- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3526

3 Stocks Including Yangmei ChemicalLtd That May Be Valued Below Their Estimated Worth

Reviewed by Simply Wall St

In a week marked by volatility, global markets have grappled with fluctuating corporate earnings and competitive pressures from emerging technologies, such as the new AI developments in China. While the Federal Reserve has opted to maintain interest rates amid steady economic growth and persistent inflation, investors are keenly observing how these factors impact stock valuations across various sectors. In this environment, identifying stocks that may be undervalued becomes crucial for investors seeking potential opportunities. Companies like Yangmei Chemical Ltd., which could be trading below their estimated worth, offer intriguing prospects for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhongji Innolight (SZSE:300308) | CN¥101.00 | CN¥195.36 | 48.3% |

| Reach Subsea (OB:REACH) | NOK8.06 | NOK16.12 | 50% |

| TF Bank (OM:TFBANK) | SEK376.00 | SEK750.28 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK82.94 | SEK165.72 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.97 | CA$11.89 | 49.8% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.23 | US$26.31 | 49.7% |

| Groupe Dynamite (TSX:GRGD) | CA$16.11 | CA$32.07 | 49.8% |

| WuXi XDC Cayman (SEHK:2268) | HK$28.25 | HK$56.12 | 49.7% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | US$37.70 | US$75.20 | 49.9% |

| Kyndryl Holdings (NYSE:KD) | US$43.45 | US$86.66 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Yangmei ChemicalLtd (SHSE:600691)

Overview: Yangmei Chemical Co., Ltd. is involved in the research, development, production, and sale of chemical products in China, with a market cap of approximately CN¥5.06 billion.

Operations: Yangmei Chemical Co., Ltd. generates its revenue through the research, development, production, and sale of chemical products within China.

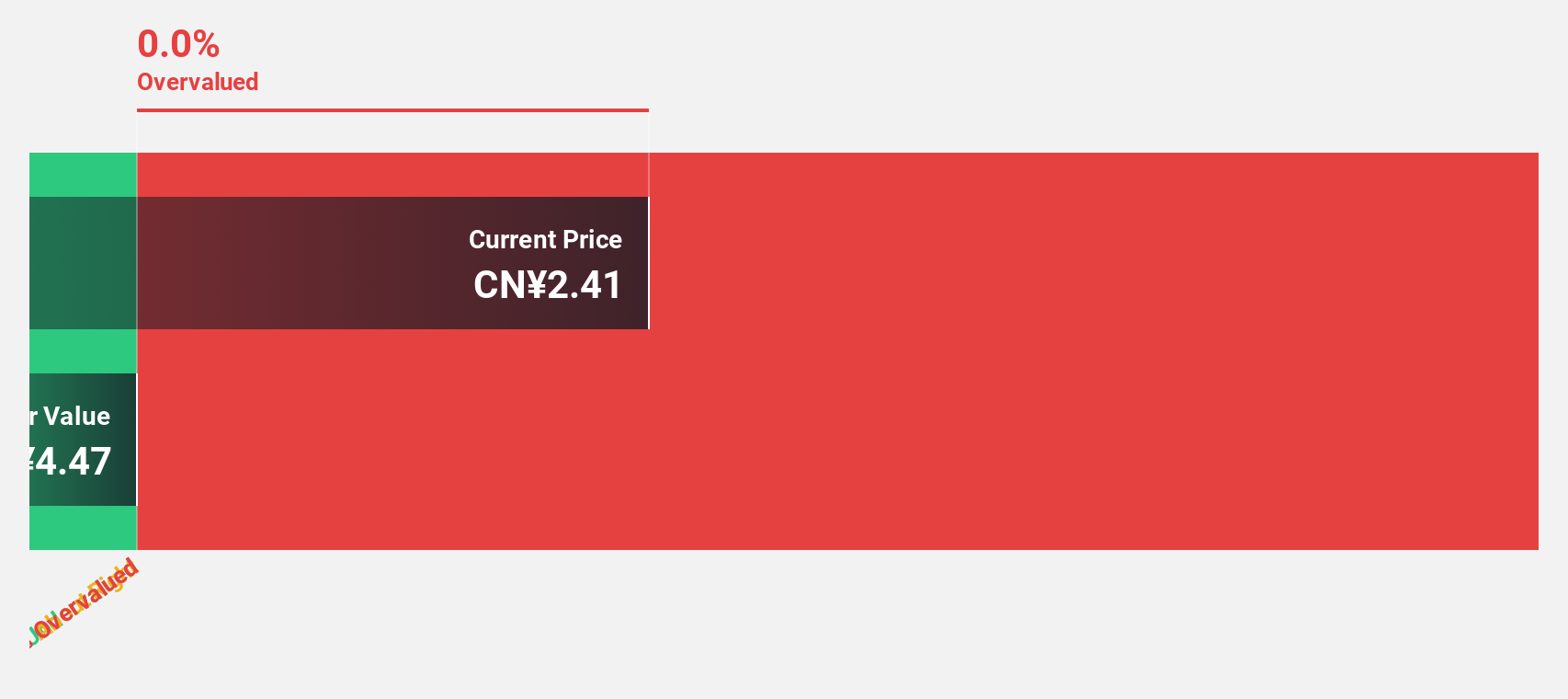

Estimated Discount To Fair Value: 31.8%

Yangmei Chemical Ltd. is trading at CN¥2.14, significantly below its estimated fair value of CN¥3.14, representing a 31.8% discount based on discounted cash flow analysis. Despite low forecasted return on equity (2.5%) in three years, the company is expected to achieve profitability and revenue growth exceeding market averages with projected earnings growth of 108.05% annually over the next three years. The recent acquisition by Shanxi Luan Chemical Co., Ltd., completed in December 2024, may influence future strategic direction and valuations.

- The growth report we've compiled suggests that Yangmei ChemicalLtd's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Yangmei ChemicalLtd's balance sheet health report.

Suzhou Alton Electrical & Mechanical Industry (SZSE:301187)

Overview: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. operates in the electrical and mechanical industry, with a market cap of CN¥6.79 billion.

Operations: The company's revenue segments are not provided in the given text.

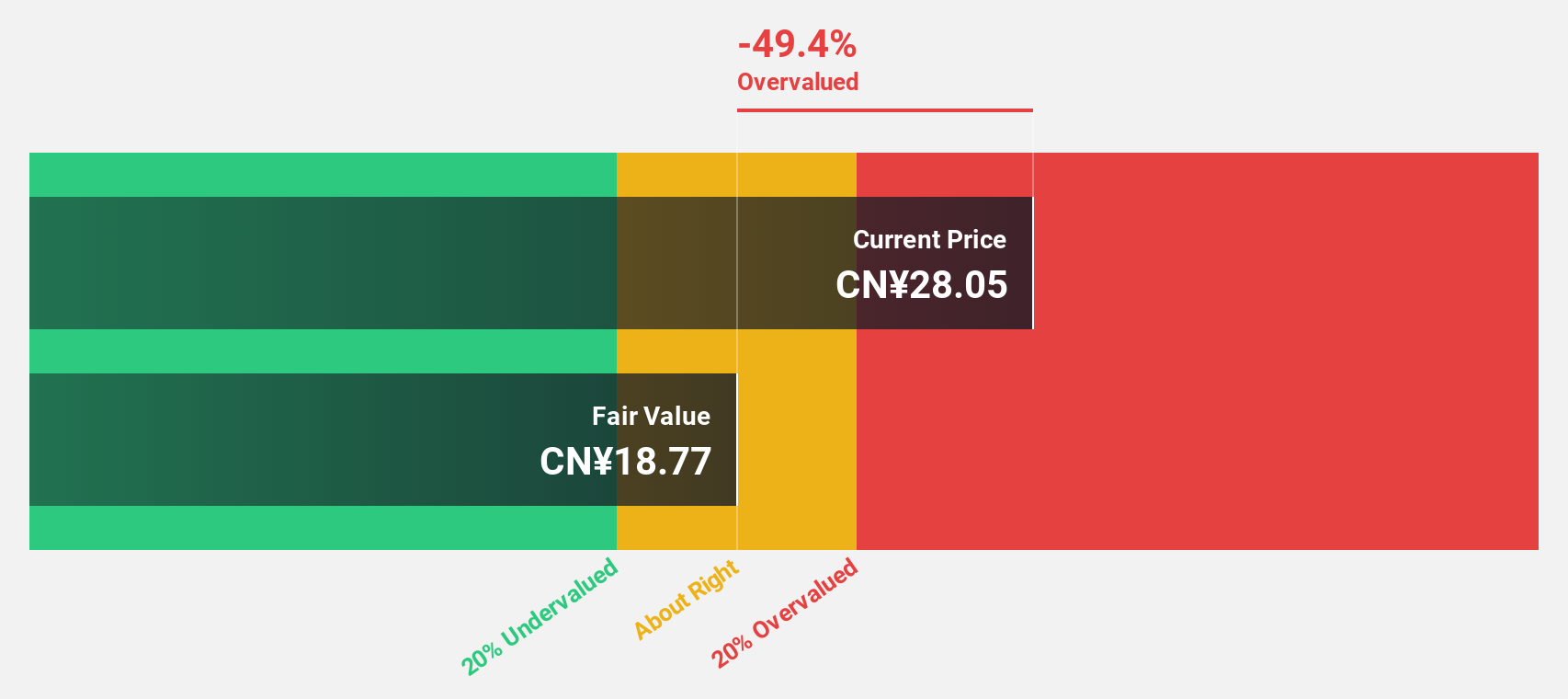

Estimated Discount To Fair Value: 13.2%

Suzhou Alton Electrical & Mechanical Industry is trading at CN¥38.6, slightly undervalued compared to its fair value of CN¥44.46. It shows strong revenue growth potential, forecasted at 25.4% annually, outpacing the broader Chinese market's 13.5%. However, earnings growth is expected to be slightly below market averages at 24% per year. Despite high non-cash earnings and a volatile share price recently, the company's financials suggest a promising outlook for cash flow-based investors.

- Our comprehensive growth report raises the possibility that Suzhou Alton Electrical & Mechanical Industry is poised for substantial financial growth.

- Dive into the specifics of Suzhou Alton Electrical & Mechanical Industry here with our thorough financial health report.

Alltop Technology (TPEX:3526)

Overview: Alltop Technology Co., Ltd. and its subsidiaries focus on the research, design, development, manufacture, and sale of electronic connectors in Taiwan and China with a market cap of NT$17.01 billion.

Operations: The company generates revenue of NT$2.95 billion from its electronic coupling segment.

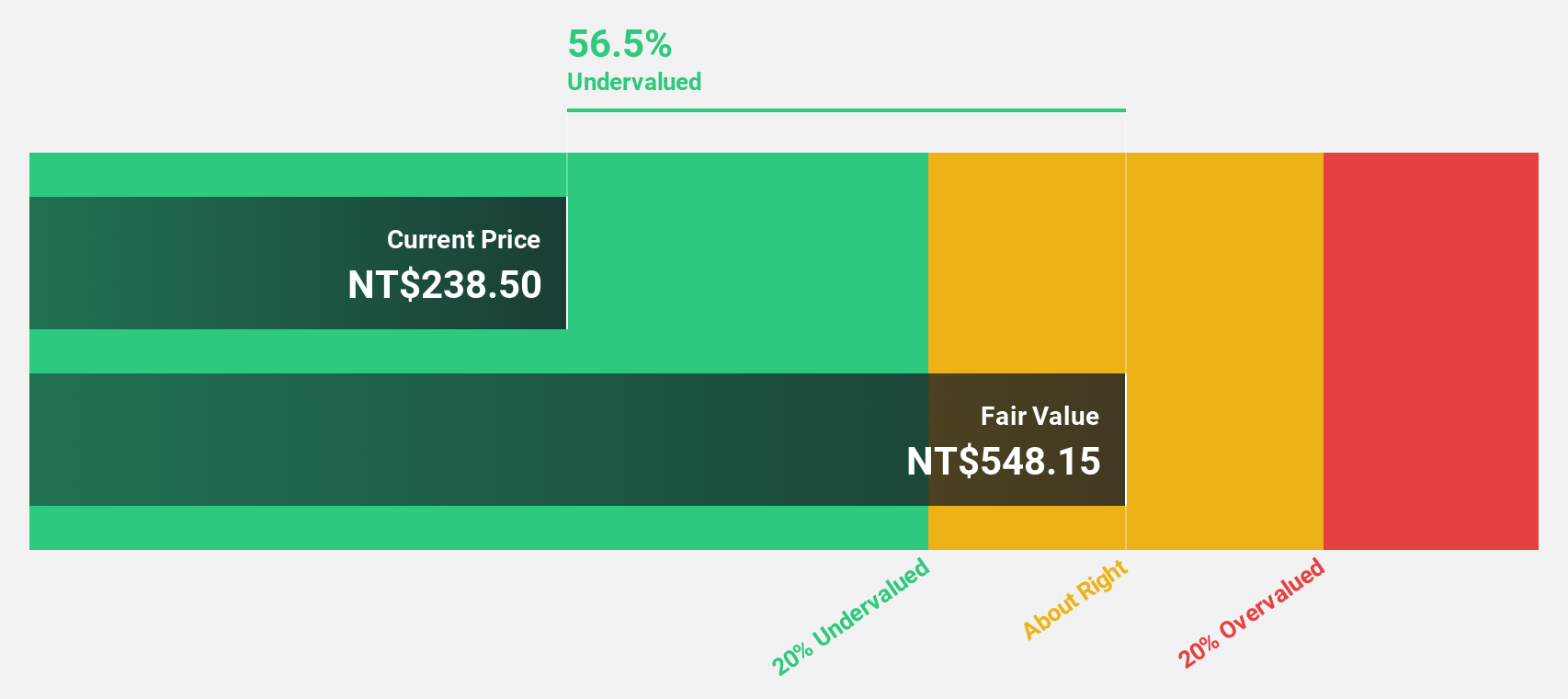

Estimated Discount To Fair Value: 47.7%

Alltop Technology, trading at NT$275.5, is significantly undervalued with a fair value estimate of NT$527.06. Revenue growth is projected at 23.7% annually, exceeding the Taiwan market's 11.3%, while earnings are expected to grow substantially by over 25% per year. Despite a dividend yield of 4.14% not fully covered by free cash flows, recent earnings have surged by over 50%, indicating strong cash flow potential for investors focused on undervaluation metrics.

- Our expertly prepared growth report on Alltop Technology implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Alltop Technology's balance sheet by reading our health report here.

Where To Now?

- Access the full spectrum of 925 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3526

Alltop Technology

Engages in the research, design, development, manufacture, and sale of electronic connectors in Taiwan and China.

Undervalued with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion