- Taiwan

- /

- Semiconductors

- /

- TWSE:2481

Unveiling February 2025's Undiscovered Gems on None

Reviewed by Simply Wall St

In February 2025, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic signals, with U.S. job growth falling short of estimates and manufacturing activity showing signs of recovery. Amid these fluctuations, small-cap stocks have felt the impact as investors weigh the potential effects of tariffs on future growth prospects. In such an environment, identifying promising stocks involves looking for companies that demonstrate resilience through strong earnings performance and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Alltop Technology (TPEX:3526)

Simply Wall St Value Rating: ★★★★★★

Overview: Alltop Technology Co., Ltd. and its subsidiaries focus on the research, design, development, manufacture, and sale of electronic connectors in Taiwan and China with a market capitalization of NT$17.92 billion.

Operations: The primary revenue stream for Alltop Technology comes from electronic coupling, generating NT$2.95 billion. The company's market capitalization stands at NT$17.92 billion.

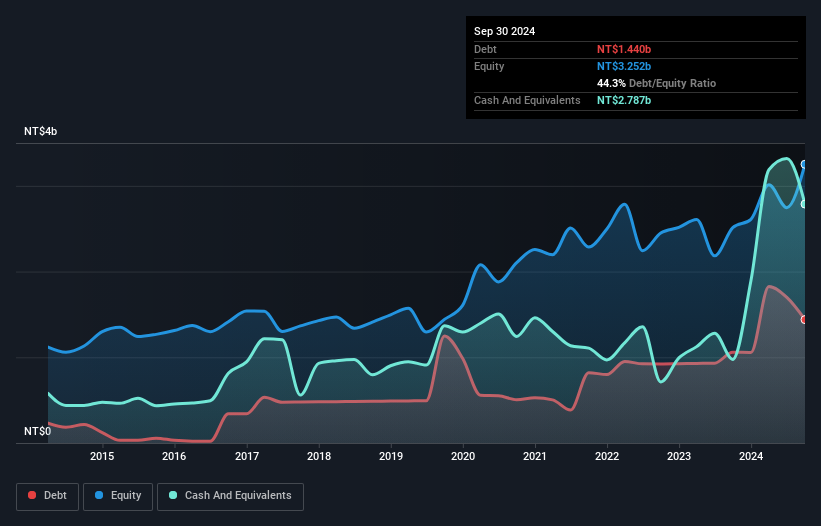

Alltop Technology, a dynamic player in the tech sector, has been making waves with its impressive performance. Its earnings grew by 53% over the past year, outpacing the electronic industry average of 6.6%. The company is trading at 46% below its estimated fair value, suggesting potential undervaluation. Alltop's debt-to-equity ratio has improved significantly from 86.5 to 44.3 over five years, indicating better financial health and stability. With high-quality earnings and more cash than total debt, it seems well-positioned for future growth as earnings are forecast to grow by over 25% annually.

- Click here and access our complete health analysis report to understand the dynamics of Alltop Technology.

Understand Alltop Technology's track record by examining our Past report.

MTI (TSE:9438)

Simply Wall St Value Rating: ★★★★★☆

Overview: MTI Ltd. focuses on content distribution for mobile phones in Japan and has a market capitalization of ¥60.13 billion.

Operations: MTI Ltd. generates revenue primarily from its Content Business, which contributes ¥16.93 billion, followed by the Health Care Business at ¥5.48 billion and the School DX Business at ¥1.23 billion. The company's net profit margin is a key indicator of its financial performance, reflecting how effectively it converts revenue into profit after expenses are accounted for.

MTI, a noteworthy player in the market, has experienced significant growth with earnings surging by 214% last year, outpacing industry averages. Despite a volatile share price recently, its high-quality earnings and robust financial health are evident. The company's debt to equity ratio rose from 0.3 to 12.7 over five years but remains manageable due to ample cash reserves exceeding total debt levels. MTI's EBIT covers interest payments by an impressive 342 times, underscoring its strong financial footing. Recent guidance revisions highlight anticipated profits between JPY 2 billion and JPY 2.33 billion for the full year ending September 2025.

- Click to explore a detailed breakdown of our findings in MTI's health report.

Examine MTI's past performance report to understand how it has performed in the past.

Panjit International (TWSE:2481)

Simply Wall St Value Rating: ★★★★★☆

Overview: Panjit International Inc. is engaged in the manufacturing, processing, assembly, import, and export of semiconductors across various countries including Taiwan, China, Korea, the United States, Japan, Germany, and Italy with a market cap of NT$18.69 billion.

Operations: The primary revenue streams for Panjit International come from Power Split Components, generating NT$11.40 billion, and Power Integrated Circuits and Components, contributing NT$943.64 million. Solar segment adds NT$220.88 million to the total revenue.

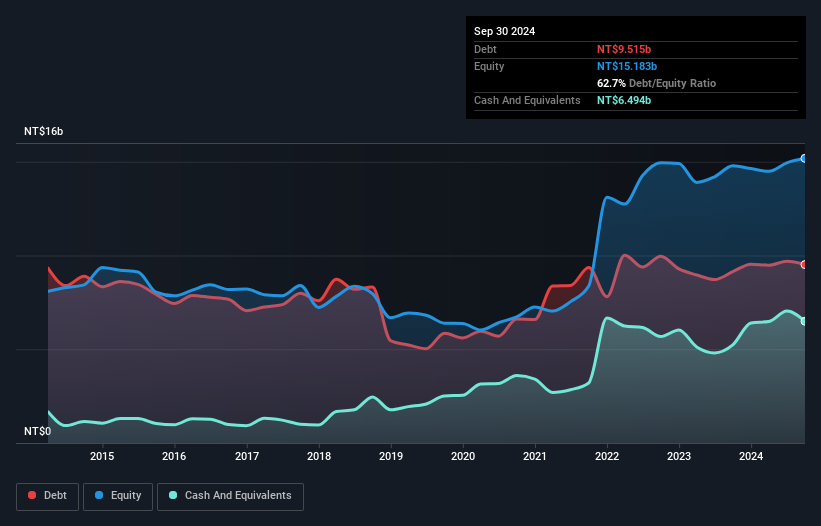

Panjit International, a nimble player in the semiconductor space, showcases a blend of solid financial health and promising growth prospects. Over the past five years, earnings have grown at 6% annually, supported by high-quality earnings and a satisfactory net debt to equity ratio of 19.9%. The company's interest payments are comfortably covered by EBIT at 33.4x coverage, indicating strong financial management. Despite trailing slightly behind the industry's recent growth rate of 5.9%, Panjit offers good value with a price-to-earnings ratio of 21.8x compared to the industry average of 29.2x, hinting at potential upside as earnings are forecasted to grow significantly in coming years.

Where To Now?

- Investigate our full lineup of 4697 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2481

PANJIT International

Manufactures, processes, assembles, imports, and exports semiconductors in Taiwan, Asia, the Americas, Europe, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)