- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6276

Here's Why We Don't Think Antec's (GTSM:6276) Statutory Earnings Reflect Its Underlying Earnings Potential

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Antec (GTSM:6276).

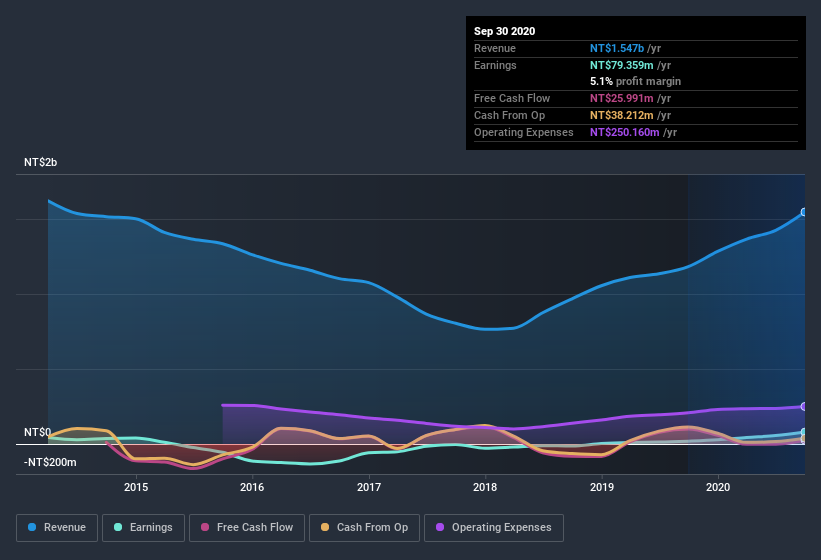

While Antec was able to generate revenue of NT$1.55b in the last twelve months, we think its profit result of NT$79.4m was more important. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

View our latest analysis for Antec

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. As a result, we'll today take a look at how dilution and cashflow shape our understanding of Antec's earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Antec.

Zooming In On Antec's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to September 2020, Antec recorded an accrual ratio of 0.41. Ergo, its free cash flow is significantly weaker than its profit. Statistically speaking, that's a real negative for future earnings. Indeed, in the last twelve months it reported free cash flow of NT$26m, which is significantly less than its profit of NT$79.4m. Antec shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings. One positive for Antec shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Antec issued 8.3% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Antec's EPS by clicking here.

How Is Dilution Impacting Antec's Earnings Per Share? (EPS)

Antec was losing money three years ago. On the bright side, in the last twelve months it grew profit by 321%. But EPS was less impressive, up only 267% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Antec shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Antec's Profit Performance

In conclusion, Antec has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means its earnings per share growth is weaker than its profit growth. Considering all this we'd argue Antec's profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. To that end, you should learn about the 3 warning signs we've spotted with Antec (including 1 which is a bit concerning).

Our examination of Antec has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Antec or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6276

Antec

Manufactures and sells computer components and accessories for the gaming, PC upgrade, and Do-It-Yourself markets in Taiwan and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives