- Taiwan

- /

- Tech Hardware

- /

- TPEX:3693

Undiscovered Gems And 2 Other Promising Stocks with Strong Potential

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced a significant rally, with small-cap indices like the Russell 2000 leading gains despite not reaching record highs. This surge reflects investor optimism about potential economic growth and favorable tax conditions under new political leadership, creating an opportune environment to explore stocks with strong potential. In such dynamic market conditions, identifying stocks that combine solid fundamentals with promising growth prospects can be particularly rewarding for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

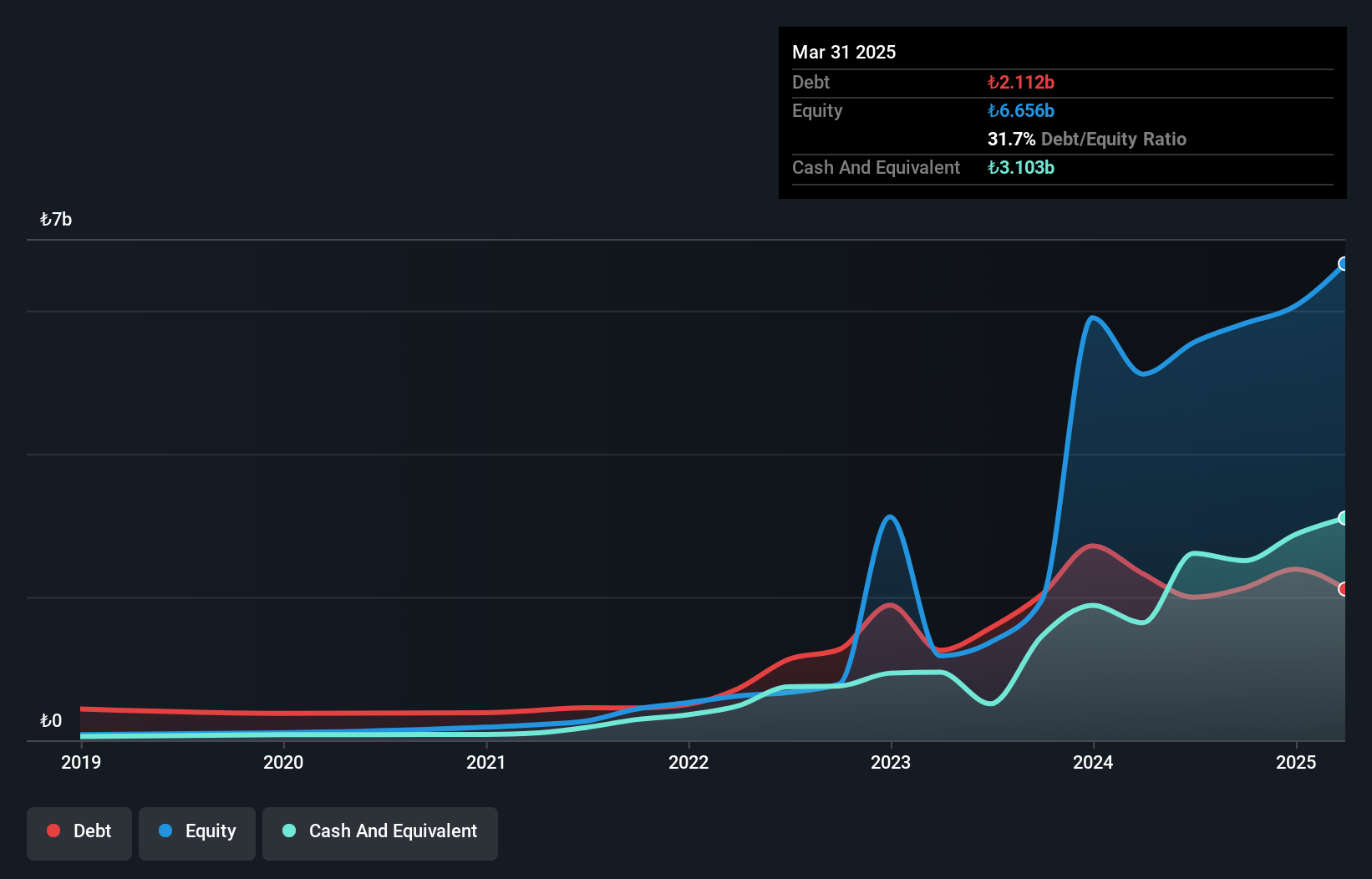

Escar Filo Kiralama Hizmetleri (IBSE:ESCAR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Escar Filo Kiralama Hizmetleri A.S. operates in Turkey, offering motor vehicle renting services with a market capitalization of TRY18.41 billion.

Operations: Escar generates revenue primarily from its rental and leasing services, amounting to TRY2.08 billion. The company focuses on motor vehicle renting services in Turkey.

Escar Filo Kiralama Hizmetleri, a noteworthy player in the transportation sector, has seen its debt to equity ratio shrink from 445.5% to 36% over five years, indicating improved financial health. Despite a one-off gain of TRY1.1 billion affecting recent results, the company trades at 81% below estimated fair value. Recent earnings growth of 63.8% annually over five years highlights robust performance despite interest payments not being fully covered by EBIT (1.8x). In the latest quarter ending June 2024, Escar reported net income of TRY144 million compared to a loss last year and was added to the S&P Global BMI Index in September 2024, suggesting increased market recognition.

