- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3508

Did You Miss Ways Technical's (GTSM:3508) 80% Share Price Gain?

It might be of some concern to shareholders to see the Ways Technical Corp., Ltd. (GTSM:3508) share price down 16% in the last month. But at least the stock is up over the last five years. However we are not very impressed because the share price is only up 80%, less than the market return of 130%. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 45% decline over the last three years: that's a long time to wait for profits.

See our latest analysis for Ways Technical

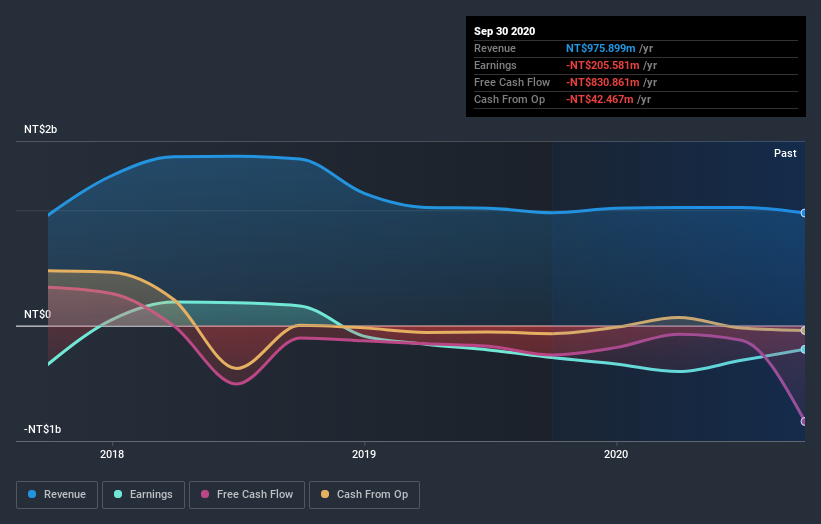

Ways Technical isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Ways Technical saw its revenue shrink by 18% per year. The stock is only up 12% for each year during the period. Arguably that's not bad given the soft revenue and loss-making position. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Ways Technical's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 38% in the last year, Ways Technical shareholders lost 4.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Ways Technical is showing 3 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Ways Technical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ways Technical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3508

Ways Technical

Manufactures and processes plastic daily necessities, surface treatment products, and products related to electronic components in Taiwan, China, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives