- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

3 Asian Stocks That May Be Undervalued By As Much As 40.7%

Reviewed by Simply Wall St

As global markets navigate the complexities of new U.S. tariffs and mixed economic data, Asian stock markets have shown resilience, with China's indices rising on hopes for more stimulus amid persistent deflation concerns. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2553.00 | ¥5091.29 | 49.9% |

| SILICON2 (KOSDAQ:A257720) | ₩52900.00 | ₩104284.28 | 49.3% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥52.83 | CN¥104.19 | 49.3% |

| Medy-Tox (KOSDAQ:A086900) | ₩162400.00 | ₩322233.66 | 49.6% |

| Mandom (TSE:4917) | ¥1442.00 | ¥2835.83 | 49.2% |

| Lucky Harvest (SZSE:002965) | CN¥35.03 | CN¥69.40 | 49.5% |

| Hugel (KOSDAQ:A145020) | ₩355000.00 | ₩698441.84 | 49.2% |

| HL Holdings (KOSE:A060980) | ₩41650.00 | ₩82439.98 | 49.5% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.82 | NZ$1.62 | 49.5% |

| ALUX (KOSDAQ:A475580) | ₩11490.00 | ₩22641.19 | 49.3% |

Let's review some notable picks from our screened stocks.

E Ink Holdings (TPEX:8069)

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels worldwide with a market cap of NT$255.85 billion.

Operations: The company generates revenue of NT$34.58 billion from its electronic components and parts segment.

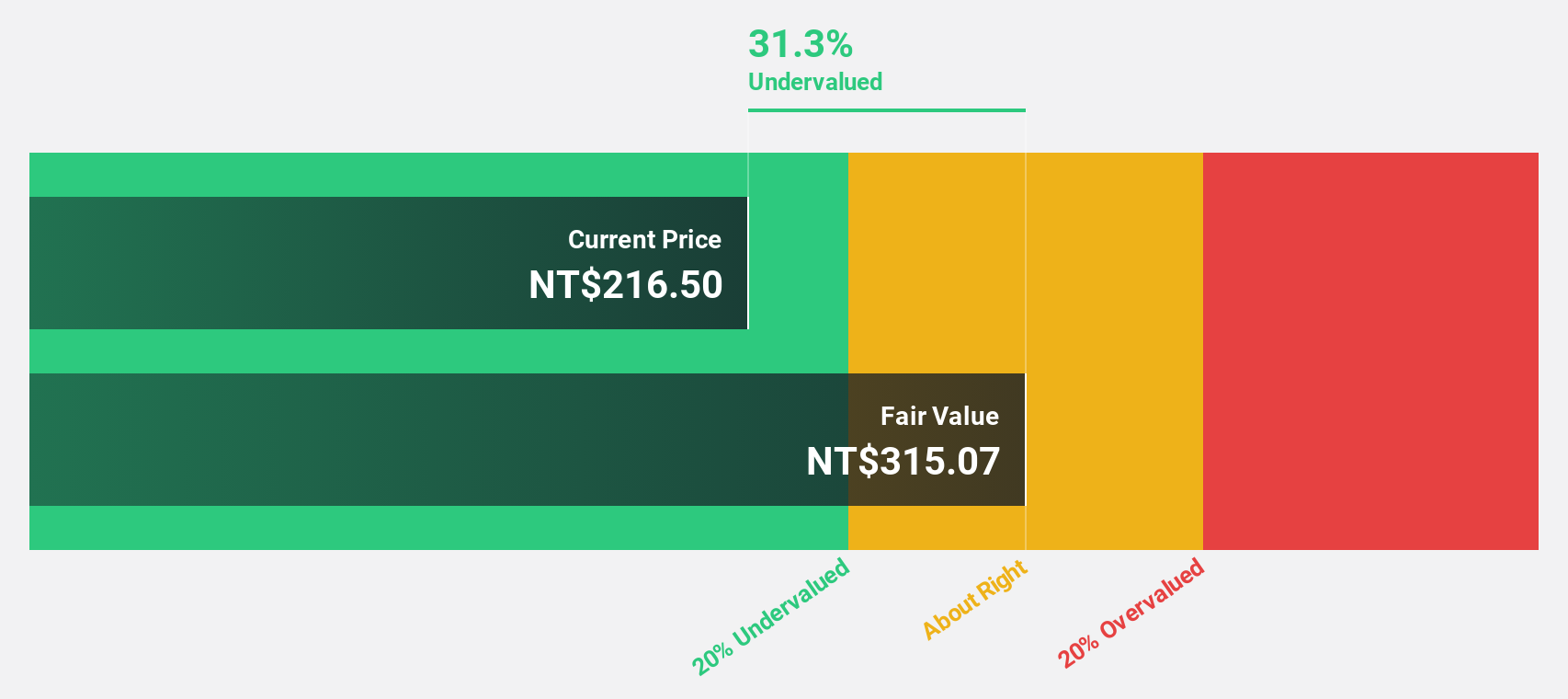

Estimated Discount To Fair Value: 31.9%

E Ink Holdings is trading significantly below its estimated fair value, presenting an opportunity for value investors. Despite recent share price volatility, its earnings and revenue are forecast to grow over 20% annually, outpacing the Taiwan market. The company's innovative ePaper technology, showcased in new product launches with Intel and Oricom, enhances user experience and sustainability. However, dividend coverage by free cash flows remains a concern amidst strong growth prospects.

- In light of our recent growth report, it seems possible that E Ink Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in E Ink Holdings' balance sheet health report.

TechnoPro Holdings (TSE:6028)

Overview: TechnoPro Holdings, Inc. operates as a temporary staffing and contract work company both in Japan and internationally, with a market cap of ¥455.83 billion.

Operations: The company's revenue segments include ¥18.31 billion from R&D Outsourcing Business, ¥24.97 billion from Construction Management Outsourcing, and ¥4.80 billion from Domestic Other Business, along with ¥24.76 billion generated by Overseas Businesses.

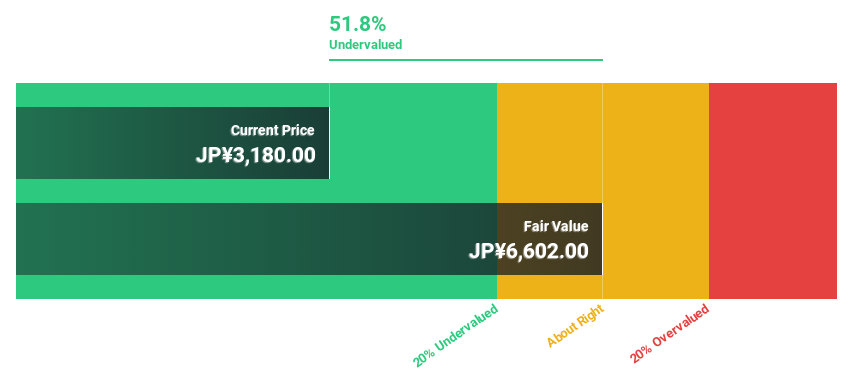

Estimated Discount To Fair Value: 40.7%

TechnoPro Holdings is trading at ¥4375, significantly below its estimated fair value of ¥7373.97, suggesting an undervaluation based on cash flows. Despite a volatile share price and an unstable dividend track record, the company’s earnings are forecast to grow 13.9% annually, surpassing Japan's market average of 7.7%. Revenue growth is expected at 8.9% per year, faster than the local market's pace but not exceptionally high overall.

- Insights from our recent growth report point to a promising forecast for TechnoPro Holdings' business outlook.

- Take a closer look at TechnoPro Holdings' balance sheet health here in our report.

Kokusai Electric (TSE:6525)

Overview: Kokusai Electric Corporation develops, manufactures, sells, repairs, and maintains semiconductor manufacturing equipment globally and has a market cap of ¥786.19 billion.

Operations: Kokusai Electric's revenue is primarily derived from its global operations in developing, manufacturing, selling, repairing, and maintaining semiconductor manufacturing equipment.

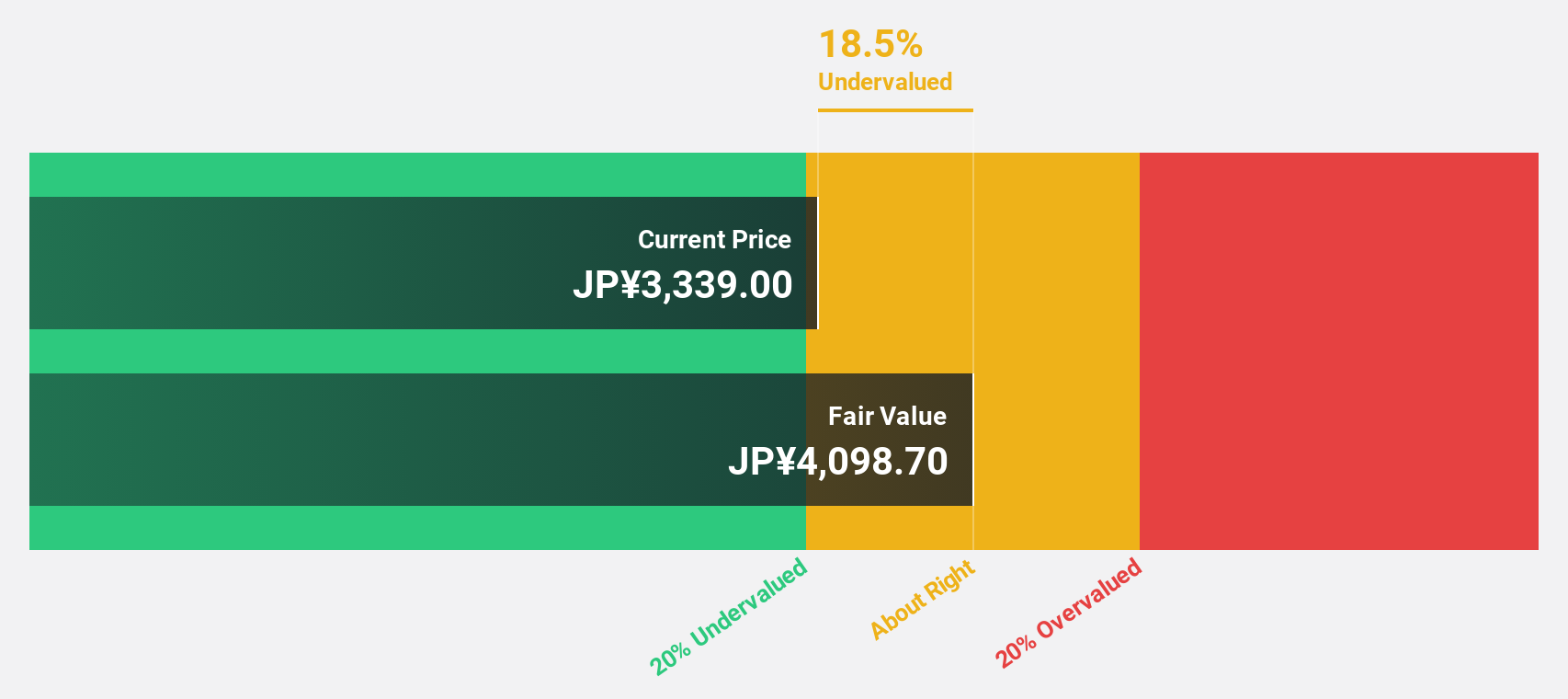

Estimated Discount To Fair Value: 17.7%

Kokusai Electric is trading at ¥3375, below its estimated fair value of ¥4100.28, highlighting its potential undervaluation based on cash flows. Despite recent share price volatility, earnings grew by 60.9% last year and are expected to grow 14.86% annually, outpacing the Japanese market's average growth rate of 7.7%. Revenue is forecasted to increase at a rate of 9.4% per year, also exceeding local market expectations but not significantly high overall.

- Our growth report here indicates Kokusai Electric may be poised for an improving outlook.

- Dive into the specifics of Kokusai Electric here with our thorough financial health report.

Next Steps

- Navigate through the entire inventory of 261 Undervalued Asian Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives