- Taiwan

- /

- Tech Hardware

- /

- TPEX:7711

Undiscovered Gems February 2025's Promising Stocks on None

Reviewed by Simply Wall St

In February 2025, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic signals. With U.S. job growth cooling and manufacturing showing signs of recovery, small-cap stocks face a challenging yet potentially rewarding environment as investors seek opportunities amid fluctuating market conditions. In this context, identifying promising stocks involves looking for companies that demonstrate resilience and adaptability in the face of economic pressures, offering potential growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Golden House | 32.13% | -0.58% | 14.32% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Terminal X Online | 20.33% | 18.40% | 20.81% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Borusan Yatirim ve Pazarlama A.S. is a company that, along with its subsidiaries, invests in the industrial, commercial, and service sectors and has a market capitalization of TRY51.16 billion.

Operations: Borusan Yatirim ve Pazarlama generates revenue through its investments in various sectors, including industrial, commercial, and service industries. The company's financial performance can be gauged by its market capitalization of TRY51.16 billion.

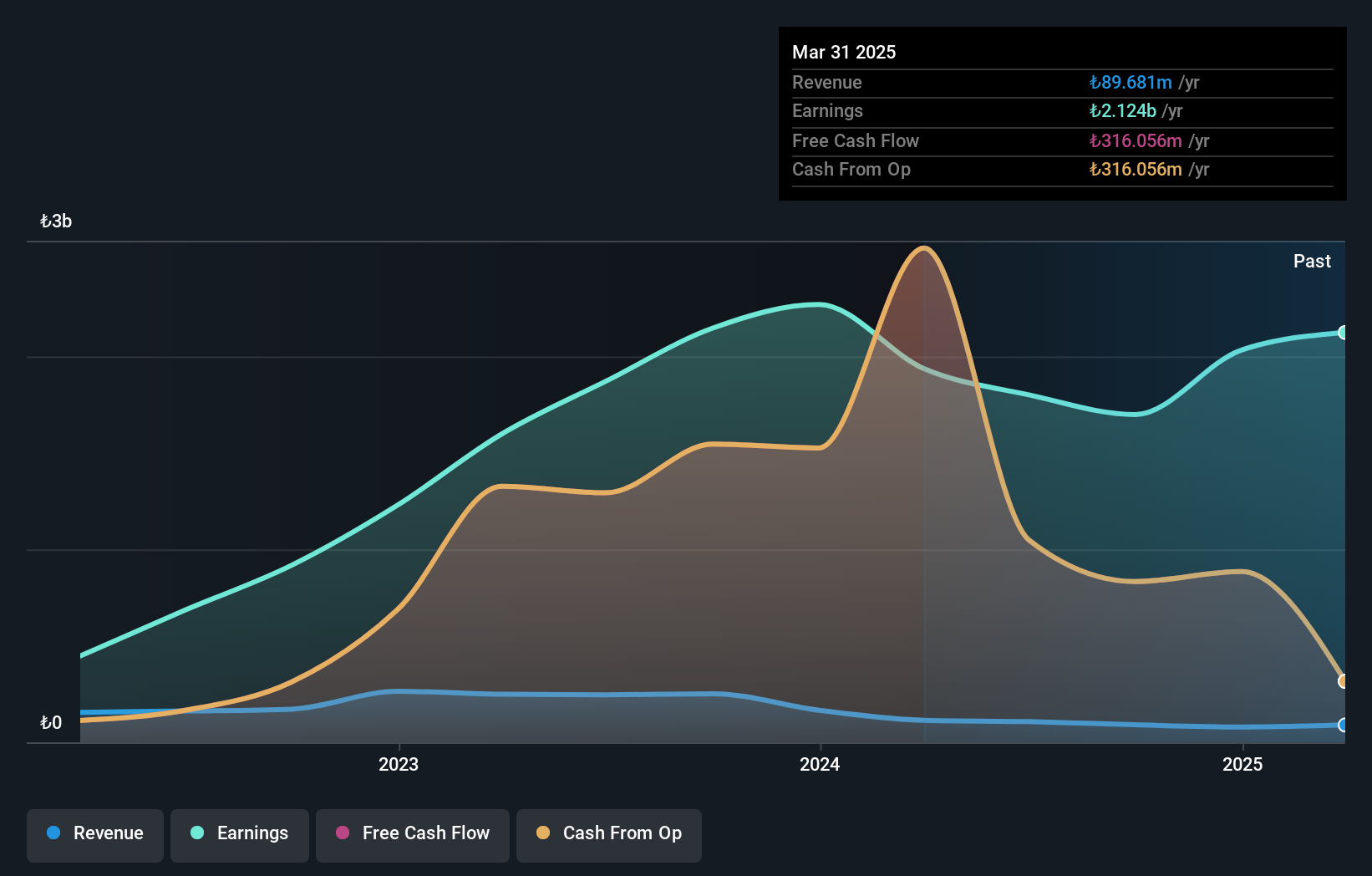

Borusan Yatirim ve Pazarlama, a smaller player in the diversified financial sector, showcases an intriguing profile with its debt-free status, contrasting its past debt to equity ratio of 1.1%. Despite high-quality earnings, recent performance reveals challenges; net income for the third quarter was TRY 501 million compared to TRY 604 million last year. Sales over nine months dropped to TRY 79 million from TRY 155 million previously. The company’s free cash flow is positive at TRY 2.86 billion as of March 2024, yet negative earnings growth at -20.9% highlights struggles against industry peers growing at an average of 46.5%.

- Click here to discover the nuances of Borusan Yatirim ve Pazarlama with our detailed analytical health report.

Gain insights into Borusan Yatirim ve Pazarlama's past trends and performance with our Past report.

ASRock Rack Incorporation (TPEX:7711)

Simply Wall St Value Rating: ★★★★★★

Overview: ASRock Rack Incorporation develops and sells server motherboards and systems both in Taiwan and internationally, with a market cap of NT$20.38 billion.

Operations: The company generates revenue primarily through the sale of server motherboards and systems. It operates in both domestic and international markets, contributing to its financial performance.

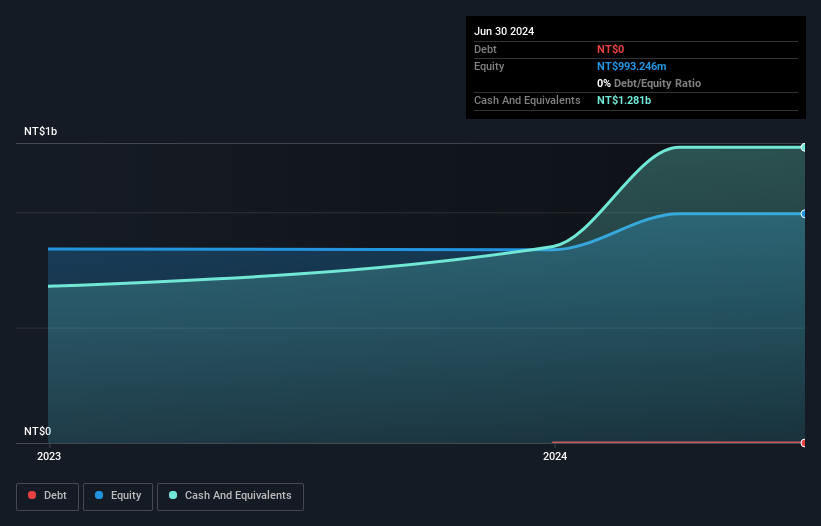

ASRock Rack Incorporation stands out with its robust earnings growth of 269% over the past year, significantly outperforming the Tech industry's 12.9%. The company is debt-free, which eliminates concerns about interest coverage and enhances financial stability. Trading at 64.5% below its estimated fair value suggests potential undervaluation in the market. Recent developments include a transaction where an undisclosed buyer acquired a 2.48% stake for approximately TWD 350 million, highlighting investor interest. With high-quality earnings and positive free cash flow, ASRock Rack appears well-positioned within its niche segment of the tech industry.

note (TSE:5243)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Note Inc. operates a media platform business in Japan with a market cap of ¥39.47 billion.

Operations: The company generates revenue primarily from its media platform business in Japan. It focuses on monetizing content through advertising, subscriptions, and partnerships.

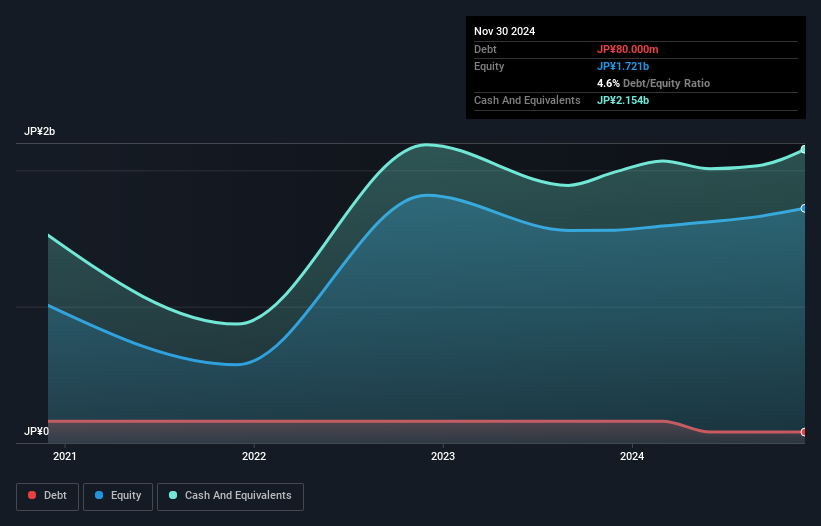

Note Inc. has recently caught attention with its strategic moves and financial performance. The company became profitable last year, demonstrating high-quality earnings and a sound cash position exceeding its total debt. Trading at 50% below its estimated fair value, it seems to offer significant potential for growth, especially with forecasted earnings growth of nearly 43% annually. Despite a highly volatile share price over the past three months, Note Inc.'s recent private placement raised approximately ¥490 million net proceeds with participation from Google International LLC, potentially bolstering future initiatives and providing an intriguing prospect in the interactive media sector.

- Click to explore a detailed breakdown of our findings in note's health report.

Assess note's past performance with our detailed historical performance reports.

Next Steps

- Navigate through the entire inventory of 4717 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:7711

ASRock Rack Incorporation

Provides cloud computing server hardware products in Taiwan and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives