- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5356

Does Sirtec InternationalLtd's (GTSM:5356) Statutory Profit Adequately Reflect Its Underlying Profit?

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Sirtec InternationalLtd's (GTSM:5356) statutory profits are a good guide to its underlying earnings.

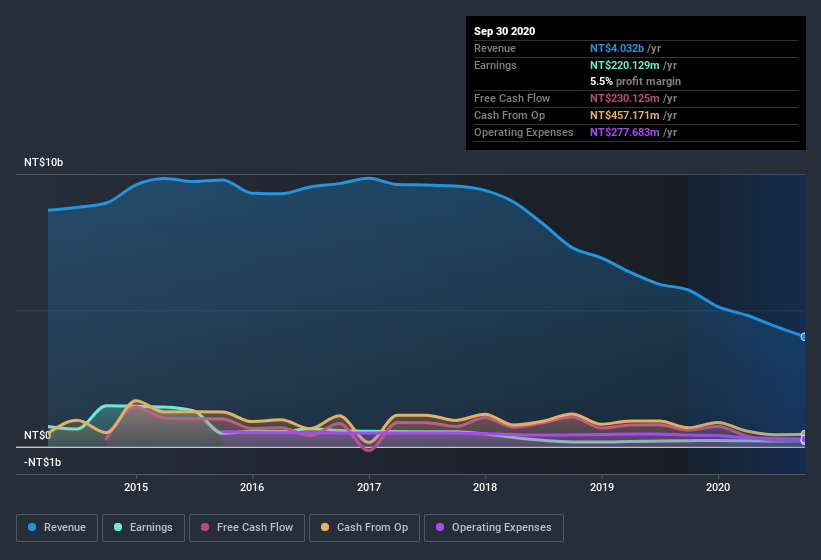

We like the fact that Sirtec InternationalLtd made a profit of NT$220.1m on its revenue of NT$4.03b, in the last year. In the last few years both its revenue and its profit have fallen, as you can see in the chart below.

Check out our latest analysis for Sirtec InternationalLtd

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Therefore, we think it makes sense to note and understand the impact that a tax benefit has had on Sirtec InternationalLtd's statutory profit in the last twelve months. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sirtec InternationalLtd.

An Unusual Tax Situation

Sirtec InternationalLtd reported a tax benefit of NT$51m, which is well worth noting. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Sirtec InternationalLtd's Profit Performance

Sirtec InternationalLtd reported that it received a tax benefit, rather than paid tax, in its last report. Given that sort of benefit is not recurring, a focus on the statutory profit might make the company seem better than it really is. Because of this, we think that it may be that Sirtec InternationalLtd's statutory profits are better than its underlying earnings power. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Sirtec InternationalLtd as a business, it's important to be aware of any risks it's facing. To that end, you should learn about the 3 warning signs we've spotted with Sirtec InternationalLtd (including 1 which can't be ignored).

This note has only looked at a single factor that sheds light on the nature of Sirtec InternationalLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Sirtec InternationalLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5356

Sirtec InternationalLtd

Designs, manufactures, and sells electronic product assemblies, and plastic injection and molding products in Taiwan and China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion