- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6227

Macnica Galaxy And Two Other Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating indices and geopolitical uncertainties, investors are increasingly attentive to the Federal Reserve's steady interest rates and the European Central Bank's recent rate cuts. Amidst these dynamics, dividend stocks continue to attract attention for their potential to provide a steady income stream, making them a compelling consideration in today's volatile market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Macnica Galaxy (TPEX:6227)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macnica Galaxy Inc. operates in the agency trading and technical service of semiconductor electronic components across Taiwan, other parts of Asia, and internationally, with a market capitalization of NT$5.40 billion.

Operations: Macnica Galaxy Inc.'s revenue is primarily derived from its domestic operations, contributing NT$10.72 billion, and international activities through Macnica Galaxy International, which account for NT$1.34 billion.

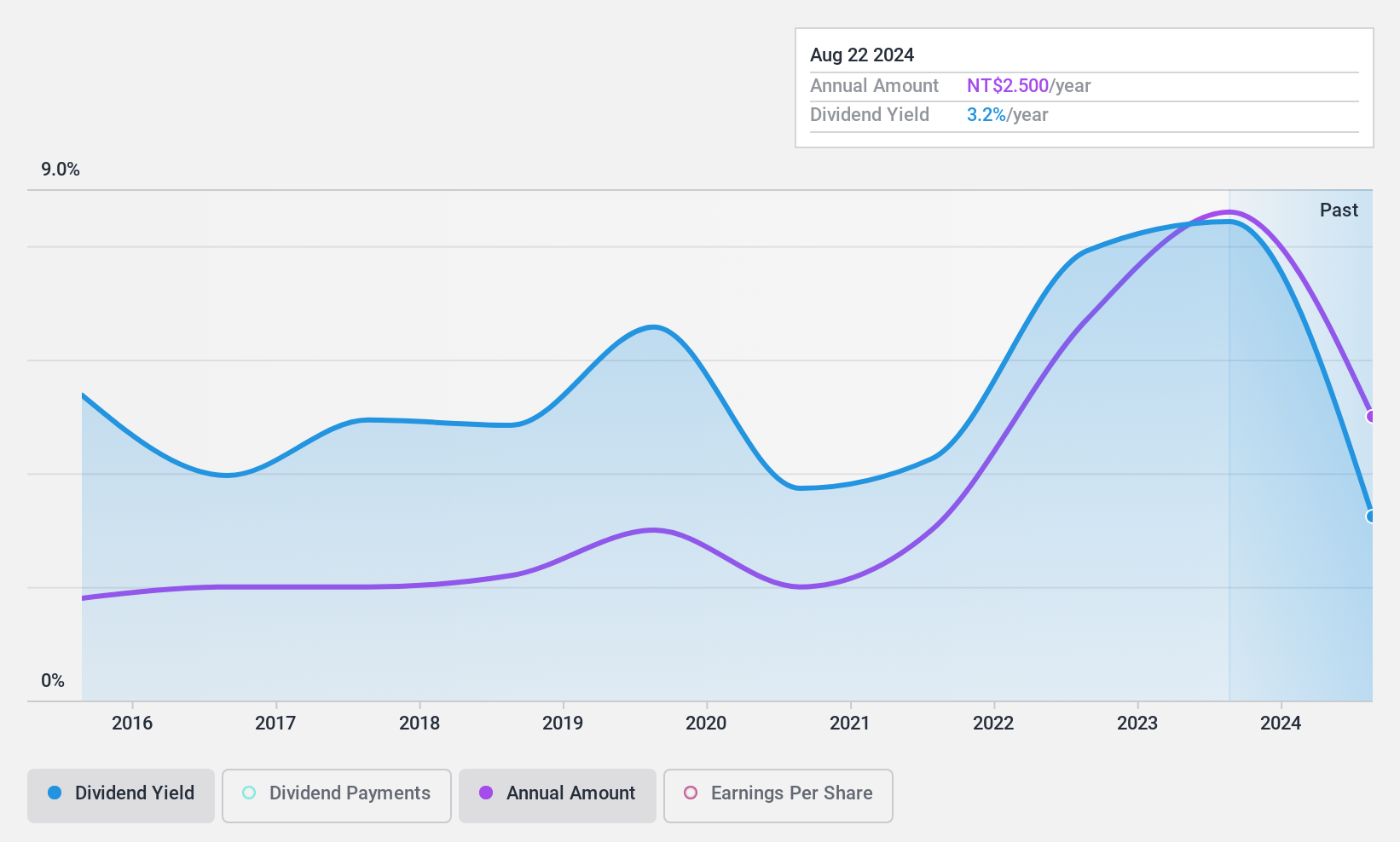

Dividend Yield: 3.2%

Macnica Galaxy's dividend yield of 3.21% is below the top quartile in Taiwan, but its dividends are well-covered by earnings with a payout ratio of 48.3% and a low cash payout ratio of 7.2%. Despite an unstable and volatile dividend history over the past decade, recent earnings growth and strong coverage by cash flows suggest potential for sustainability. However, investors should be cautious due to recent share price volatility and fluctuating past dividends.

- Dive into the specifics of Macnica Galaxy here with our thorough dividend report.

- Our expertly prepared valuation report Macnica Galaxy implies its share price may be lower than expected.

Iriso Electronics (TSE:6908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iriso Electronics Co., Ltd. develops, manufactures, and sells connectors across Japan, the rest of Asia, Europe, and North America with a market cap of ¥55.76 billion.

Operations: Iriso Electronics Co., Ltd. generates revenue from its operations in Asia (¥52.06 billion), Japan (¥40.51 billion), Europe (¥9.47 billion), and North America (¥6.39 billion).

Dividend Yield: 3.4%

Iriso Electronics' dividend yield of 3.38% falls short compared to the top 25% in Japan, yet it maintains a sustainable payout with earnings and cash flow coverage at 59.7% and 38.2%, respectively. Despite past volatility in dividends, recent increases indicate growth potential. The company's recent share buyback program aims to enhance shareholder returns, though structural reforms are under consideration following a board meeting on February 4, 2025.

- Unlock comprehensive insights into our analysis of Iriso Electronics stock in this dividend report.

- Upon reviewing our latest valuation report, Iriso Electronics' share price might be too optimistic.

Nippon Yusen Kabushiki Kaisha (TSE:9101)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Yusen Kabushiki Kaisha provides a range of logistics services globally and has a market capitalization of ¥2.13 trillion.

Operations: Nippon Yusen Kabushiki Kaisha's revenue segments include ¥764.87 million from Logistics, ¥172.85 million from Liner Trade, and ¥175.97 million from Air Cargo Transportation.

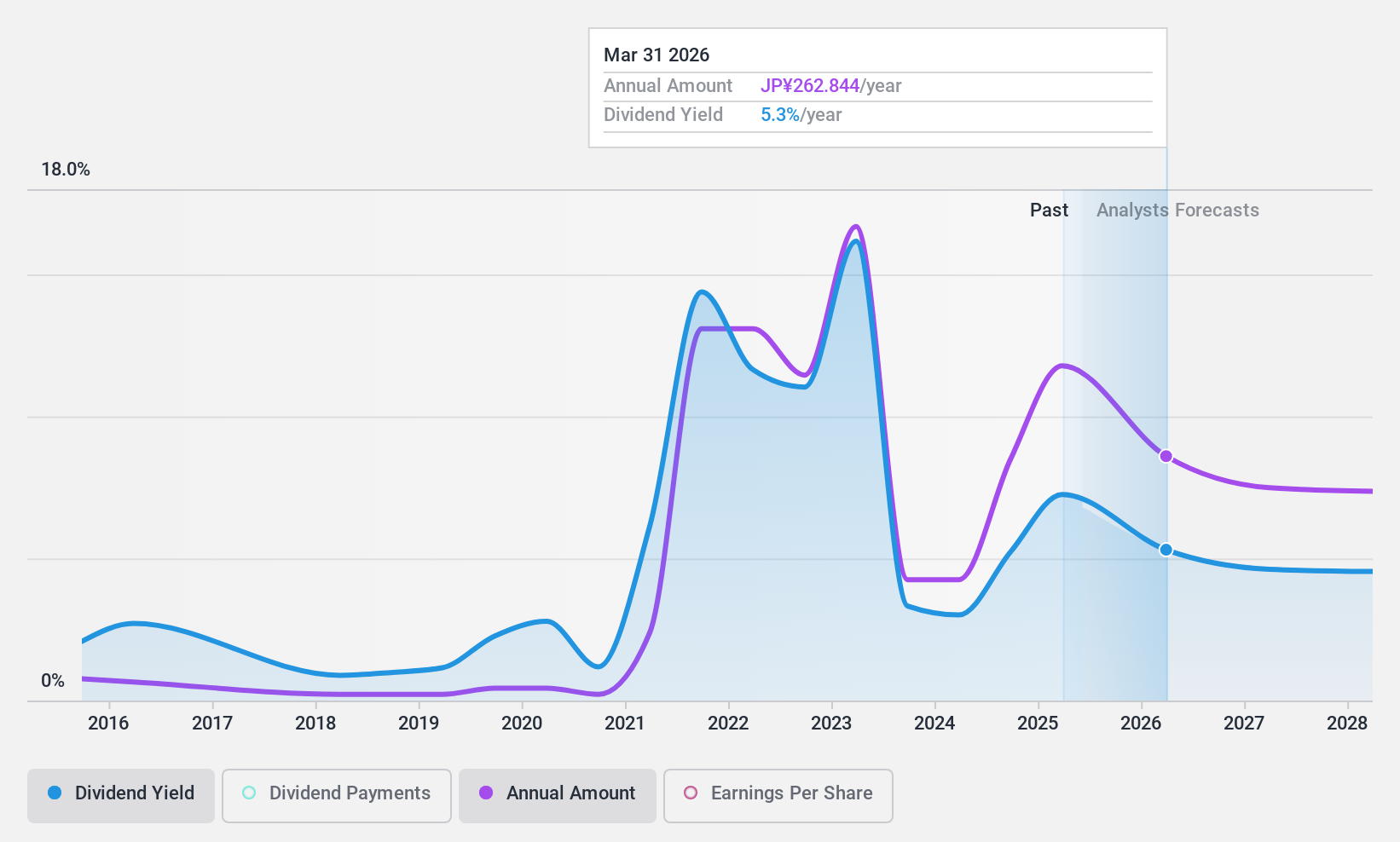

Dividend Yield: 5.1%

Nippon Yusen Kabushiki Kaisha's recent dividend forecast revision to ¥180 per share for the fiscal year ending March 2025 highlights its commitment to shareholder returns, despite past volatility. The dividend yield of 5.13% is attractive, yet not well covered by free cash flow, indicating potential sustainability concerns. A low payout ratio of 25.5% suggests earnings coverage is solid, but a high cash payout ratio of 178.3% raises questions about long-term reliability amidst declining earnings forecasts and ongoing share buybacks totaling ¥130 billion.

- Click to explore a detailed breakdown of our findings in Nippon Yusen Kabushiki Kaisha's dividend report.

- Our valuation report here indicates Nippon Yusen Kabushiki Kaisha may be overvalued.

Seize The Opportunity

- Click through to start exploring the rest of the 1956 Top Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6227

Macnica Galaxy

Together with its subisidaries, engages in the agency trading and technical service of semiconductor electronic components in Taiwan, rest of Asia, and internationally.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives