- Japan

- /

- Professional Services

- /

- TSE:4310

3 Top Asian Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

The Asian markets have been experiencing a mix of challenges and opportunities, with global trade tensions and economic slowdowns in key regions like China impacting investor sentiment. Amid these conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Zenrin (TSE:9474) | 3.91% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| NCD (TSE:4783) | 4.02% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.11% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.57% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Daicel (TSE:4202) | 4.68% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

Click here to see the full list of 1154 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

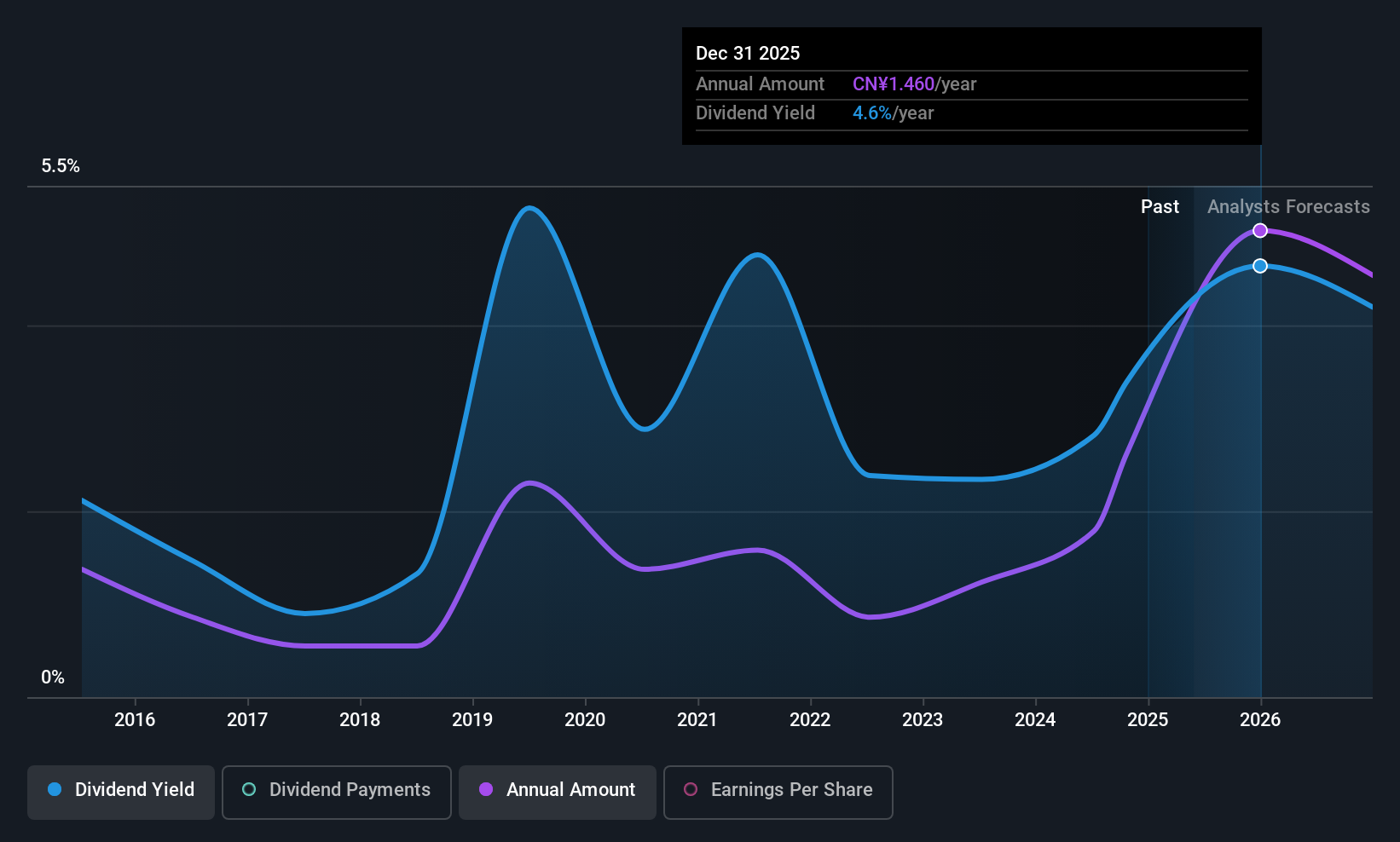

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. is engaged in the research, development, production, and sale of industrial valves both domestically in China and internationally, with a market cap of CN¥24.23 billion.

Operations: Neway Valve (Suzhou) Co., Ltd. generates its revenue primarily from the valve industry, with a reported figure of CN¥6.43 billion.

Dividend Yield: 4.8%

Neway Valve (Suzhou) offers a dividend yield of 4.82%, placing it among the top 25% of dividend payers in China. However, its dividends have been volatile over the past decade and are not well covered by earnings, with a high payout ratio of 95.1%. Despite recent earnings growth of 48.9%, sustainability concerns persist due to unreliable payment history and an extraordinary shareholders meeting scheduled for July could impact future dividends.

- Unlock comprehensive insights into our analysis of Neway Valve (Suzhou) stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Neway Valve (Suzhou) is priced lower than what may be justified by its financials.

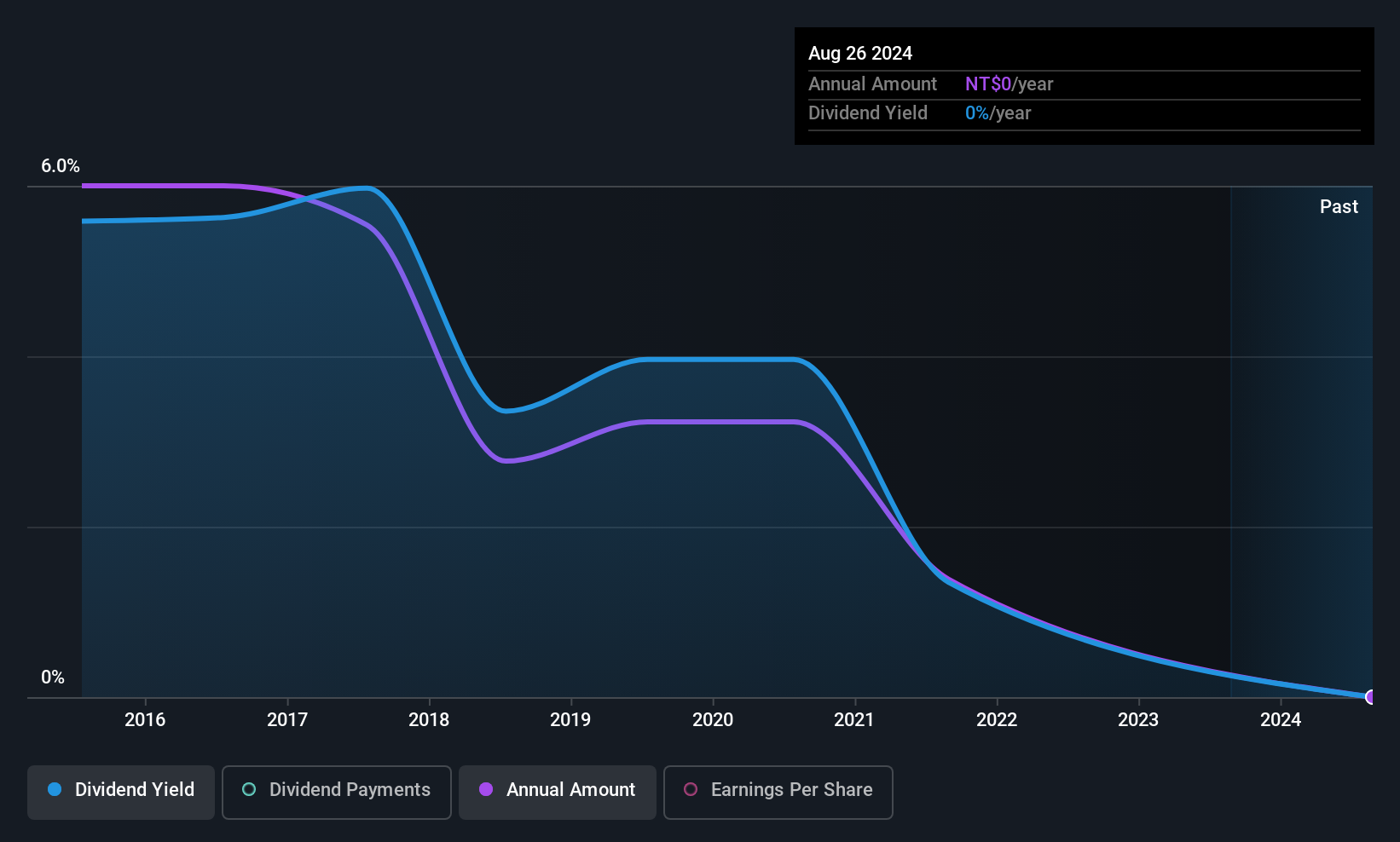

New Era Electronics (TPEX:4909)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: New Era Electronics Co., Ltd designs, manufactures, assembles, and sells printed circuit boards (PCBs) both in Taiwan and internationally, with a market cap of NT$5.85 billion.

Operations: New Era Electronics Co., Ltd generates revenue from its Electronic Components & Parts segment, amounting to NT$2.35 billion.

Dividend Yield: 9.6%

New Era Electronics offers a dividend yield of 9.57%, ranking it in the top 25% of Taiwan's market. Despite this, dividends have been unreliable and volatile over the past decade. The payout ratio is sustainable, with coverage by both earnings (67.8%) and cash flows (62.8%). However, recent financial performance shows significant declines in revenue and net income, raising concerns about future dividend stability amidst highly volatile share prices recently.

- Click here to discover the nuances of New Era Electronics with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of New Era Electronics shares in the market.

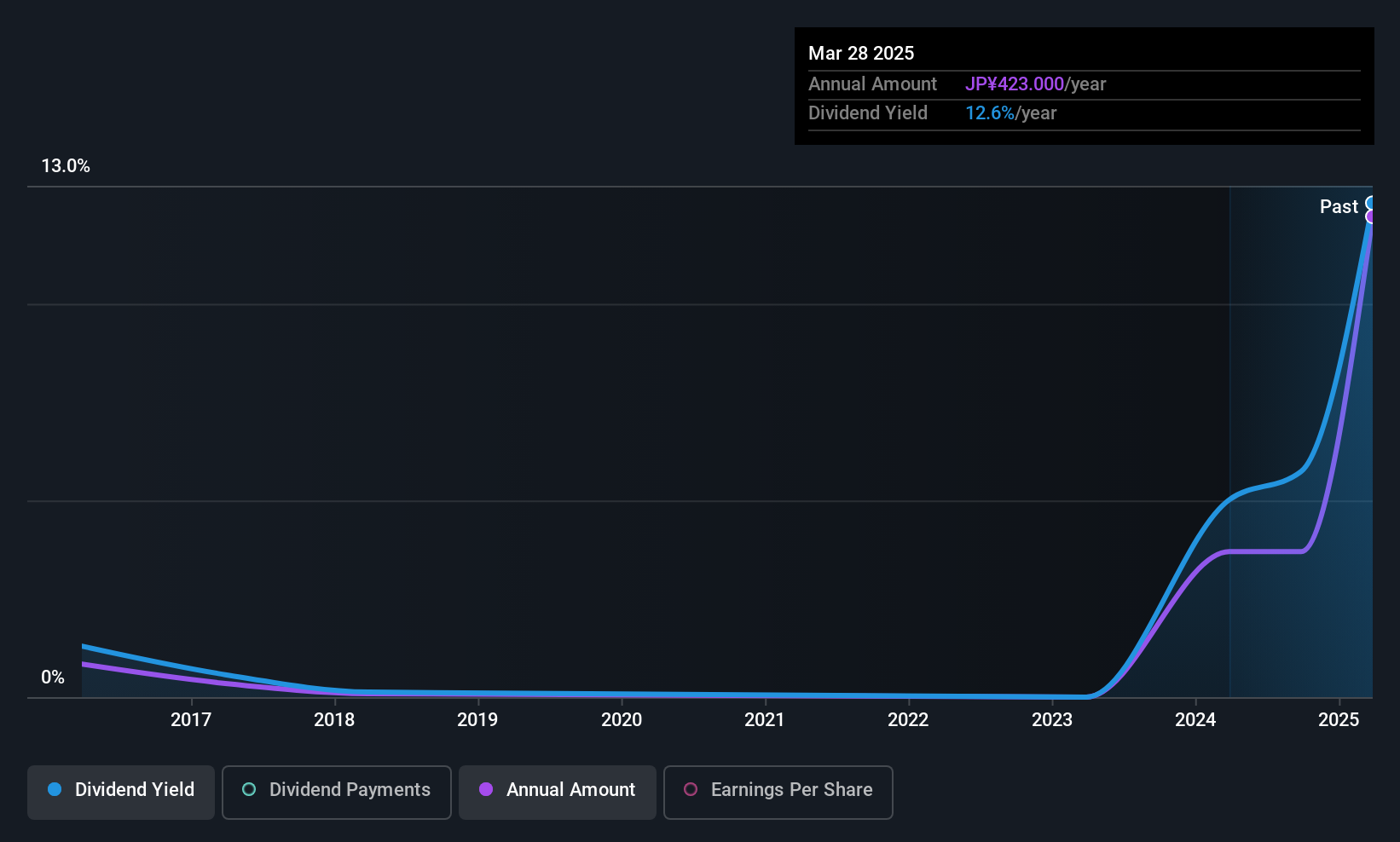

Dream Incubator (TSE:4310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dream Incubator Inc. is a venture capital and private equity firm focused on incubation and investments across all business stages, with a market cap of ¥23.40 billion.

Operations: Dream Incubator Inc. generates revenue through its venture capital and private equity activities, specializing in incubation and investments across various business stages.

Dividend Yield: 4%

Dream Incubator's dividend yield of 3.99% places it among the top 25% in Japan, yet its dividend history is marred by volatility and unreliability over the past decade. Recent announcements show a significant increase to ¥317 per share for fiscal year-end 2025, but guidance indicates a drastic cut to ¥0 for Q2 and ¥106 for year-end 2026. While dividends are covered by cash flows, the unstable track record raises concerns about sustainability despite trading below estimated fair value.

- Get an in-depth perspective on Dream Incubator's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Dream Incubator's current price could be inflated.

Key Takeaways

- Reveal the 1154 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4310

Dream Incubator

A venture capital and private equity firm specializing in incubation and investments in all business stages.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives