- Japan

- /

- Construction

- /

- TSE:256A

3 Asian Dividend Stocks Yielding Over 3.1%

Reviewed by Simply Wall St

As Asian markets witness a resurgence in investor enthusiasm, particularly in technology and AI sectors, dividend stocks continue to attract attention for their potential to provide steady income amidst economic fluctuations. In this environment, selecting stocks with robust dividend yields over 3.1% can offer investors a reliable income stream while navigating the complexities of market dynamics and growth prospects.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.38% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.85% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.76% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

Click here to see the full list of 1022 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

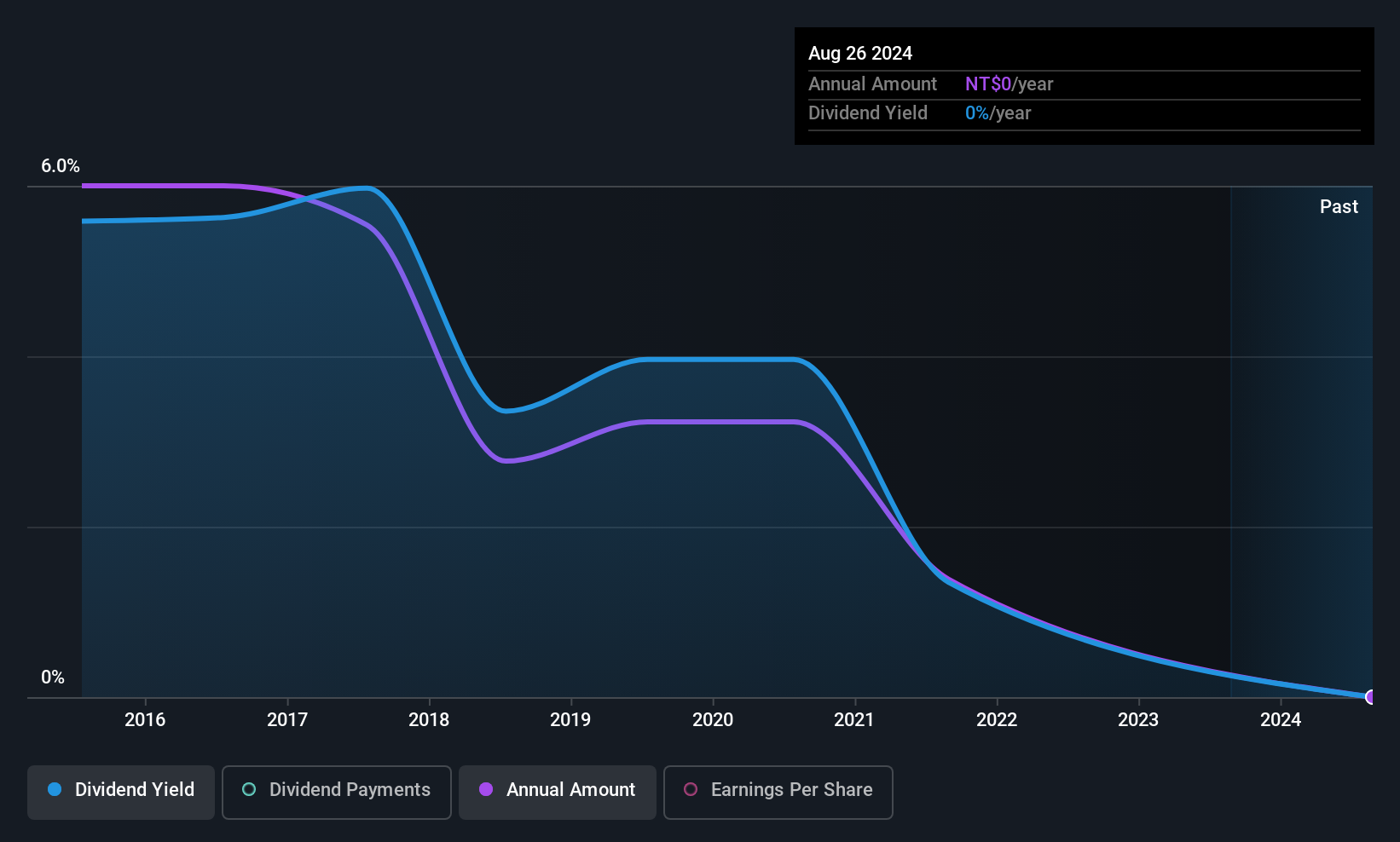

New Era Electronics (TPEX:4909)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Era Electronics Co., Ltd designs, manufactures, assembles, and sells printed circuit boards (PCBs) both in Taiwan and internationally, with a market cap of NT$4.04 billion.

Operations: New Era Electronics Co., Ltd generates revenue through its operations in the design, manufacture, assembly, and sale of printed circuit boards (PCBs) across domestic and international markets.

Dividend Yield: 13.9%

New Era Electronics faces challenges for dividend investors, with volatile and unreliable dividend payments over the past decade. Despite a high yield of 13.87%, dividends are not well covered by earnings due to a high payout ratio of 2553%. While cash flows reasonably cover dividends, recent financial performance shows significant declines in sales and net income, raising concerns about sustainability. The stock trades significantly below its estimated fair value, suggesting potential valuation appeal amidst these risks.

- Navigate through the intricacies of New Era Electronics with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, New Era Electronics' share price might be too optimistic.

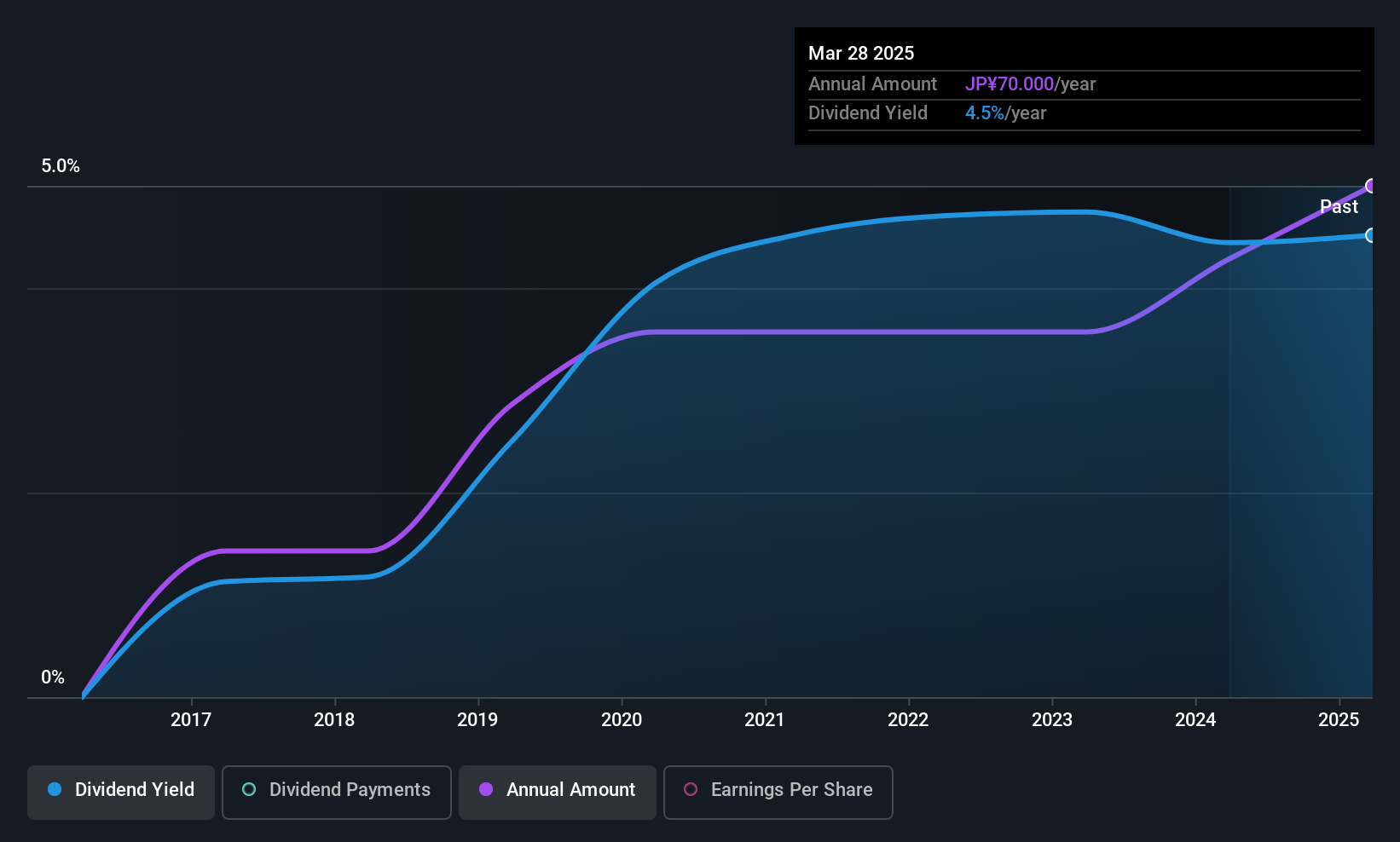

TOBISHIMA HOLDINGS (TSE:256A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TOBISHIMA HOLDINGS Inc. operates in the construction industry both in Japan and internationally, with a market cap of ¥44.74 billion.

Operations: TOBISHIMA HOLDINGS Inc. generates its revenue from construction activities conducted both domestically and abroad.

Dividend Yield: 4.3%

TOBISHIMA HOLDINGS offers a stable dividend profile, with consistent growth over the past decade and a yield of 4.28%, placing it in the top 25% of Japanese dividend payers. However, dividends are not covered by free cash flows and debt coverage by operating cash flow is weak. Despite these concerns, the payout ratio remains low at 37.8%, indicating coverage by earnings. The stock's P/E ratio of 9.8x suggests potential value compared to the market average.

- Get an in-depth perspective on TOBISHIMA HOLDINGS' performance by reading our dividend report here.

- Our expertly prepared valuation report TOBISHIMA HOLDINGS implies its share price may be too high.

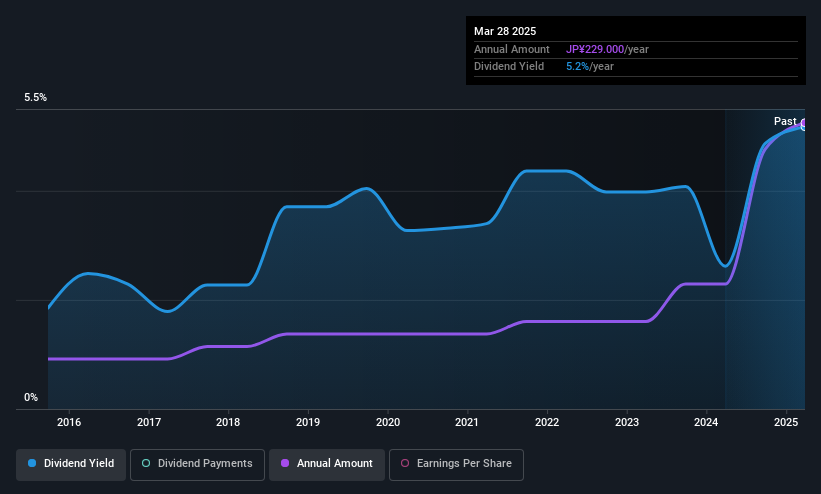

KurimotoLtd (TSE:5602)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kurimoto Ltd. is a company that manufactures and sells ductile iron pipes, valves, and industrial and construction materials both in Japan and internationally, with a market cap of ¥109.43 billion.

Operations: Kurimoto Ltd.'s revenue is derived from its Lifeline Business segment, which generated ¥62.30 billion, the Mechanical Systems segment with ¥30.25 billion, and the Industrial Construction Materials segment contributing ¥34.14 billion.

Dividend Yield: 3.2%

Kurimoto Ltd. has maintained reliable and stable dividend payments over the past decade, with recent increases reflecting a positive outlook. However, its dividend yield of 3.19% is below top-tier levels in Japan and not well covered by free cash flows due to a high cash payout ratio of 168.3%. Despite this, dividends are supported by earnings with a reasonable payout ratio of 53.1%. Recent guidance revisions highlight improved profitability and increased earnings expectations for the company.

- Unlock comprehensive insights into our analysis of KurimotoLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that KurimotoLtd is trading beyond its estimated value.

Summing It All Up

- Click here to access our complete index of 1022 Top Asian Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOBISHIMA HOLDINGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:256A

TOBISHIMA HOLDINGS

Engages in the construction business in Japan and internationally.

Established dividend payer with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026