- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6510

Exploring High Growth Tech Stocks In Asia With Promising Potential

Reviewed by Simply Wall St

Amidst global market concerns about AI-related stock valuations and mixed economic indicators, Asian markets have been navigating a complex landscape, with technology sectors particularly under scrutiny due to their rapid growth and potential volatility. When considering high-growth tech stocks in Asia, investors often look for companies that demonstrate robust innovation capabilities and adaptability to evolving technological trends, especially in the face of broader market sentiment challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.43% | 49.42% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

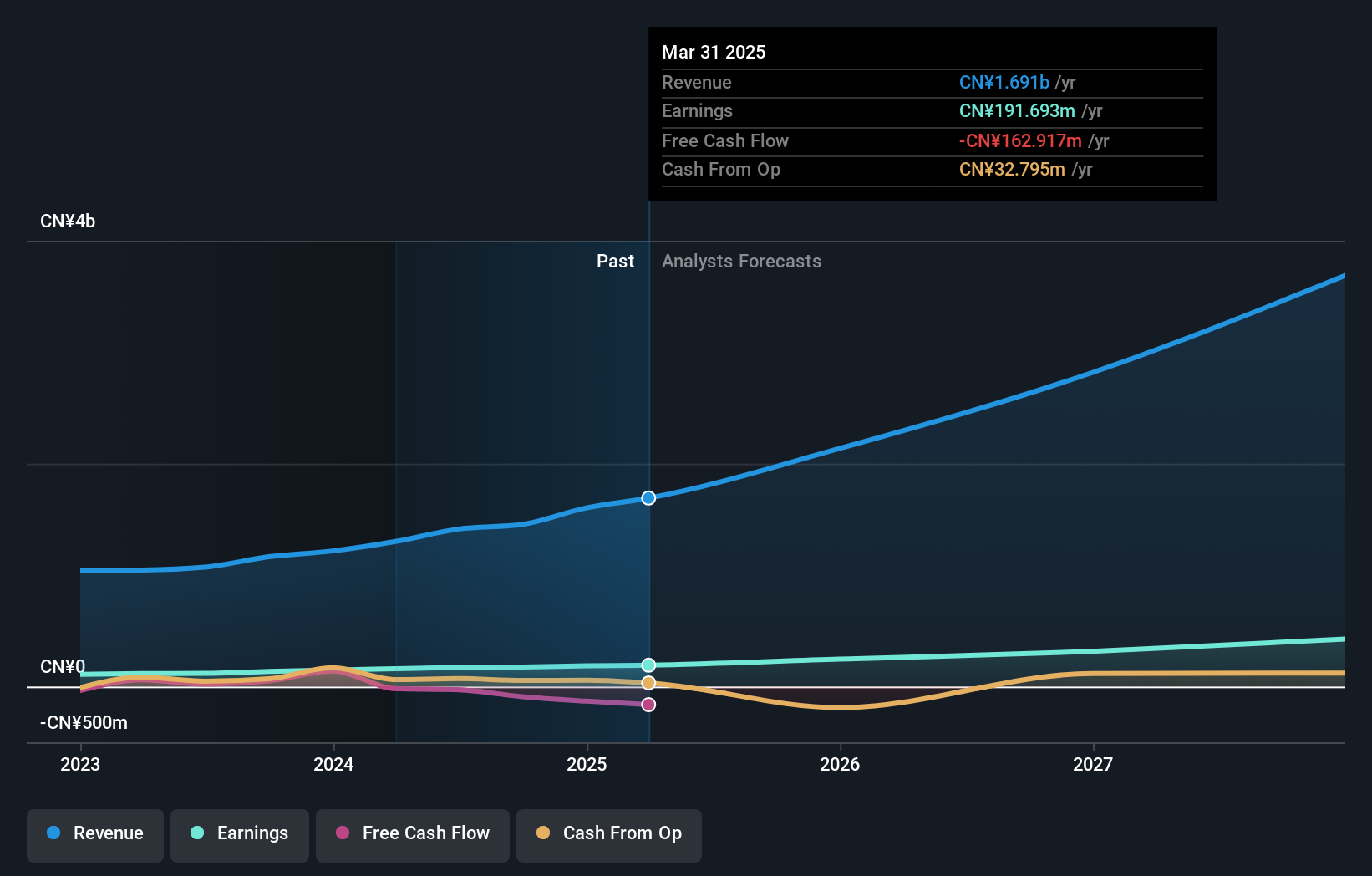

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang ZUCH Technology Co., Ltd. focuses on the research, development, production, and sale of electronic connectors in China with a market capitalization of CN¥6.52 billion.

Operations: ZUCH Technology specializes in the development and sale of electronic connectors, contributing to its market presence in China.

Zhejiang ZUCH Technology has demonstrated robust financial performance with a notable 26.9% annual revenue growth and 24.6% earnings growth, surpassing many peers in the electronic industry where average earnings growth is just 9%. This acceleration is underpinned by strategic amendments to its corporate governance, enhancing operational agility. The firm's commitment to innovation is evident from its R&D investments, aligning with industry shifts towards advanced tech solutions. With recent inclusion in the S&P Global BMI Index and consistent revenue upsurge, ZUCH is poised to capitalize on expanding market demands in Asia’s tech sector.

- Click here to discover the nuances of Zhejiang ZUCH Technology with our detailed analytical health report.

Learn about Zhejiang ZUCH Technology's historical performance.

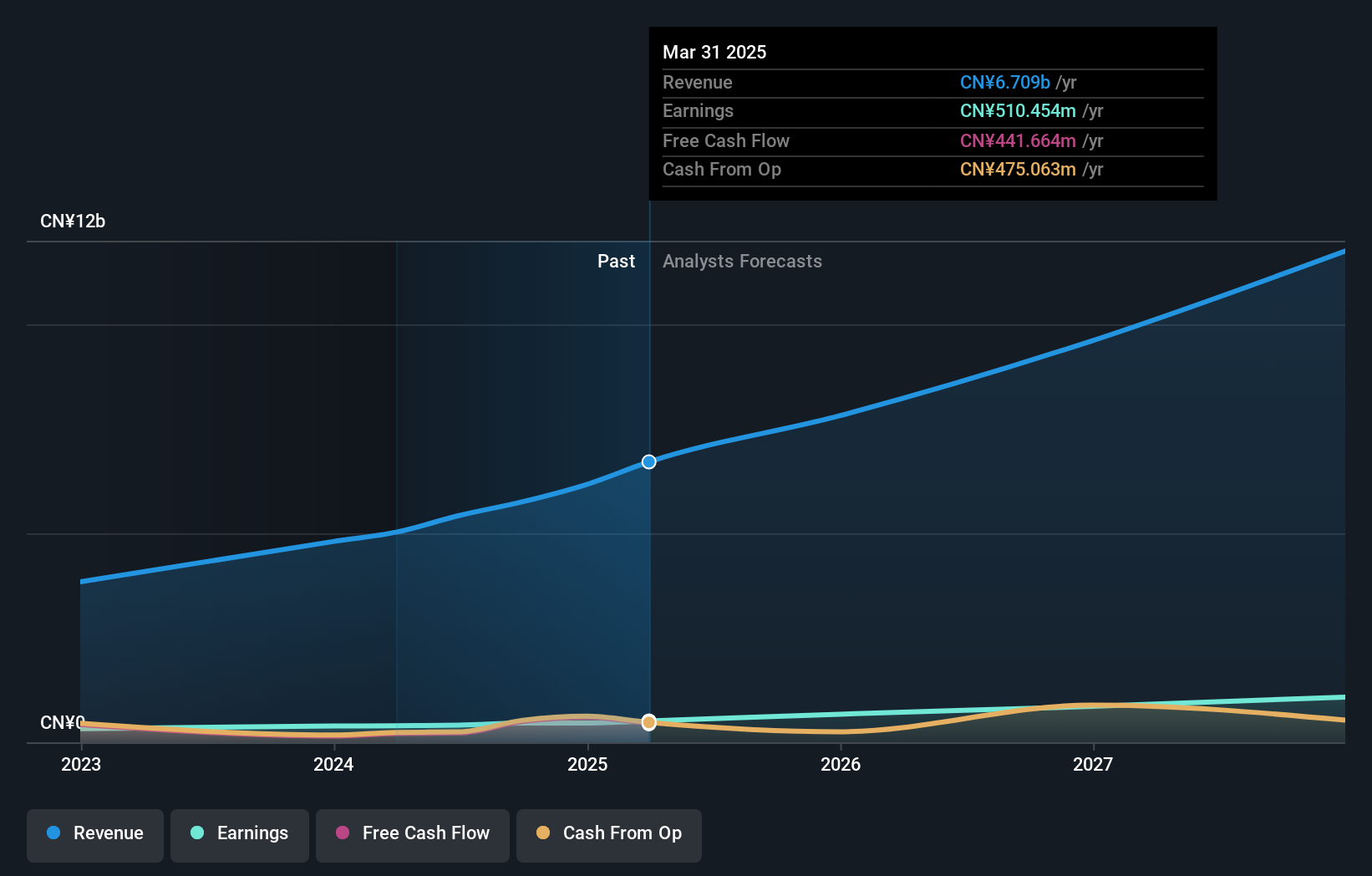

Ugreen Group (SZSE:301606)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ugreen Group Limited focuses on the research, development, design, production, and sale of 3C consumer electronic products both in China and internationally with a market cap of CN¥24.87 billion.

Operations: The company generates revenue primarily from the sale of computer peripherals, amounting to CN¥8.23 billion.

Ugreen Group has showcased impressive growth with a 28.2% increase in annual revenue and a 34% rise in earnings, outpacing the Chinese market's average. This performance is bolstered by strategic product launches like the MagFlow Series, enhancing its competitive edge in wireless charging technology. Furthermore, R&D commitment is evident as expenses surged to CNY 500 million, supporting innovations like the Nexode Retractable Series which redefines cable management solutions for tech-savvy consumers and professionals alike. These initiatives not only reflect Ugreen's adaptability to consumer needs but also its potential to sustain growth amidst fierce tech competition.

- Take a closer look at Ugreen Group's potential here in our health report.

Understand Ugreen Group's track record by examining our Past report.

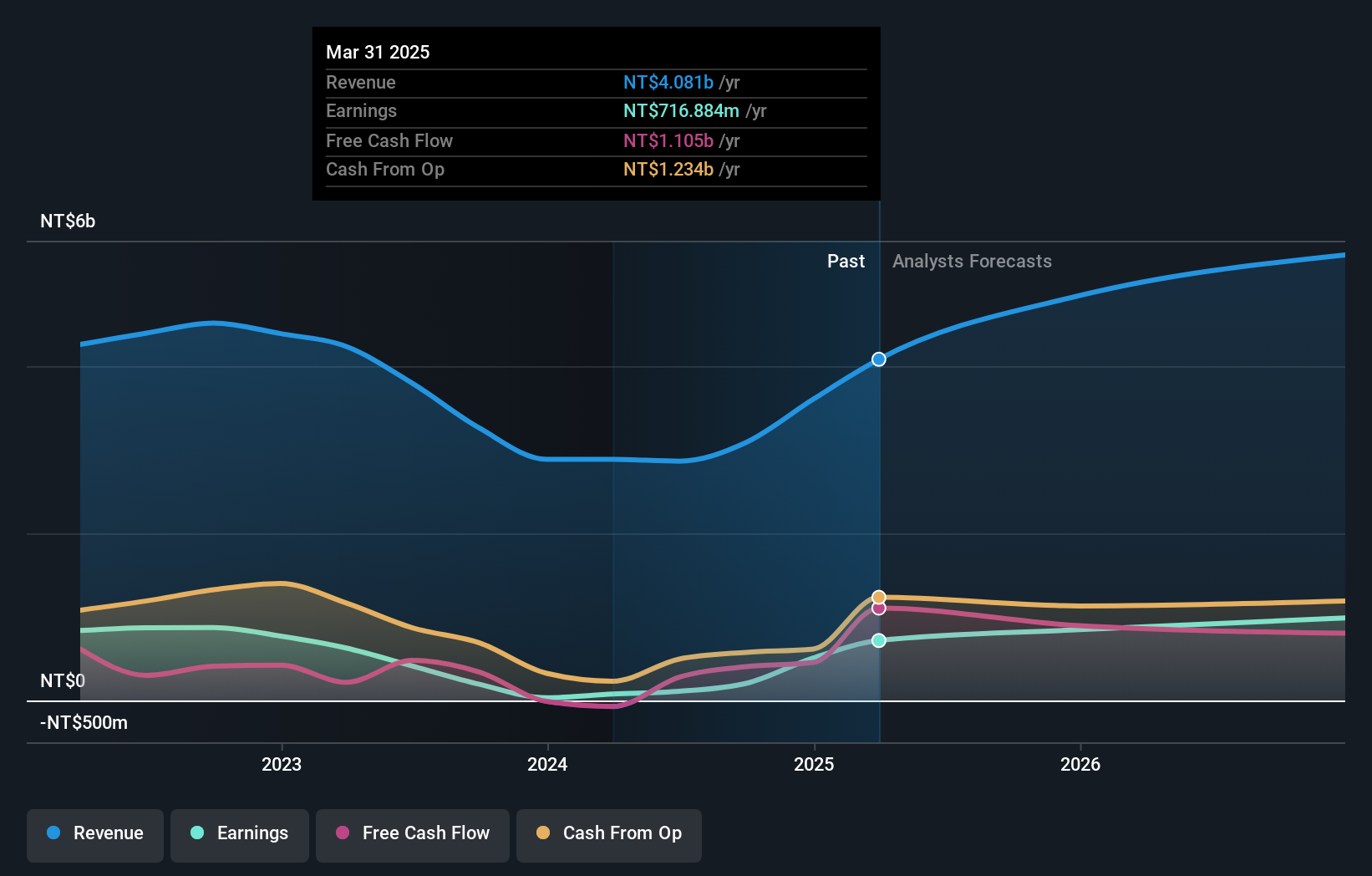

Chunghwa Precision Test Tech (TPEX:6510)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chunghwa Precision Test Tech. Co., Ltd. operates in the semiconductor testing industry both domestically in Taiwan and internationally, with a market capitalization of NT$58.69 billion.

Operations: Chunghwa Precision Test Tech focuses on semiconductor component testing, generating revenue primarily from electronic components and parts, which amounted to NT$4.90 billion. The company's market capitalization stands at NT$58.69 billion.

Chunghwa Precision Test Tech has demonstrated robust growth, with a 404.3% surge in earnings over the past year, significantly outstripping the electronic industry's average of 6.6%. This performance is underpinned by a strategic alliance with Yokowo Co., Ltd., aimed at enhancing product competitiveness through mutual investments and technology sharing. The company's commitment to innovation is further evidenced by its R&D spending, crucial for maintaining its competitive edge in the semiconductor testing market. With expected annual revenue and profit growth rates of 17% and 25.5% respectively, Chunghwa is well-positioned to capitalize on expanding market demands while navigating a highly volatile share price landscape.

Key Takeaways

- Explore the 194 names from our Asian High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6510

Chunghwa Precision Test Tech

Engages in the testing of semiconductor components in Taiwan, Republic of China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success