- Taiwan

- /

- Communications

- /

- TPEX:6514

What Can The Trends At Radiation Technology (GTSM:6514) Tell Us About Their Returns?

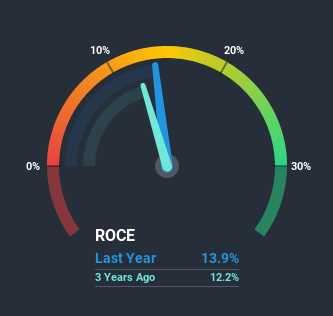

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So when we looked at Radiation Technology (GTSM:6514) and its trend of ROCE, we really liked what we saw.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Radiation Technology, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = NT$91m ÷ (NT$905m - NT$252m) (Based on the trailing twelve months to September 2020).

Therefore, Radiation Technology has an ROCE of 14%. On its own, that's a standard return, however it's much better than the 9.8% generated by the Communications industry.

View our latest analysis for Radiation Technology

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Radiation Technology's past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

Investors would be pleased with what's happening at Radiation Technology. Over the last five years, returns on capital employed have risen substantially to 14%. Basically the business is earning more per dollar of capital invested and in addition to that, 28% more capital is being employed now too. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

The Bottom Line

All in all, it's terrific to see that Radiation Technology is reaping the rewards from prior investments and is growing its capital base. Investors may not be impressed by the favorable underlying trends yet because over the last five years the stock has only returned 29% to shareholders. So with that in mind, we think the stock deserves further research.

One more thing to note, we've identified 3 warning signs with Radiation Technology and understanding them should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade Radiation Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6514

Radiation Technology

Engages in the design, manufacture, and sale of antennas worldwide.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.