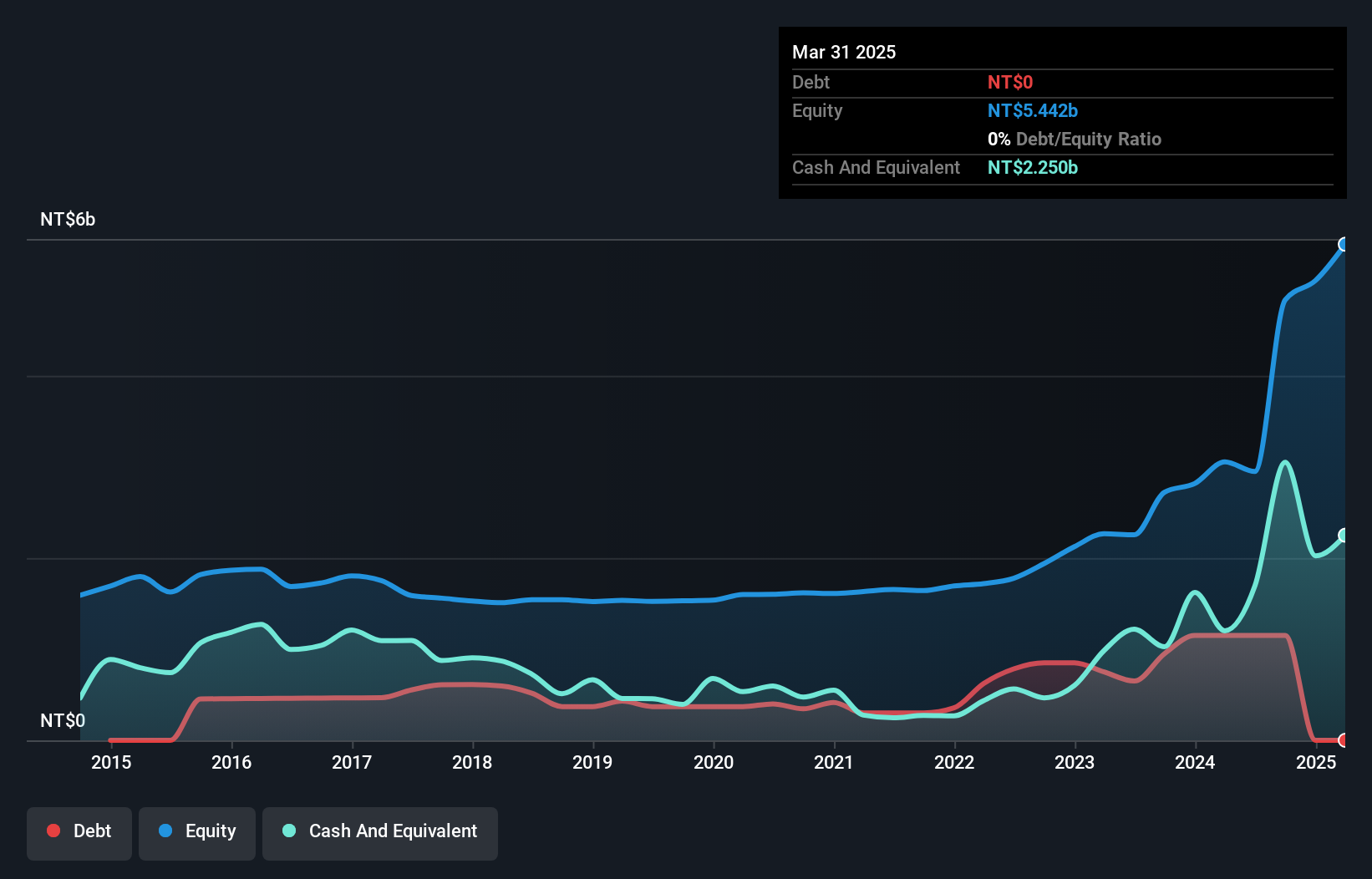

AIC (TPEX:3693)

Simply Wall St Value Rating: ★★★★★☆

Overview: AIC Inc. offers OEM/ODM, commercial off-the-shelf, and server and storage solutions across the United States, Asia, and Europe with a market capitalization of NT$15.91 billion.

Operations: AIC generates revenue primarily from its Computers and Related Spare Parts Department, which contributes NT$8.99 billion to its financial performance.

AIC has been making waves with its recent performance, showcasing a notable earnings growth of 53.8% over the past year, outpacing the Tech industry average of 11.3%. The company's debt to equity ratio increased from 24.3% to 39% in five years, yet it remains well-positioned with more cash than total debt and strong interest coverage at 240.7x EBIT. Recent results highlight sales reaching TWD 2.12 billion for Q2, up from TWD 1.92 billion last year, while net income rose to TWD 269 million from TWD 209 million, reflecting robust operational efficiency and potential for continued growth.

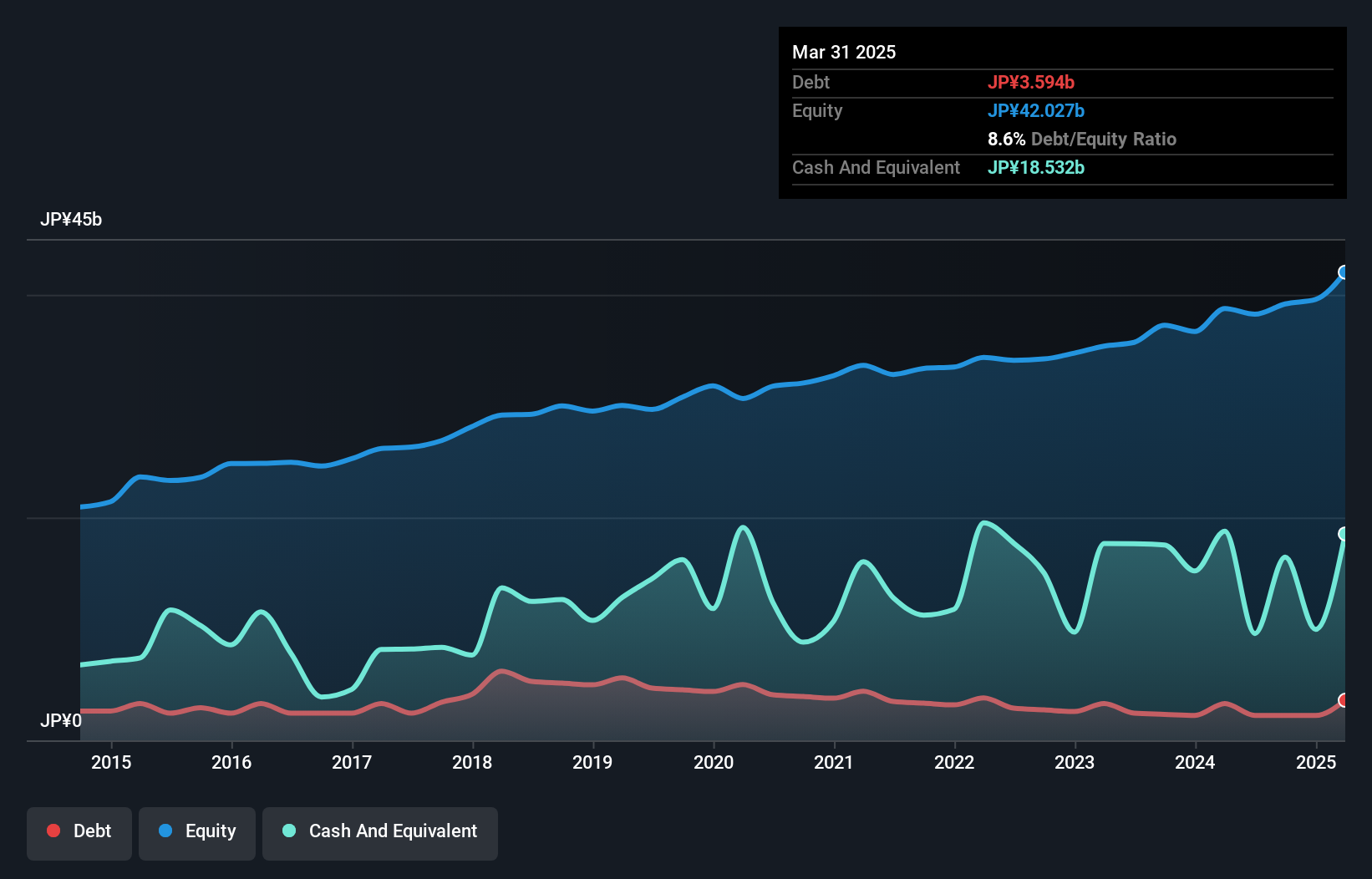

Asahi Kogyosha (TSE:1975)

Simply Wall St Value Rating: ★★★★★★

Overview: Asahi Kogyosha Co., Ltd. primarily engages in air-conditioning and sanitation installation works in Japan, with a market capitalization of ¥42.76 billion.

Operations: Asahi Kogyosha generates revenue mainly from its Facility Construction segment, contributing ¥86.67 billion, while its Equipment Manufacturing Sales Business adds ¥4.27 billion. The company's net profit margin is a key financial indicator to consider when evaluating its performance.

Asahi Kogyosha, a compact player in its field, has recently been added to the S&P Global BMI Index, reflecting growing recognition. The company showcases high-quality earnings with a robust 27.8% growth over the past year, outpacing the Construction industry's 26.6%. Its price-to-earnings ratio of 10.8x is appealing compared to Japan's market average of 13.5x. Over five years, Asahi Kogyosha reduced its debt-to-equity from 15.8% to a manageable 5.8%, and it holds more cash than total debt, ensuring financial stability while covering interest payments comfortably without concern for cash runway issues due to profitability.

- Dive into the specifics of Asahi Kogyosha here with our thorough health report.

Review our historical performance report to gain insights into Asahi Kogyosha's's past performance.

Where To Now?

- Navigate through the entire inventory of 4667 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3693

AIC

Provides OEM/ODM, commercial off-the-shelf, and server and storage solutions in Taiwan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion