High Growth Tech And 2 Other Innovative Stocks With Strong Prospects

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and competitive pressures in the AI sector, investors are closely watching key indices like the Nasdaq Composite, which recently experienced volatility due to emerging technologies. Amidst these dynamic conditions, identifying stocks with strong growth potential involves looking for companies that can innovate and adapt to market changes while maintaining robust financial health.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1222 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Talant Optronics (Suzhou) (SZSE:301045)

Simply Wall St Growth Rating: ★★★★★☆

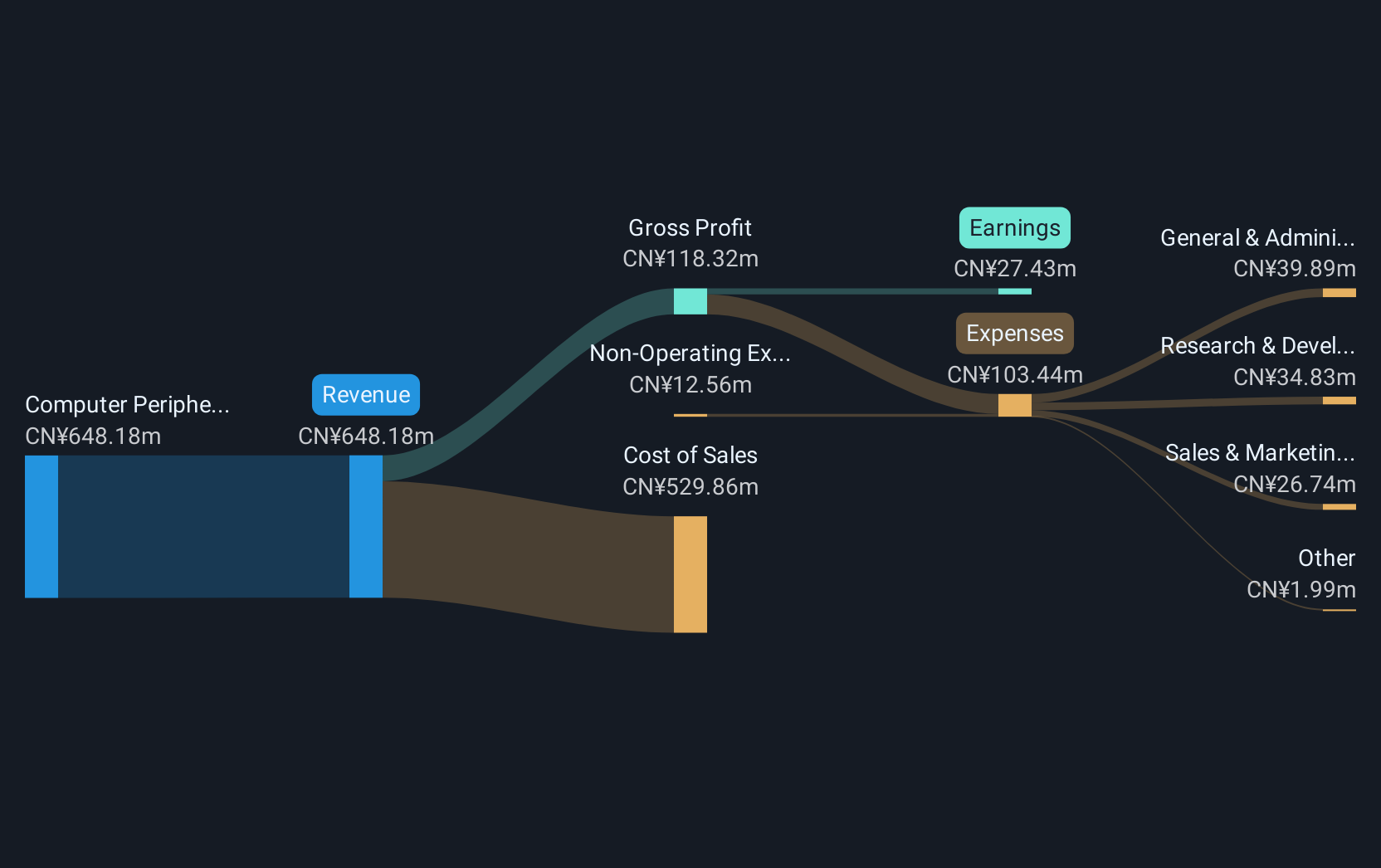

Overview: Talant Optronics (Suzhou) Co., Ltd. focuses on the research, development, production, and sale of photoelectric light guide plates and related components both in China and internationally, with a market cap of CN¥2.57 billion.

Operations: The company generates revenue primarily from the sale of photoelectric light guide plates and related components, with a significant portion coming from computer peripherals, contributing CN¥642.10 million.

Talant Optronics (Suzhou) is capturing attention with its robust financial performance, evidenced by a remarkable 866.5% surge in earnings over the past year and an annual revenue growth rate of 30.7%. This growth trajectory surpasses the broader Chinese market's average, positioning it well within the high-growth tech sector. Recent strategic moves, including a significant equity acquisition by Shanghai Fortune Asset Management and Fengchi Hengfeng for CNY 99.5 million, underscore investor confidence and potential for future expansion. Moreover, Talant's focus on R&D is evident from its commitment to reinvesting in innovation, crucial for maintaining its competitive edge in the fast-evolving tech landscape.

Brogent Technologies (TPEX:5263)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Brogent Technologies Inc. is a technology company that specializes in digital content creation services across Taiwan, Asia, Europe, the Americas, and other international markets, with a market cap of NT$10.17 billion.

Operations: Brogent Technologies generates revenue primarily from its entertainment software segment, amounting to NT$1.14 billion. The company operates in various international markets, focusing on digital content creation services.

Brogent Technologies has demonstrated a significant turnaround, with its recent earnings report highlighting a surge in sales to TWD 883.63 million from TWD 607.18 million year-over-year and a shift to net income of TWD 13.2 million from a net loss of TWD 108.58 million. This performance is underpinned by an impressive annual revenue growth forecast of 44.1% and earnings expected to grow by 102.15% per year, signaling strong upward momentum compared to the broader market's growth rates. The firm's strategic focus on R&D is likely enhancing its product offerings and competitive stance in the tech sector, crucial for sustaining long-term growth in this rapidly evolving industry landscape.

- Take a closer look at Brogent Technologies' potential here in our health report.

Gain insights into Brogent Technologies' past trends and performance with our Past report.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★☆☆

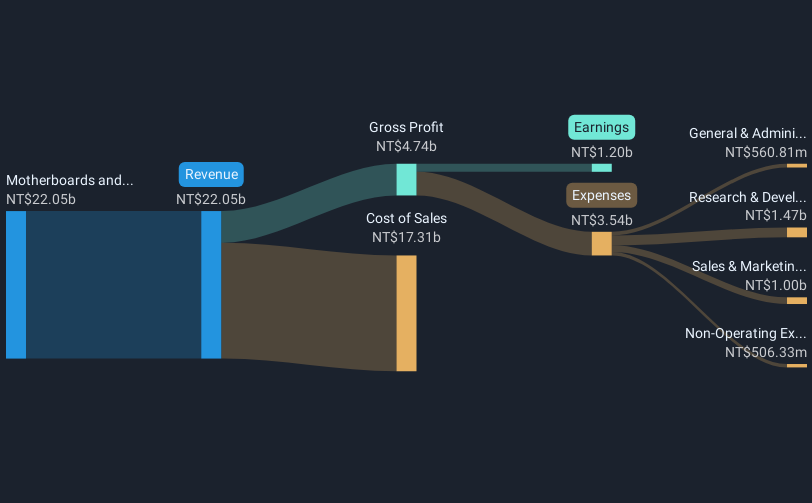

Overview: ASROCK Incorporation is a Taiwanese company specializing in the design, development, and sale of motherboards, with a market capitalization of NT$28.12 billion.

Operations: The company generates revenue primarily from the sale of motherboards, amounting to NT$22.05 billion.

With a robust annual revenue growth of 22.8% and earnings projected to increase by 19.1% per year, ASROCK Incorporation stands out in the tech sector. Recent special calls indicate active engagement with investors, potentially reflecting strategic shifts or updates. The company's commitment to innovation is evident from its R&D spending trends, crucial for maintaining competitiveness in a rapidly advancing industry. Although not leading the high-growth tech category outright, ASROCK's performance and strategic maneuvers suggest it is well-positioned to capitalize on market opportunities, supported by its significant earnings growth over the past year at 95.8%.

- Dive into the specifics of ASROCK Incorporation here with our thorough health report.

Assess ASROCK Incorporation's past performance with our detailed historical performance reports.

Taking Advantage

- Dive into all 1222 of the High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brogent Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5263

Brogent Technologies

A technology company, provides digital content creation services in Taiwan, Asia, Europe, the Americas, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion