- China

- /

- Electronic Equipment and Components

- /

- SZSE:300679

High Growth Tech Stocks And 2 Other Promising Global Picks

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant movements, with U.S. stock indexes reaching record highs following the Federal Reserve's decision to cut short-term interest rates for the first time this year. This has led to a rally in small-cap stocks, as seen with the Russell 2000 Index gaining 2.16%, amidst ongoing trade discussions between the U.S. and China and mixed economic indicators such as rising retail sales and subdued housing market data. In this context, identifying high growth tech stocks involves looking for companies that can capitalize on favorable interest rate environments while demonstrating resilience amid global economic shifts and trade developments.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

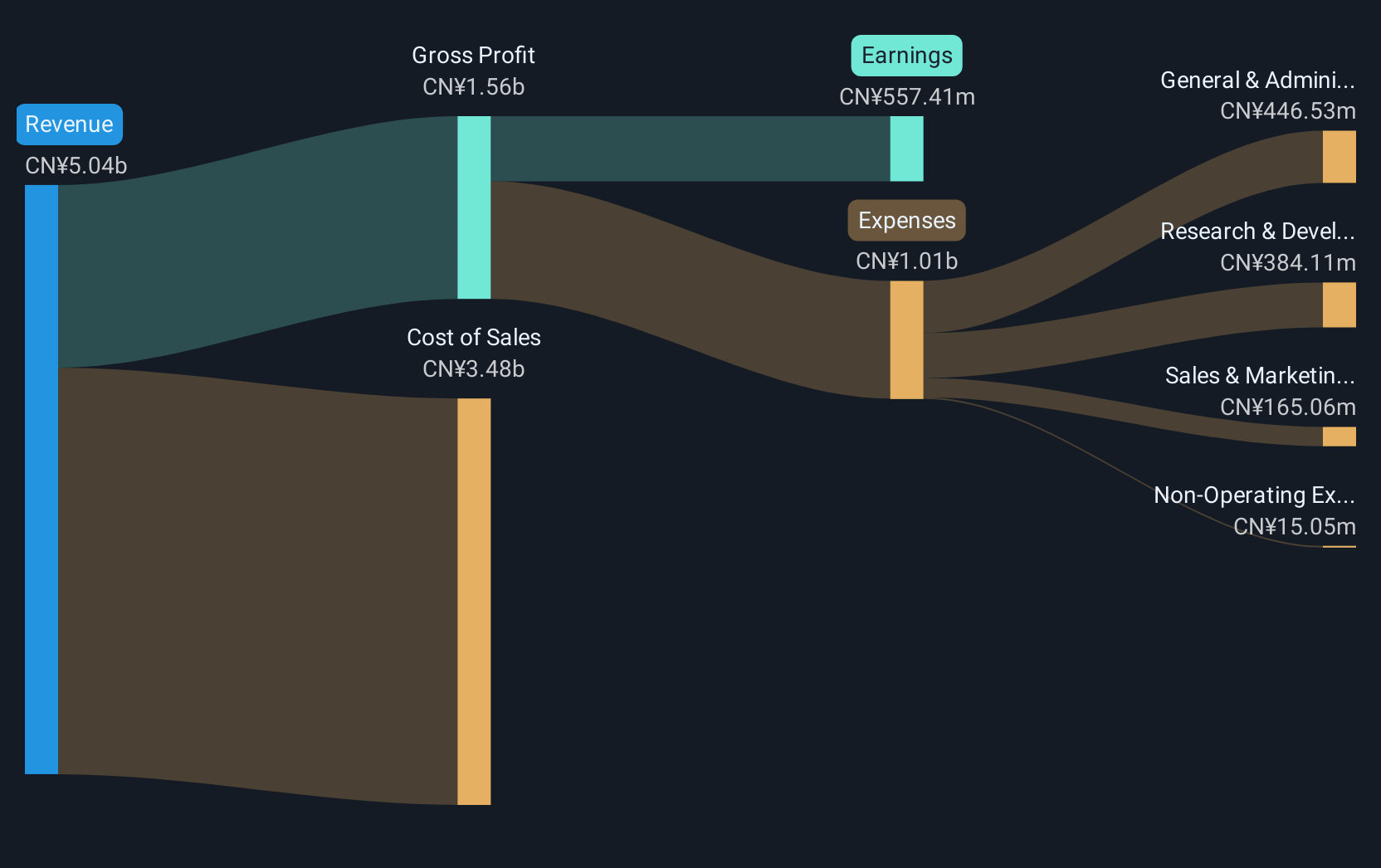

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system products across various global markets with a market cap of CN¥24.84 billion.

Operations: The company focuses on producing micro electronic connectors and interconnection system products for diverse international markets, including China, North America, Europe, Japan, and the Asia Pacific region.

Electric Connector Technology has demonstrated robust financial performance, with a notable increase in sales to CNY 2.49 billion, up from CNY 2.12 billion the previous year, reflecting a growth trajectory above many industry peers. Despite this revenue surge, net income slightly decreased to CNY 242.66 million from CNY 307.57 million due to strategic amendments in company bylaws aimed at future scalability and governance enhancement. Looking ahead, the firm is poised for significant expansion with expected annual revenue and earnings growth rates of 22.8% and 30.4%, respectively—outpacing broader market forecasts. This aggressive growth strategy is underpinned by high-quality earnings and positive free cash flow dynamics, positioning Electric Connector Technology as a potentially influential player in the tech sector's evolving landscape.

Ugreen Group (SZSE:301606)

Simply Wall St Growth Rating: ★★★★★★

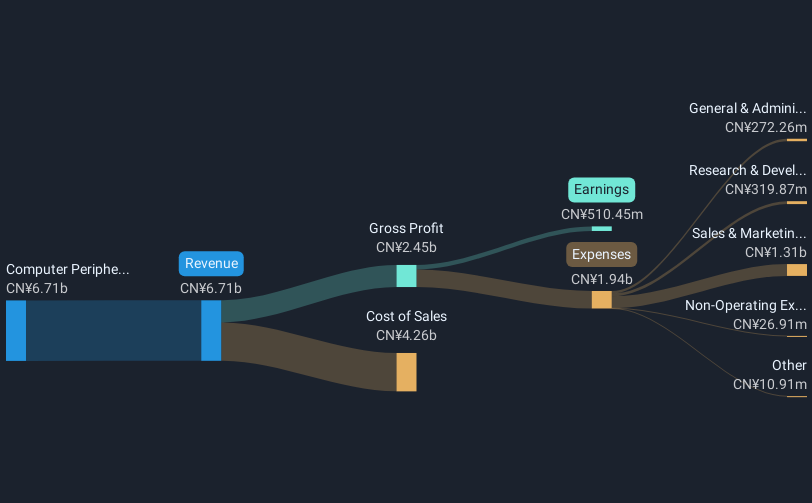

Overview: Ugreen Group Limited is involved in the research, development, design, production, and sale of 3C consumer electronic products both in China and internationally, with a market cap of CN¥27.96 billion.

Operations: Ugreen Group Limited primarily generates revenue from its computer peripherals segment, which amounts to CN¥7.28 billion. The company's operations encompass the entire lifecycle of 3C consumer electronic products, from research and development to sales, targeting both domestic and international markets.

UGreen Group's recent product launches, including the MagFlow Series and Nexode Retractable Series, underscore its commitment to innovation in wireless charging and cable management solutions. These developments are pivotal as they cater to the latest technological standards like Qi2 25W, enhancing compatibility with major brands such as Apple and Android. Financially, UGreen has shown impressive growth with a reported revenue increase to CNY 3.86 billion from CNY 2.74 billion year-over-year and a net income rise to CNY 274.68 million from CNY 206.93 million, reflecting an annualized revenue growth of 24% and earnings growth of approximately 29%. This trajectory is supported by strategic amendments in company bylaws aimed at bolstering future scalability, positioning UGreen for sustained advancement in the tech landscape.

- Click here to discover the nuances of Ugreen Group with our detailed analytical health report.

Gain insights into Ugreen Group's past trends and performance with our Past report.

Chunghwa Precision Test Tech (TPEX:6510)

Simply Wall St Growth Rating: ★★★★☆☆

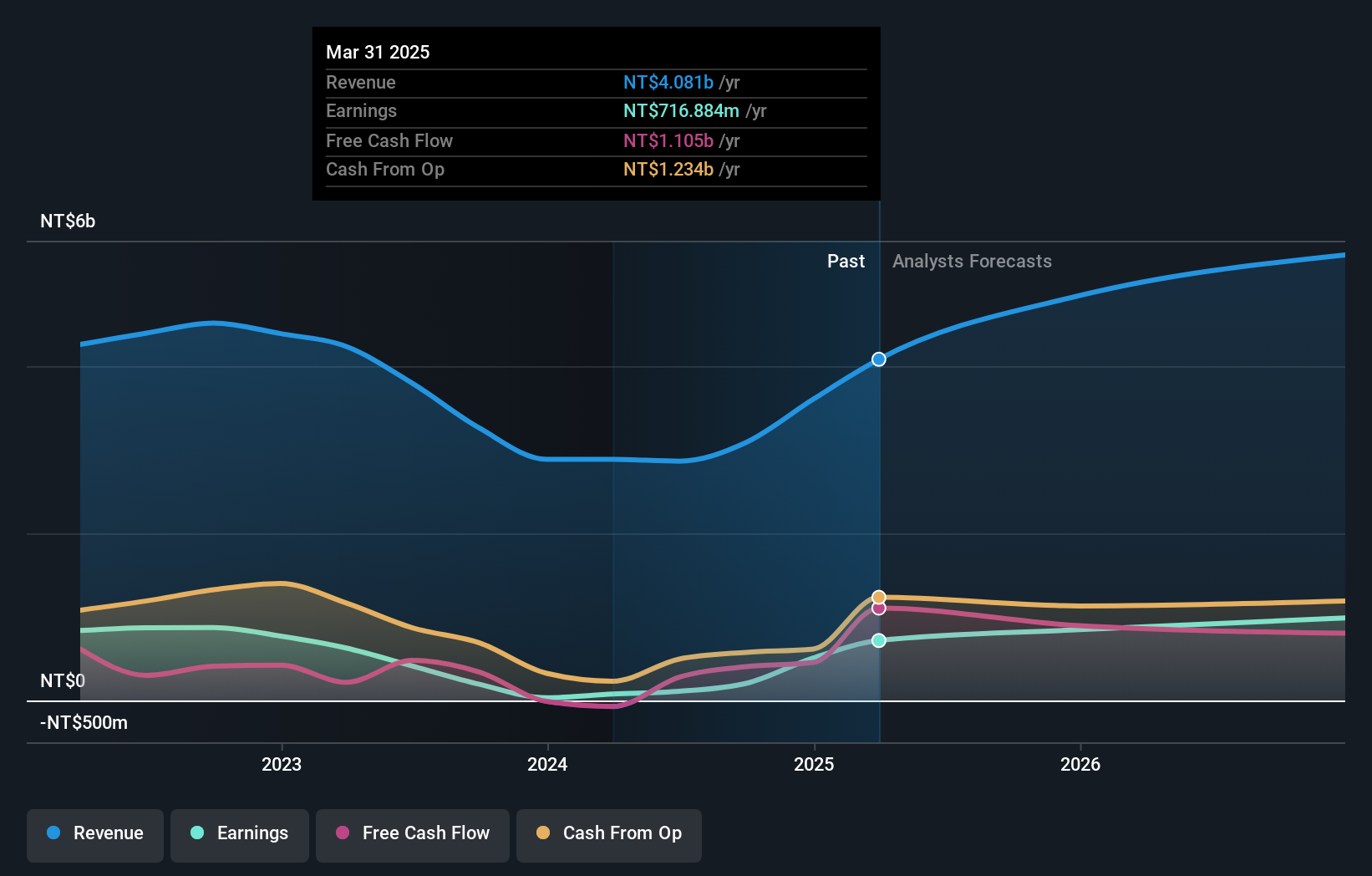

Overview: Chunghwa Precision Test Tech. Co., Ltd. is involved in the testing of semiconductor components both in Taiwan and internationally, with a market cap of NT$56.40 billion.

Operations: Chunghwa Precision Test Tech. Co., Ltd. generates revenue primarily from the electronic components and parts segment, which amounts to NT$4.57 billion. The company operates in the semiconductor testing industry across Taiwan and internationally, focusing on providing specialized testing services for semiconductor components.

Chunghwa Precision Test Tech has demonstrated robust financial performance, with second-quarter sales soaring to TWD 1.22 billion from TWD 723 million year-over-year, and net income escalating to TWD 216 million from TWD 67 million. This surge is underpinned by a substantial annual earnings growth of approximately 692%, significantly outpacing the electronic industry's average. The company's commitment to R&D is evident as it strategically allocates resources to foster innovation and maintain competitive advantage in precision testing technologies, crucial for high-tech manufacturing sectors like semiconductors.

Key Takeaways

- Discover the full array of 250 Global High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electric Connector Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300679

Electric Connector Technology

Engages in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system related products in China, North America, Europe, Japan, Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives