- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8358

Did You Participate In Any Of Co-Tech Development's (GTSM:8358) Incredible 507% Return?

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the Co-Tech Development Corporation (GTSM:8358) share price has soared 384% over five years. And this is just one example of the epic gains achieved by some long term investors. On the other hand, the stock price has retraced 6.3% in the last week. But this could be related to the soft market, with stocks selling off around 2.2% in the last week.

See our latest analysis for Co-Tech Development

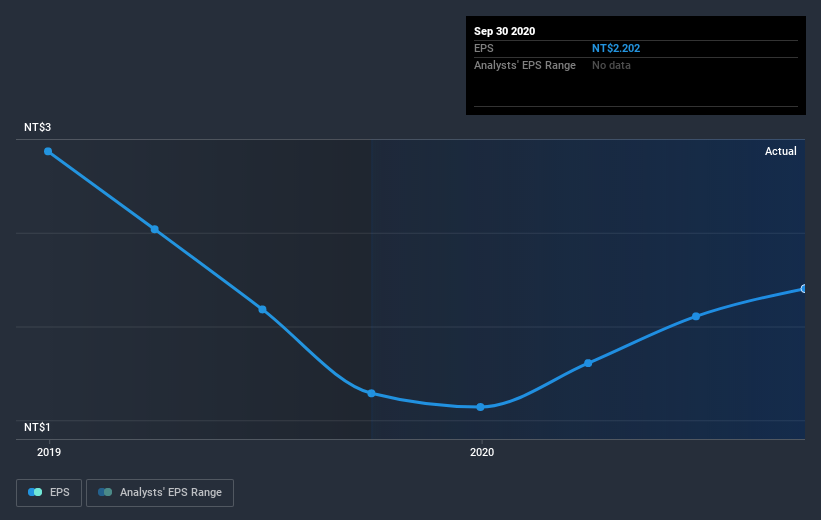

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, Co-Tech Development moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Co-Tech Development's key metrics by checking this interactive graph of Co-Tech Development's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Co-Tech Development's TSR for the last 5 years was 507%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Co-Tech Development provided a TSR of 3.2% over the last twelve months. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 43% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Co-Tech Development , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Co-Tech Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:8358

Co-Tech Development

Engages in the production and sale of copper foil for printed circuit board industry in Taiwan and China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives