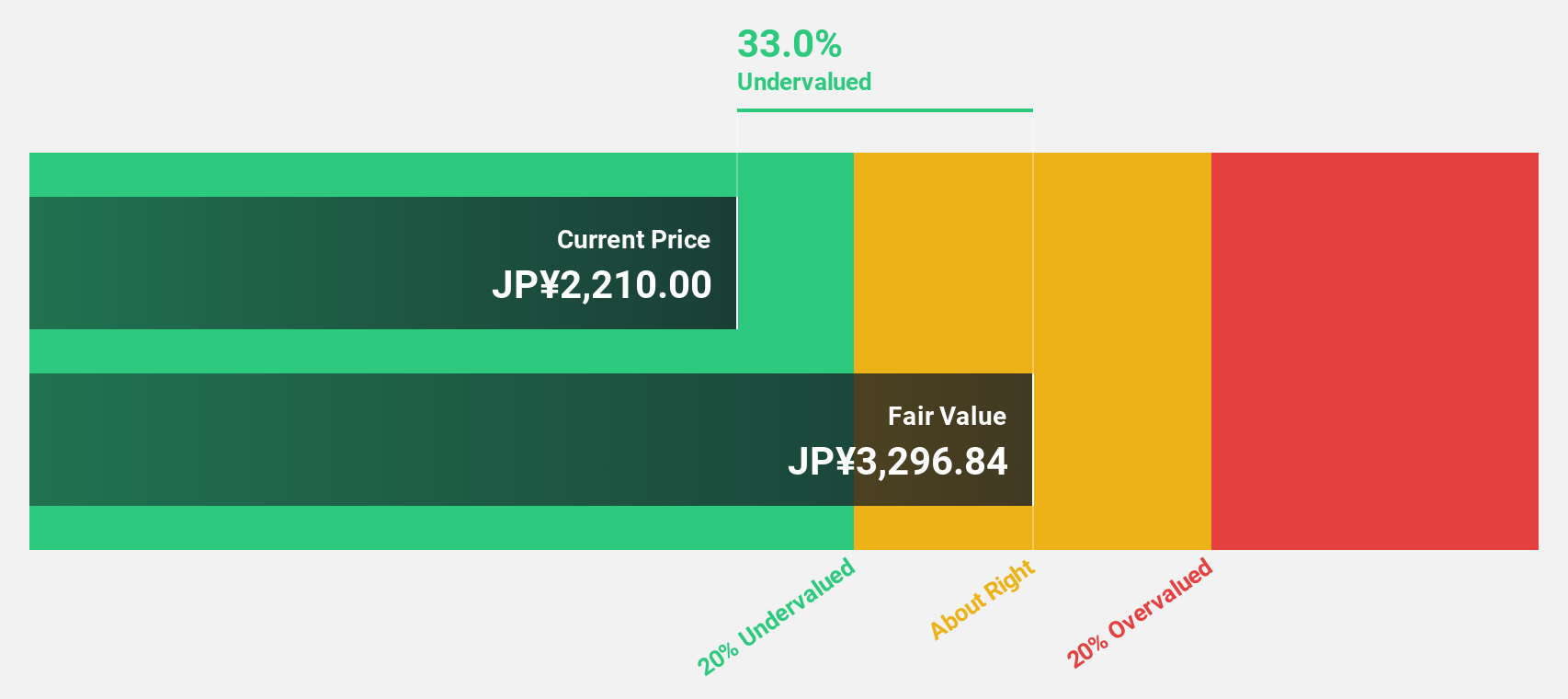

Estimated Discount To Fair Value: 33%

COVER Corporation is trading at ¥2210, significantly below its estimated fair value of ¥3296.67, indicating it is undervalued based on discounted cash flow analysis. The company's earnings grew by 34.4% last year and are forecast to grow by 20.46% annually over the next three years, outpacing the Japanese market average. Despite high volatility in recent months, its robust earnings growth potential and favorable valuation present a compelling case for investors focused on cash flows.

- In light of our recent growth report, it seems possible that COVER's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of COVER.

Where To Now?

- Explore the 495 names from our Undervalued Global Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002837

Shenzhen Envicool Technology

Produces and sells temperature control and energy savings solutions and products in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives