- Turkey

- /

- Basic Materials

- /

- IBSE:BOBET

Discovering Undiscovered Gems in January 2025

Reviewed by Simply Wall St

As we step into January 2025, the global markets reflect a mixed sentiment with U.S. stocks closing out another strong year despite recent economic concerns, such as the sharp decline in the Chicago PMI and a downward revision of GDP forecasts by the Atlanta Fed. Amidst this backdrop of fluctuating indices and economic indicators, identifying promising small-cap stocks can be particularly rewarding, as these companies often thrive on innovation and agility—qualities that are crucial in navigating uncertain market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

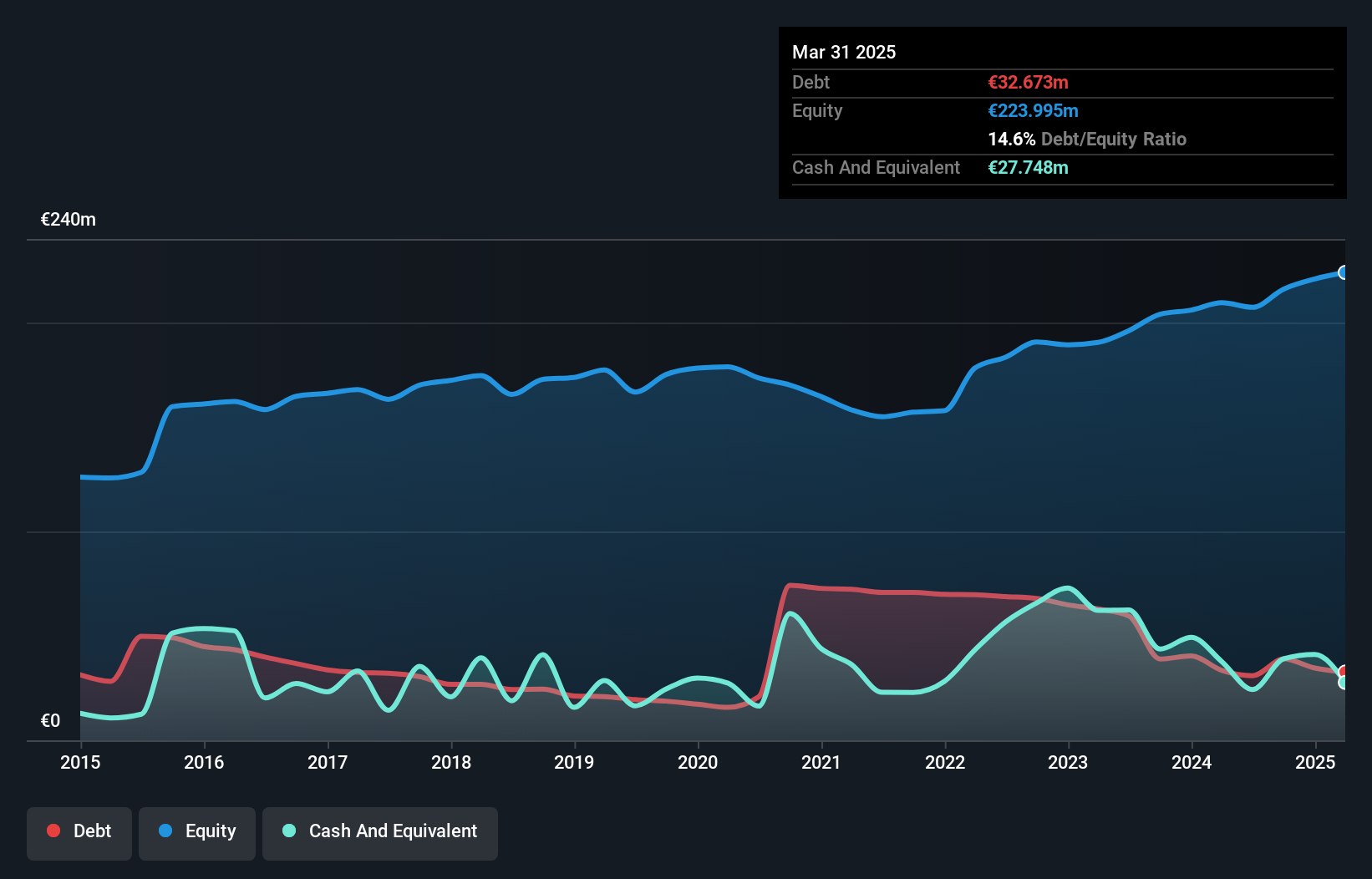

Aeroporto Guglielmo Marconi di Bologna (BIT:ADB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aeroporto Guglielmo Marconi di Bologna S.p.A. operates and manages the Bologna airport, with a market capitalization of €278.17 million.

Operations: Aeroporto Guglielmo Marconi di Bologna generates revenue primarily from two segments: Aviation (€97.94 million) and Non-Aeronautical (€61.10 million).

Aeroporto Guglielmo Marconi di Bologna, a smaller player in the infrastructure sector, has shown impressive earnings growth of 63.9% over the past year, far outpacing the industry average of 9.9%. For the first nine months of 2024, revenue reached €118.7 million compared to €104.72 million last year, while net income rose to €19.54 million from €14.66 million. With a price-to-earnings ratio at 12.9x below Italy's market average and interest payments well-covered by EBIT (33.9x), it seems poised for steady performance despite forecasted earnings decline averaging 6.9% annually over three years.

- Unlock comprehensive insights into our analysis of Aeroporto Guglielmo Marconi di Bologna stock in this health report.

Understand Aeroporto Guglielmo Marconi di Bologna's track record by examining our Past report.

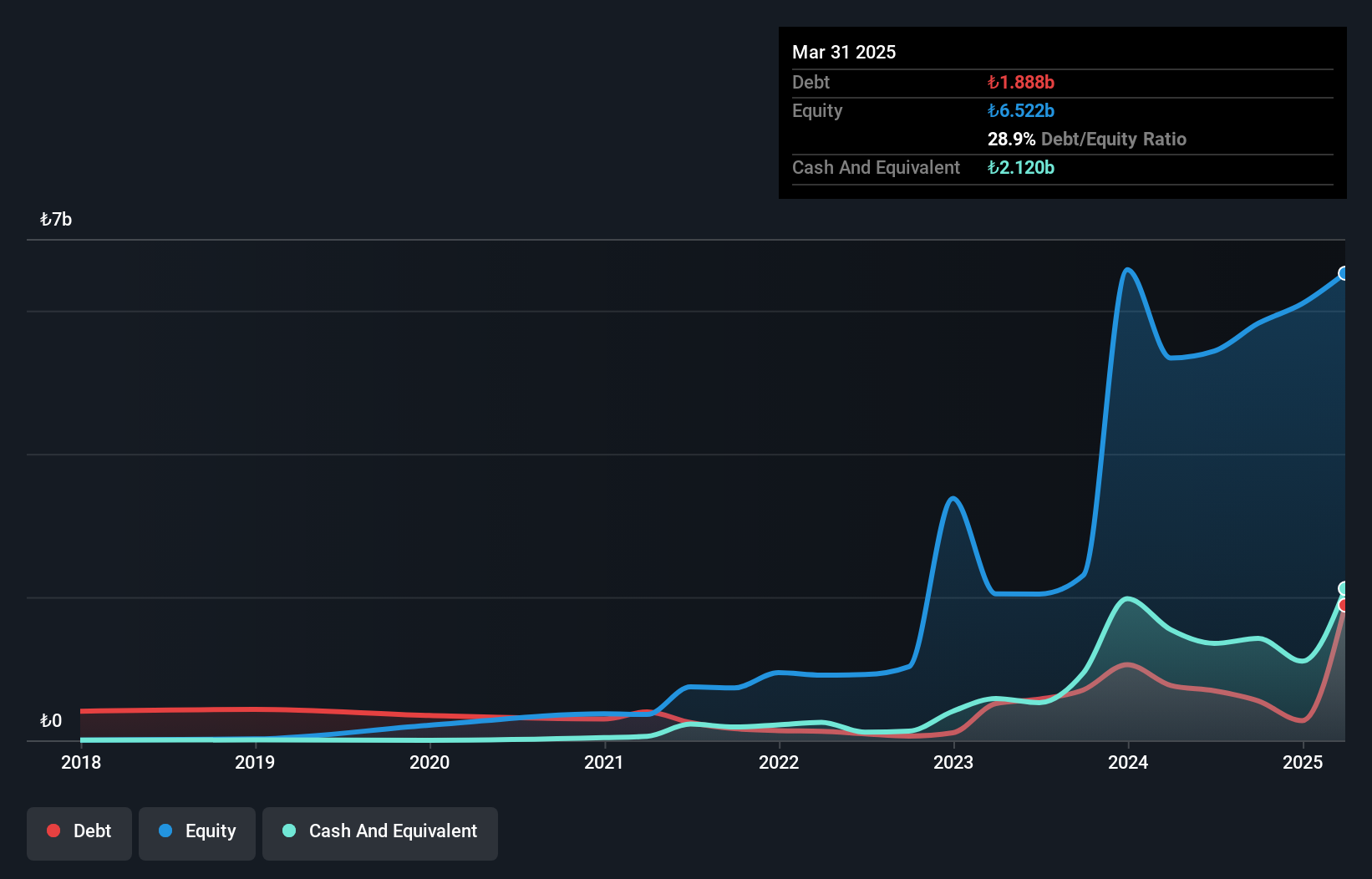

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi (IBSE:BOBET)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi operates in Turkey under the Bosphorus Concrete brand, focusing on the production, manufacturing, and sale of ready-made concrete and aggregates with a market cap of TRY9.17 billion.

Operations: Bosphorus Concrete generates revenue primarily from its cement segment, amounting to TRY6.76 billion. The company's financial performance is reflected in its market cap of TRY9.17 billion.

Bogazici Beton, a small player in the construction materials sector, has shown a mixed financial performance recently. Its sales for Q3 2024 were TRY 2.44 billion, down from TRY 3.10 billion the previous year, while net income fell to TRY 48.22 million from TRY 84.28 million. Despite these challenges, the company boasts a favorable debt profile with more cash than total debt and has significantly reduced its debt-to-equity ratio from 226.9% to just 9.4% over five years. However, earnings growth remains negative at -31%, contrasting with industry trends and highlighting potential areas of concern moving forward.

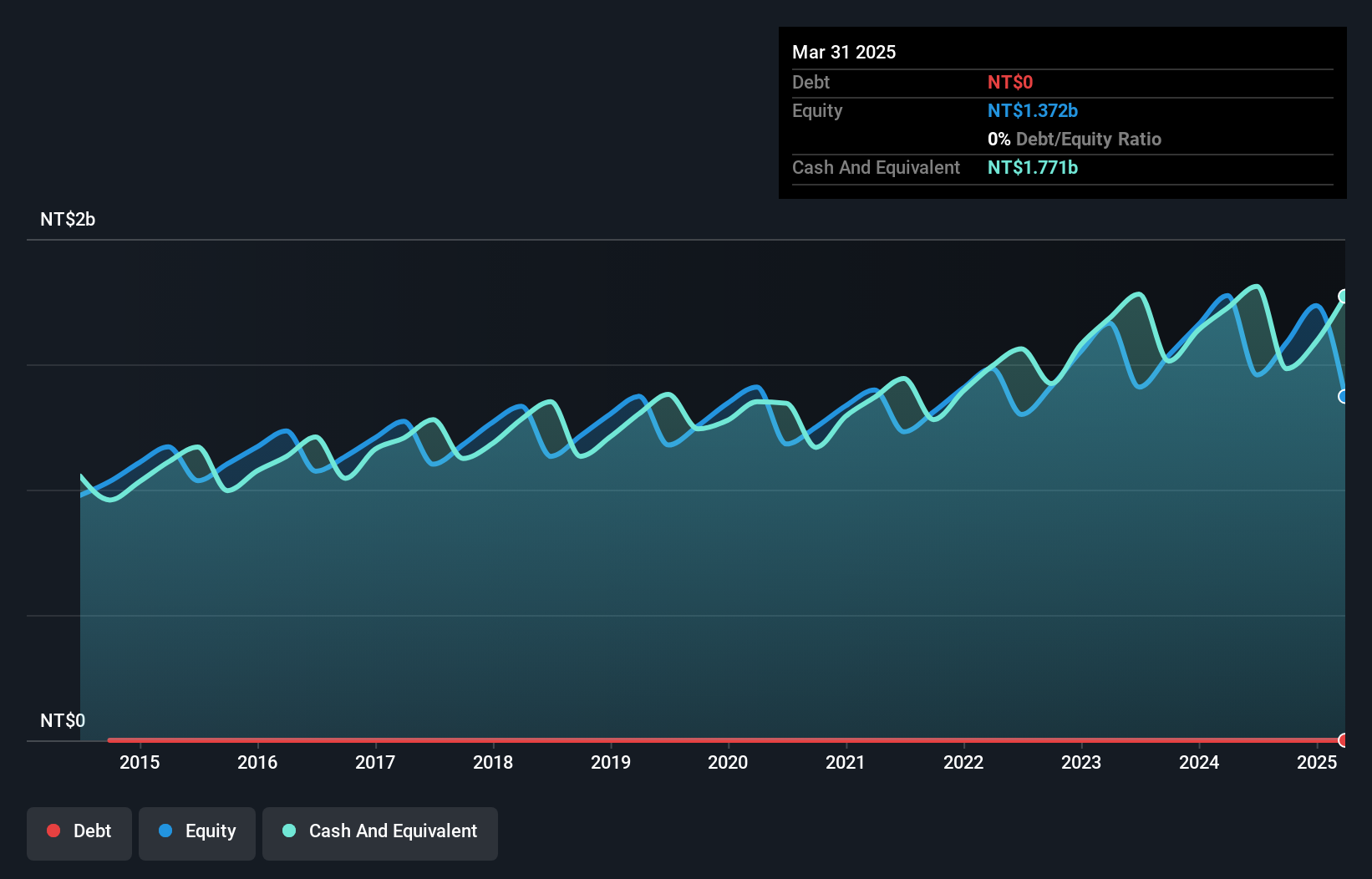

Planet Technology (TPEX:6263)

Simply Wall St Value Rating: ★★★★★★

Overview: Planet Technology Corporation offers IP-based networking products and solutions for small-to-medium-sized businesses, enterprises, and network infrastructures globally, with a market cap of NT$9.69 billion.

Operations: Planet Technology's revenue is primarily derived from its Computer Network Equipment and Telecommunication Products segment, amounting to NT$1.85 billion.

Planet Technology, a smaller player in the tech industry, stands out with its solid financial footing. The company remains debt-free over the past five years and consistently generates positive free cash flow, reaching TWD 483.50 million recently. Despite a slight dip in earnings growth by 1.8%, it still outpaces the broader communications sector's decline of 9.2%. Trading at 4.7% below estimated fair value suggests potential for investors seeking undervalued opportunities. Recent quarterly results show modest improvements with sales of TWD 459.67 million and net income of TWD 129.17 million, reflecting steady performance amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Planet Technology.

Gain insights into Planet Technology's past trends and performance with our Past report.

Where To Now?

- Delve into our full catalog of 4668 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BOBET

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi

Produces, manufactures, and sells ready-made concrete and aggregates under the Bosphorus Concrete brand in Turkey.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)