- Taiwan

- /

- Tech Hardware

- /

- TPEX:3611

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, marked by inflation concerns and political uncertainty, investors are keenly assessing how these factors might impact their portfolios. With U.S. equities experiencing declines and interest rates potentially remaining higher for longer, dividend stocks offer a compelling option for those seeking steady income amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1999 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

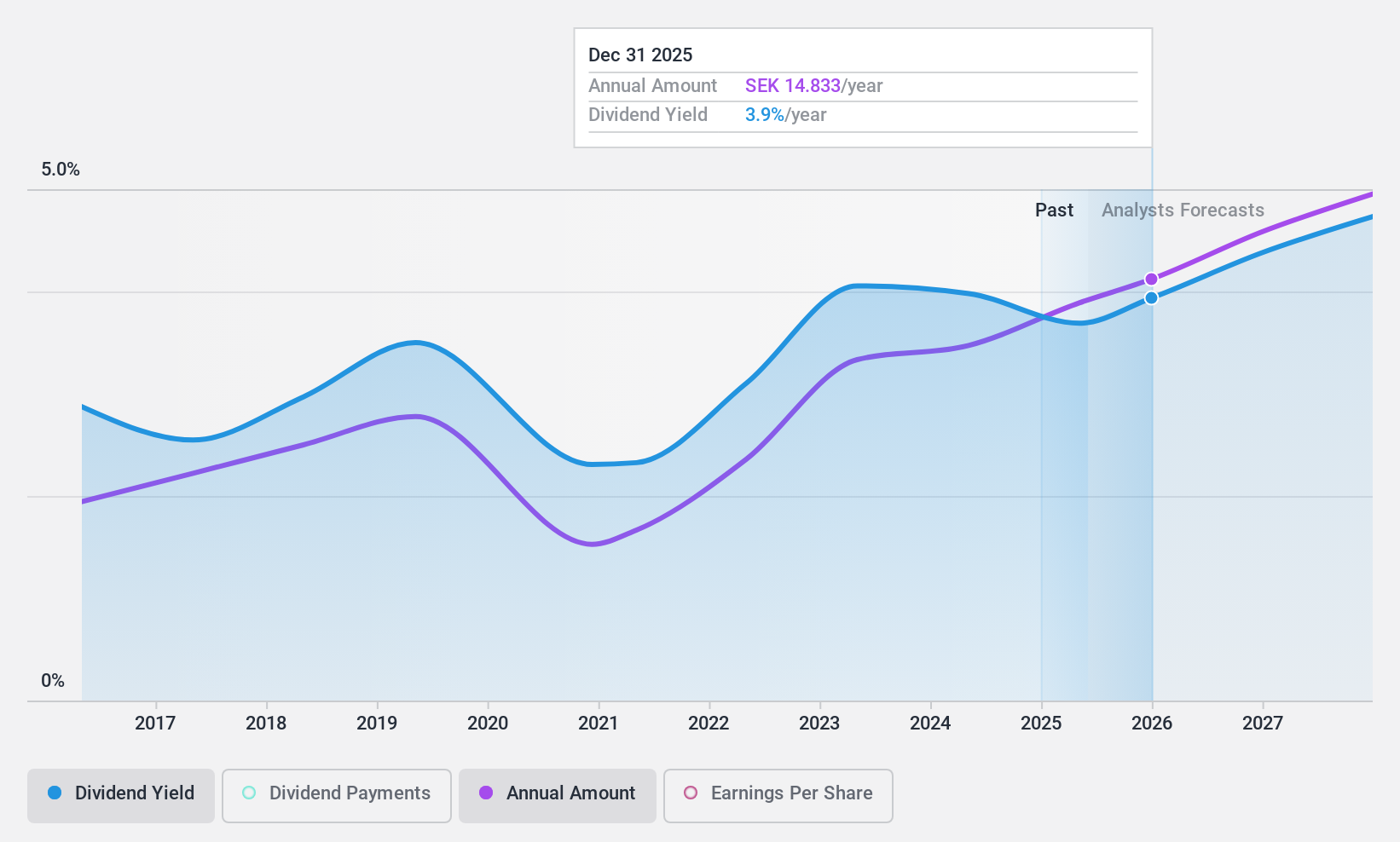

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables with a market cap of SEK22.62 billion.

Operations: Loomis AB (publ) generates revenue through its segments, with SEK14.49 billion from Europe and Latin America, SEK15.48 billion from the United States of America (USA), and SEK94 million from Loomis Pay.

Dividend Yield: 3.7%

Loomis offers a mixed profile for dividend investors. Its dividend payments are covered by earnings, with a payout ratio of 56.8%, and cash flows, with a low cash payout ratio of 20.8%. However, its dividend yield of 3.68% is lower than the top tier in Sweden, and the dividends have been volatile over the past decade. Recent buybacks worth SEK 399.75 million could signal confidence but do not guarantee future stability or growth in dividends.

- Navigate through the intricacies of Loomis with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Loomis shares in the market.

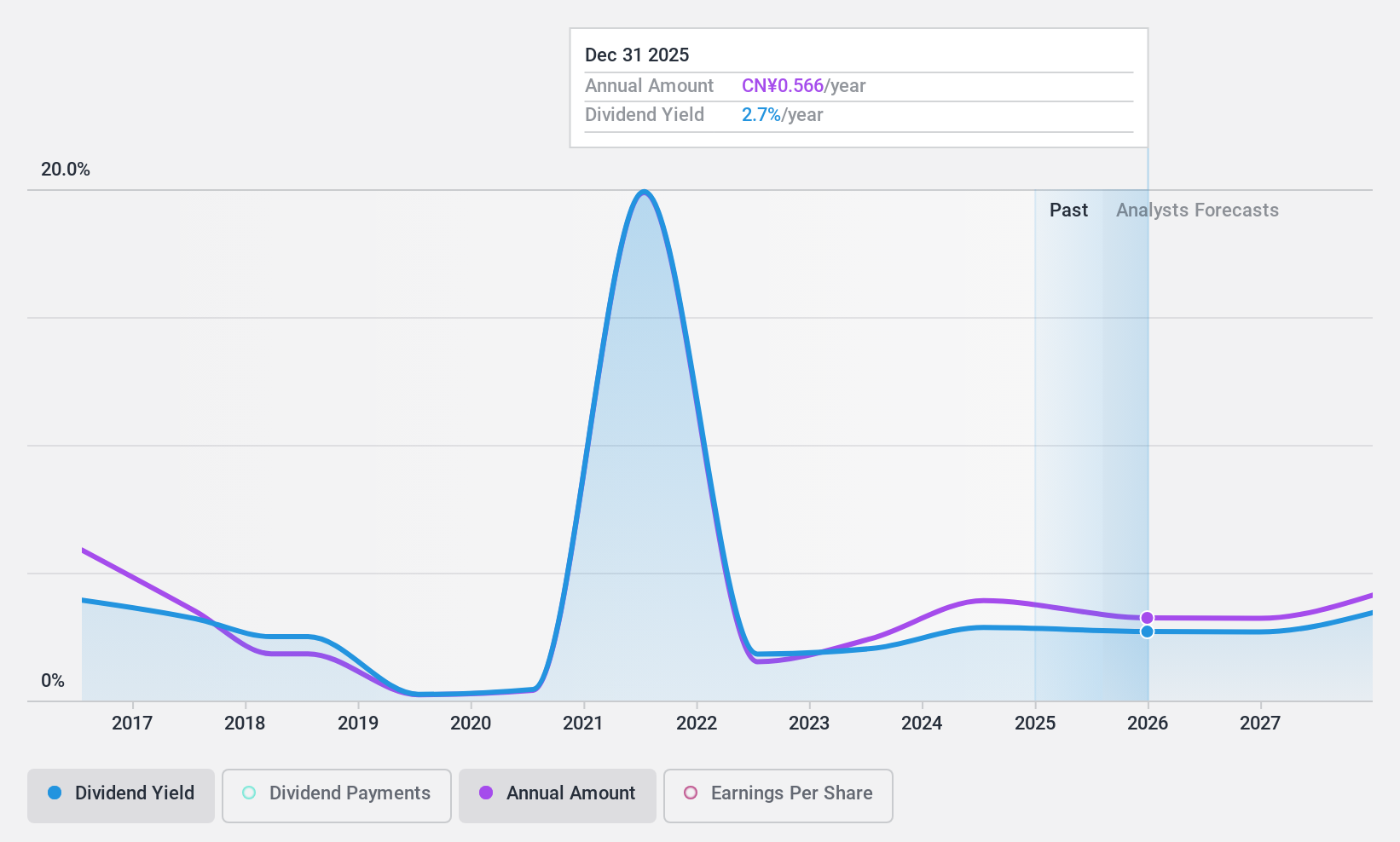

Jiangling Motors Corporation (SZSE:000550)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangling Motors Corporation, Ltd. and its subsidiaries produce and sell automobiles and automobile parts in China and internationally, with a market cap of CN¥14.92 billion.

Operations: Jiangling Motors Corporation, Ltd. generates its revenue primarily from the production and sale of automobiles, related spare parts, and components, totaling CN¥37.39 billion.

Dividend Yield: 3.1%

Jiangling Motors Corporation's dividend profile is characterized by a low payout ratio of 36.2%, indicating dividends are well covered by earnings, and a cash payout ratio of 25.7%, suggesting strong cash flow support. Despite this, the dividends have been volatile over the past decade, with declines noted. Recent strategic alliances and robust earnings growth—CNY 1,166.09 million net income for nine months ending September 2024—may enhance future stability but do not assure consistent dividend growth or reliability.

- Get an in-depth perspective on Jiangling Motors Corporation's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Jiangling Motors Corporation is trading behind its estimated value.

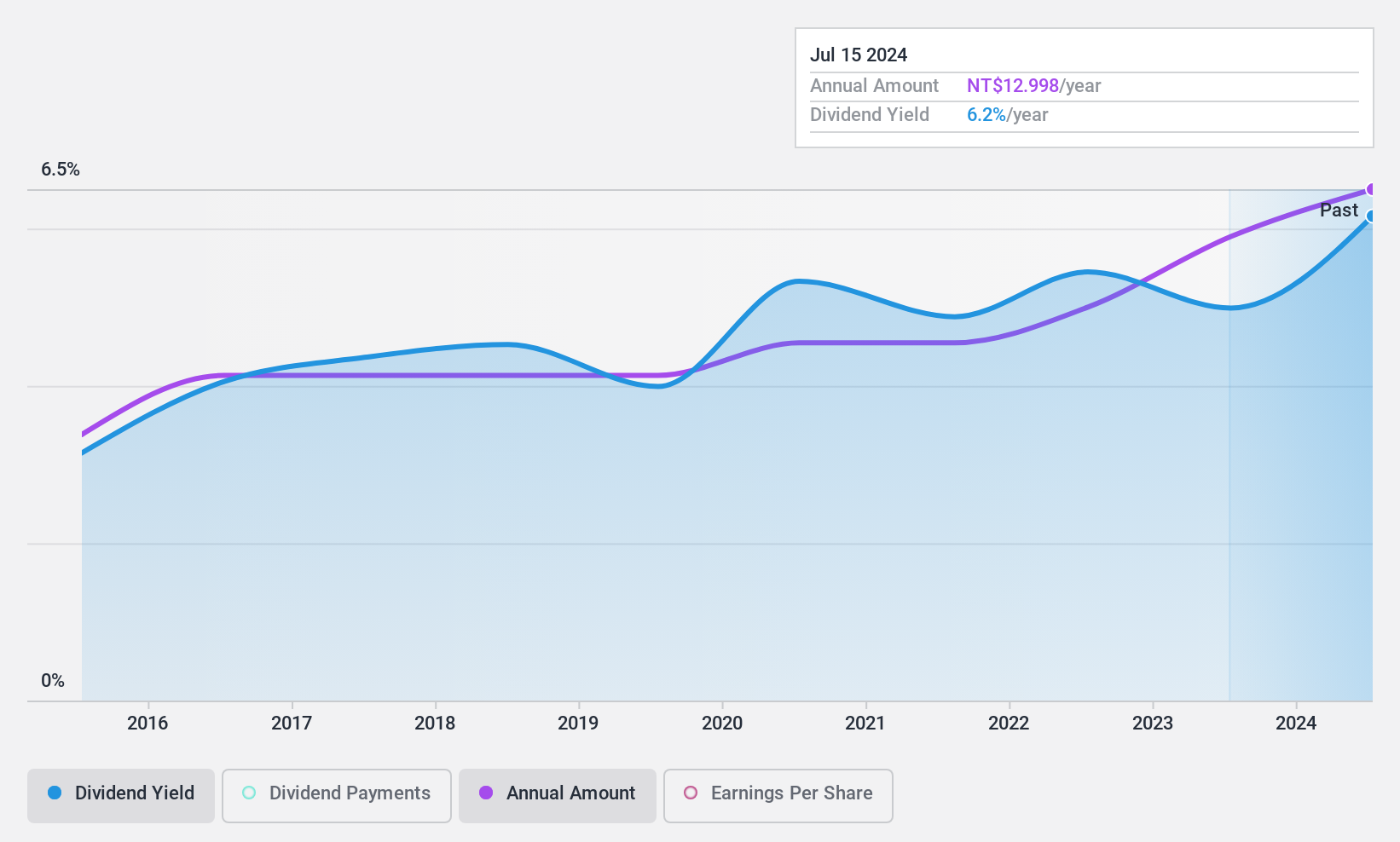

TSC Auto ID Technology (TPEX:3611)

Simply Wall St Dividend Rating: ★★★★★★

Overview: TSC Auto ID Technology Co., Ltd. manufactures and services auto-identification systems and products globally, with a market cap of NT$9.52 billion.

Operations: TSC Auto ID Technology Co., Ltd. generates revenue primarily from selling bar code printers and their spare parts (NT$4.86 billion) and various label papers and consumables for printers (NT$3.47 billion).

Dividend Yield: 6.5%

TSC Auto ID Technology offers a high dividend yield of 6.47%, ranking in the top 25% in the TW market, supported by stable and growing payments over the past decade. Despite an 87.1% payout ratio, dividends are covered by earnings and cash flows (85.9%). The stock trades at a favorable P/E ratio of 13.5x against the market's 20.1x, though recent earnings have declined with net income falling to TWD 533.77 million for nine months ending September 2024 from TWD 756.75 million previously.

- Dive into the specifics of TSC Auto ID Technology here with our thorough dividend report.

- The valuation report we've compiled suggests that TSC Auto ID Technology's current price could be quite moderate.

Summing It All Up

- Dive into all 1999 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TSC Auto ID Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3611

TSC Auto ID Technology

Engages in the manufacture and service of auto-identification systems/products worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion