- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6140

Is Dimension Computer Technology (GTSM:6140) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Dimension Computer Technology Co., Ltd. (GTSM:6140) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Dimension Computer Technology

What Is Dimension Computer Technology's Net Debt?

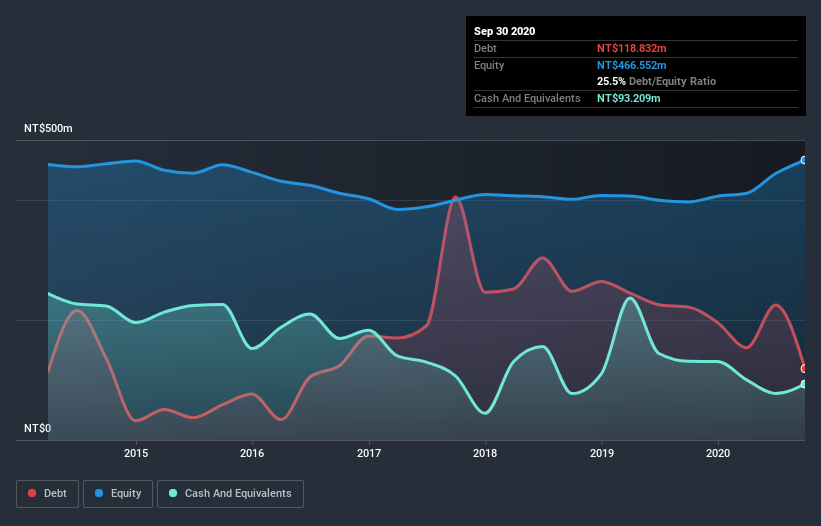

The image below, which you can click on for greater detail, shows that Dimension Computer Technology had debt of NT$118.8m at the end of September 2020, a reduction from NT$221.4m over a year. However, it also had NT$93.2m in cash, and so its net debt is NT$25.6m.

How Strong Is Dimension Computer Technology's Balance Sheet?

According to the last reported balance sheet, Dimension Computer Technology had liabilities of NT$699.0m due within 12 months, and liabilities of NT$15.9m due beyond 12 months. Offsetting these obligations, it had cash of NT$93.2m as well as receivables valued at NT$748.3m due within 12 months. So it can boast NT$126.7m more liquid assets than total liabilities.

This surplus suggests that Dimension Computer Technology is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Dimension Computer Technology's net debt is only 0.29 times its EBITDA. And its EBIT easily covers its interest expense, being 93.5 times the size. So we're pretty relaxed about its super-conservative use of debt. Better yet, Dimension Computer Technology grew its EBIT by 1,643% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Dimension Computer Technology will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Dimension Computer Technology actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, Dimension Computer Technology's impressive interest cover implies it has the upper hand on its debt. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. It looks Dimension Computer Technology has no trouble standing on its own two feet, and it has no reason to fear its lenders. For investing nerds like us its balance sheet is almost charming. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Dimension Computer Technology is showing 2 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Dimension Computer Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6140

Dimension Computer Technology

Provides software and hardware systems for corporate customers in Taiwan and the Mainland China.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.