- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6775

Investors Still Waiting For A Pull Back In Entire Technology Co.,Ltd. (GTSM:6775)

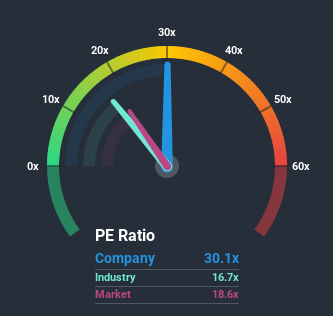

When close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 18x, you may consider Entire Technology Co.,Ltd. (GTSM:6775) as a stock to avoid entirely with its 30.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Earnings have risen firmly for Entire TechnologyLtd recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Entire TechnologyLtd

How Is Entire TechnologyLtd's Growth Trending?

In order to justify its P/E ratio, Entire TechnologyLtd would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. The latest three year period has also seen an excellent 845% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 23% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Entire TechnologyLtd is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Entire TechnologyLtd's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Entire TechnologyLtd maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Entire TechnologyLtd that we have uncovered.

If you're unsure about the strength of Entire TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Entire TechnologyLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Entire Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:6775

Entire Technology

Engages in the manufacturing of electronic components in Taiwan.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives