Is There More To The Story Than Syscom Computer Engineering's (TPE:2453) Earnings Growth?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Syscom Computer Engineering (TPE:2453).

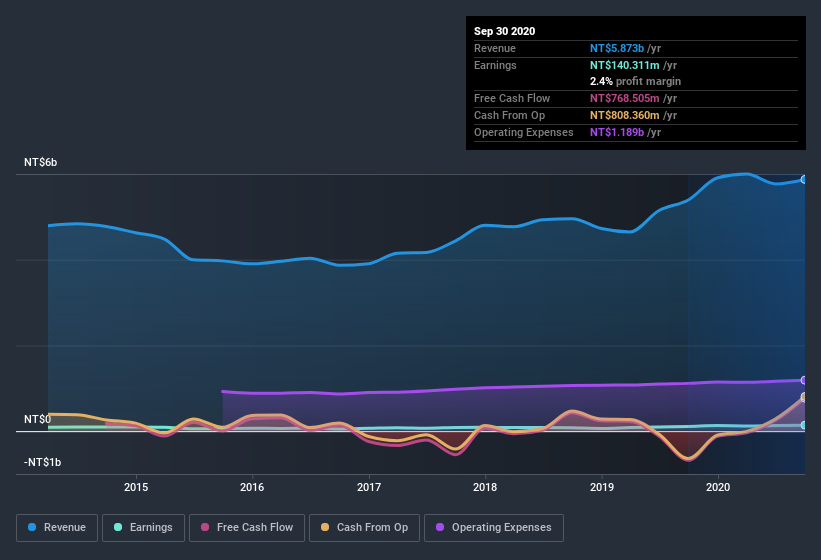

It's good to see that over the last twelve months Syscom Computer Engineering made a profit of NT$140.3m on revenue of NT$5.87b. In the chart below, you can see that its profit and revenue have both grown over the last three years.

View our latest analysis for Syscom Computer Engineering

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Therefore, we think it's worth taking a closer look at Syscom Computer Engineering's cashflow, as well as examining the impact that unusual items have had on its reported profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Syscom Computer Engineering.

A Closer Look At Syscom Computer Engineering's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to September 2020, Syscom Computer Engineering recorded an accrual ratio of -0.32. Therefore, its statutory earnings were very significantly less than its free cashflow. To wit, it produced free cash flow of NT$769m during the period, dwarfing its reported profit of NT$140.3m. Given that Syscom Computer Engineering had negative free cash flow in the prior corresponding period, the trailing twelve month resul of NT$769m would seem to be a step in the right direction. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

How Do Unusual Items Influence Profit?

Surprisingly, given Syscom Computer Engineering's accrual ratio implied strong cash conversion, its paper profit was actually boosted by NT$22m in unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Syscom Computer Engineering's Profit Performance

Syscom Computer Engineering's profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. Considering all the aforementioned, we'd venture that Syscom Computer Engineering's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that Syscom Computer Engineering has 2 warning signs and it would be unwise to ignore these.

Our examination of Syscom Computer Engineering has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Syscom Computer Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2453

Syscom Computer Engineering

Provides information technology services in Taiwan, China, the United States, and Southeast Asia.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion