In a market environment where U.S. stock indexes are climbing toward record highs and small-cap stocks are lagging behind their larger counterparts, investors may find opportunities in lesser-known companies that have the potential to thrive despite broader economic challenges. With inflation data fueling expectations for prolonged higher interest rates, identifying stocks with strong fundamentals and growth potential becomes crucial in navigating this complex landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Value Rating: ★★★★☆☆

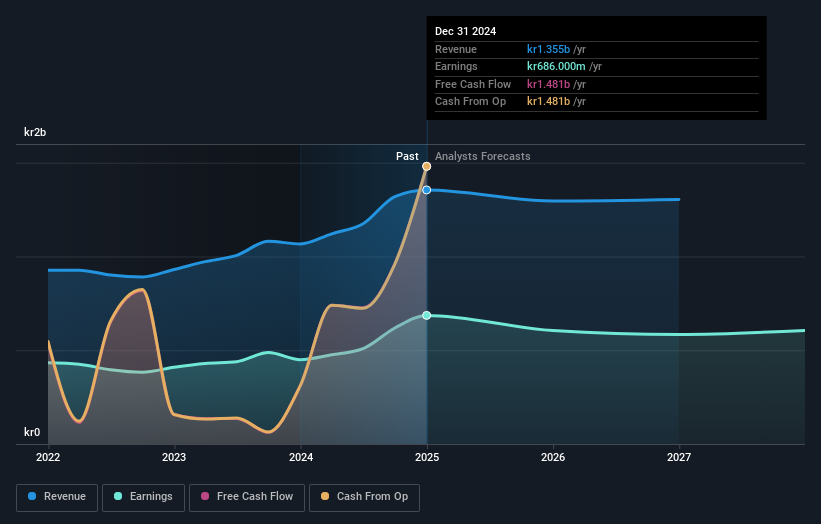

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to private and corporate customers in Norway, with a market capitalization of NOK6 billion.

Operations: SpareBank 1 Ringerike Hadeland generates revenue primarily from its Retail Market (NOK456 million) and Business Market (NOK467 million) segments. The company also earns from Property Management and IT and Accounting Services, contributing NOK56 million and NOK87 million, respectively.

SpareBank 1 Ringerike Hadeland, with total assets of NOK31.5 billion and equity of NOK5.3 billion, appears undervalued at 31% below its estimated fair value. The bank's reliance on customer deposits for funding, covering 80% of liabilities, suggests a stable financial footing. Total loans stand at NOK26.2 billion against deposits of NOK21 billion, indicating solid lending activity. Earnings surged by 53% last year to NOK704 million from NOK461 million previously, outpacing the industry growth rate of 20%. However, future earnings are forecasted to decrease by an average of 5% annually over the next three years.

Junhe Pumps HoldingLtd (SHSE:603617)

Simply Wall St Value Rating: ★★★★★☆

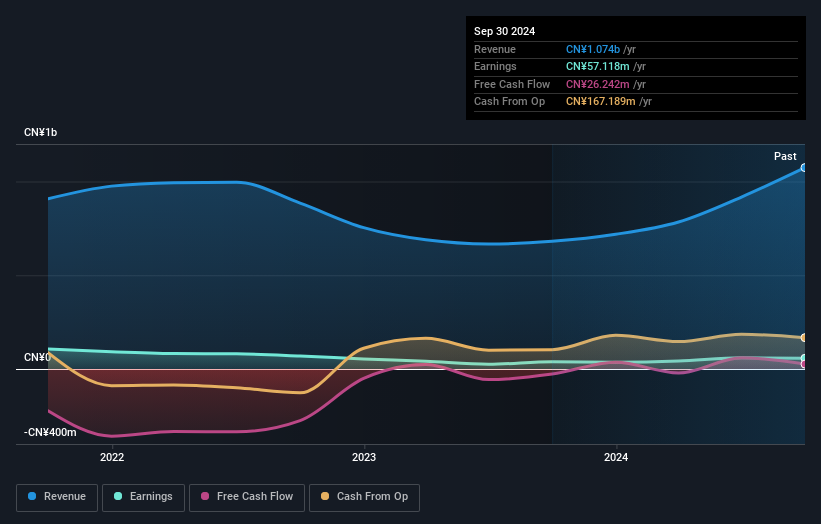

Overview: Junhe Pumps Holding Co., Ltd specializes in the production and sale of household water pumps in China, with a market capitalization of CN¥3.11 billion.

Operations: Junhe Pumps Holding Co., Ltd generates its revenue primarily from the sale of machinery pumps, totaling approximately CN¥1.07 billion. The company's financial data indicates a focus on this core product line as a significant contributor to its income streams.

Junhe Pumps Holding Ltd, a relatively small player in the machinery sector, has shown impressive earnings growth of 45.5% over the past year, outpacing the industry average of -0.06%. Despite a volatile share price in recent months, Junhe seems to maintain high-quality earnings and covers its interest payments comfortably. The firm's debt-to-equity ratio rose from 25.3% to 32.2% over five years but remains manageable as it holds more cash than total debt. With a free cash flow position that turned positive recently at US$59.70 million and capital expenditures around US$125 million, Junhe's financial health appears stable for future endeavors.

- Click here and access our complete health analysis report to understand the dynamics of Junhe Pumps HoldingLtd.

Assess Junhe Pumps HoldingLtd's past performance with our detailed historical performance reports.

Netronix (TPEX:6143)

Simply Wall St Value Rating: ★★★★★★

Overview: Netronix, Inc. designs and manufactures network and e-Reader products in Taiwan and internationally, with a market capitalization of NT$11.02 billion.

Operations: Netronix generates revenue primarily from its Consumer Electronics Division, contributing NT$5.01 billion, and its Computer Interface Equipment Division, which adds NT$1.39 billion.

Netronix, a tech player with a knack for high-quality earnings, has shown impressive growth with earnings surging 37.1% last year, outpacing the industry’s 12.9%. The company is trading at a significant discount of 66.9% below its estimated fair value, suggesting potential upside for investors. Over the past five years, Netronix has impressively slashed its debt to equity ratio from 136.7% to just 8.5%, showcasing prudent financial management and reducing risk exposure. Despite recent share price volatility, its strong cash position over total debt offers reassurance in terms of financial stability and future growth prospects within the tech sector.

- Get an in-depth perspective on Netronix's performance by reading our health report here.

Gain insights into Netronix's historical performance by reviewing our past performance report.

Where To Now?

- Investigate our full lineup of 4733 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:RING

SpareBank 1 Ringerike Hadeland

A financial institution, provides various banking products and services to private and corporate customers in Norway.

Solid track record established dividend payer.

Market Insights

Community Narratives