Amid a backdrop of easing inflation and renewed trade tensions, Asian markets are navigating a complex landscape that has seen smaller-cap indexes in the U.S. lag behind their larger counterparts, yet still manage to post positive returns. In this environment, identifying high-growth tech stocks in Asia requires careful consideration of companies that can leverage technological advancements and strategic positioning to thrive despite global economic uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 22.41% | 23.53% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shenzhen Kinwong Electronic (SHSE:603228)

Simply Wall St Growth Rating: ★★★★☆☆

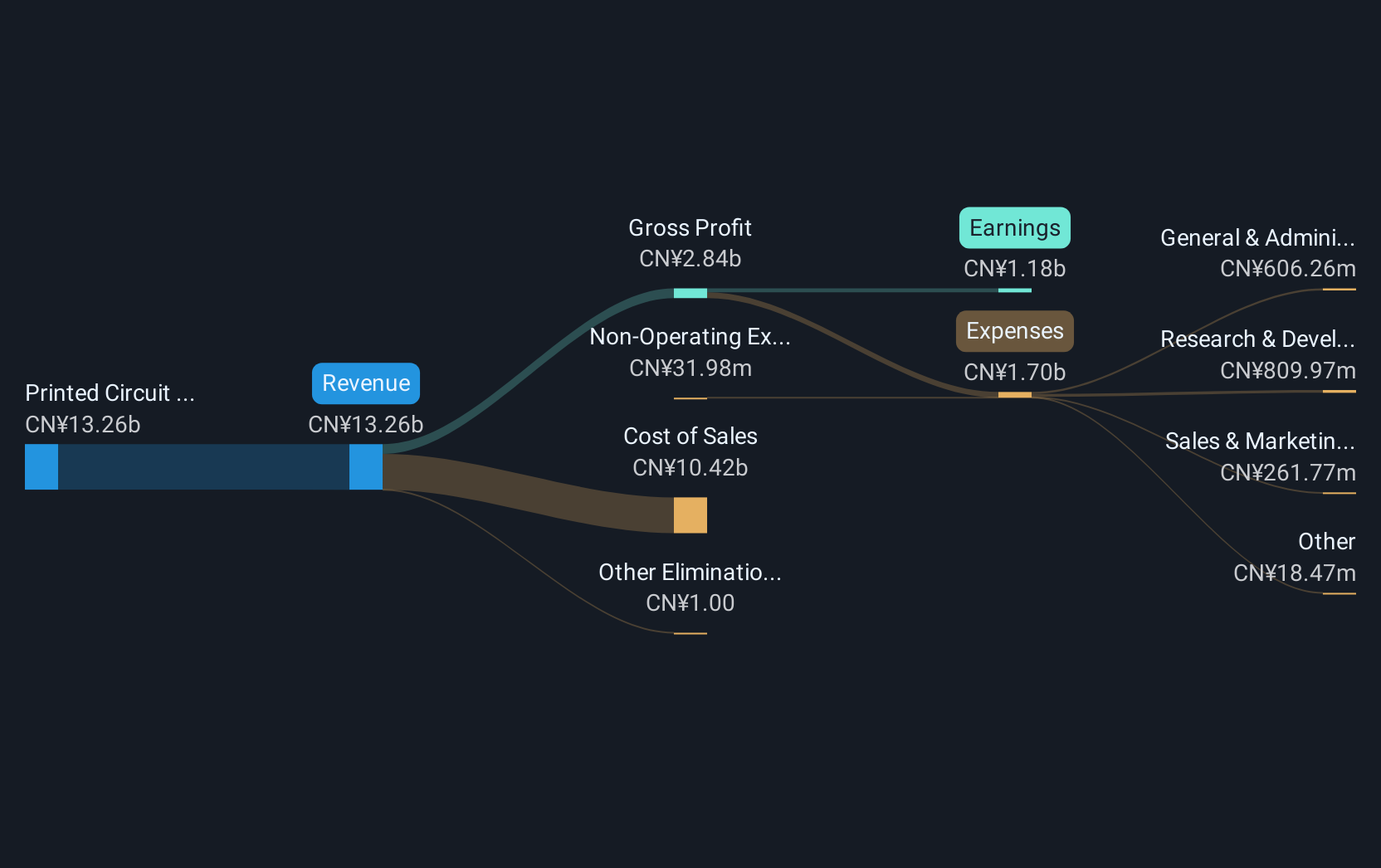

Overview: Shenzhen Kinwong Electronic Co., Ltd. is involved in the research, development, production, and sale of printed circuit boards and electronic materials both in China and internationally, with a market cap of approximately CN¥29.28 billion.

Operations: Kinwong Electronic focuses on the production and sale of printed circuit boards, generating a revenue of CN¥13.26 billion from this segment.

Shenzhen Kinwong Electronic has demonstrated robust growth metrics, with revenue climbing to CNY 3.34 billion this quarter from CNY 2.74 billion in the previous year, marking a significant increase of 21.9%. This performance is bolstered by an earnings growth of 23.7% per year, outpacing the broader Chinese market's average. The company's commitment to innovation is evidenced by its substantial R&D investment, which aligns with industry trends towards advanced electronic solutions and might signal sustained future growth amidst a competitive tech landscape. Moreover, recent corporate activities including their annual general meeting and quarterly earnings announcements reflect active engagement and transparency with stakeholders, enhancing investor confidence in their operational strategies and market position.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Kinwong Electronic.

Gain insights into Shenzhen Kinwong Electronic's past trends and performance with our Past report.

Semitronix (SZSE:301095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Semitronix Corporation offers characterization and yield improvement solutions for the semiconductor industry both in China and internationally, with a market cap of CN¥11.49 billion.

Operations: The company focuses on delivering solutions that enhance semiconductor characterization and yield, targeting both domestic and international markets. With a market capitalization of approximately CN¥11.49 billion, it operates within the semiconductor industry, providing specialized services aimed at optimizing production processes.

Semitronix Corporation has shown a promising uptick in its financial health, with first-quarter sales jumping to CNY 66.48 million from CNY 43.9 million the previous year, reflecting a robust revenue growth rate of 51.7%. This performance is complemented by a significant reduction in net loss to CNY 13.71 million from CNY 22.9 million, indicating improving operational efficiency. The company's commitment to innovation and market adaptation is underscored by an R&D investment that aligns with evolving technological demands, positioning it well within the competitive landscape of Asia's high-growth tech sector.

- Get an in-depth perspective on Semitronix's performance by reading our health report here.

Evaluate Semitronix's historical performance by accessing our past performance report.

Taiwan Union Technology (TPEX:6274)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Taiwan Union Technology Corporation specializes in producing and distributing copper foil substrates, adhesive sheets, and multi-layer laminated boards both domestically and internationally, with a market capitalization of NT$51.79 billion.

Operations: The company focuses on manufacturing and selling copper foil substrates, adhesive sheets, and multi-layer laminated boards to both domestic and international markets. It operates with a market capitalization of NT$51.79 billion.

Taiwan Union Technology has demonstrated robust financial performance, with a 44.3% increase in Q1 sales year-over-year, reaching TWD 6.37 billion. This growth is supported by a significant rise in net income to TWD 671.95 million from TWD 451.84 million, reflecting an earnings growth of about 48.7%. The company's strategic focus on R&D is evident from its recent presentations at major tech conferences, positioning it well for sustained innovation and market competitiveness within Asia’s tech sector.

Where To Now?

- Discover the full array of 495 Asian High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301095

Semitronix

Provides characterization and yield improvement solutions for the semiconductor industry in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion