As global markets navigate the early days of President Trump's administration, U.S. stocks are reaching new heights, buoyed by optimism around potential trade deals and AI investments. Amid this backdrop of economic activity and political developments, dividend stocks offer a compelling option for investors seeking stability and income in a fluctuating market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

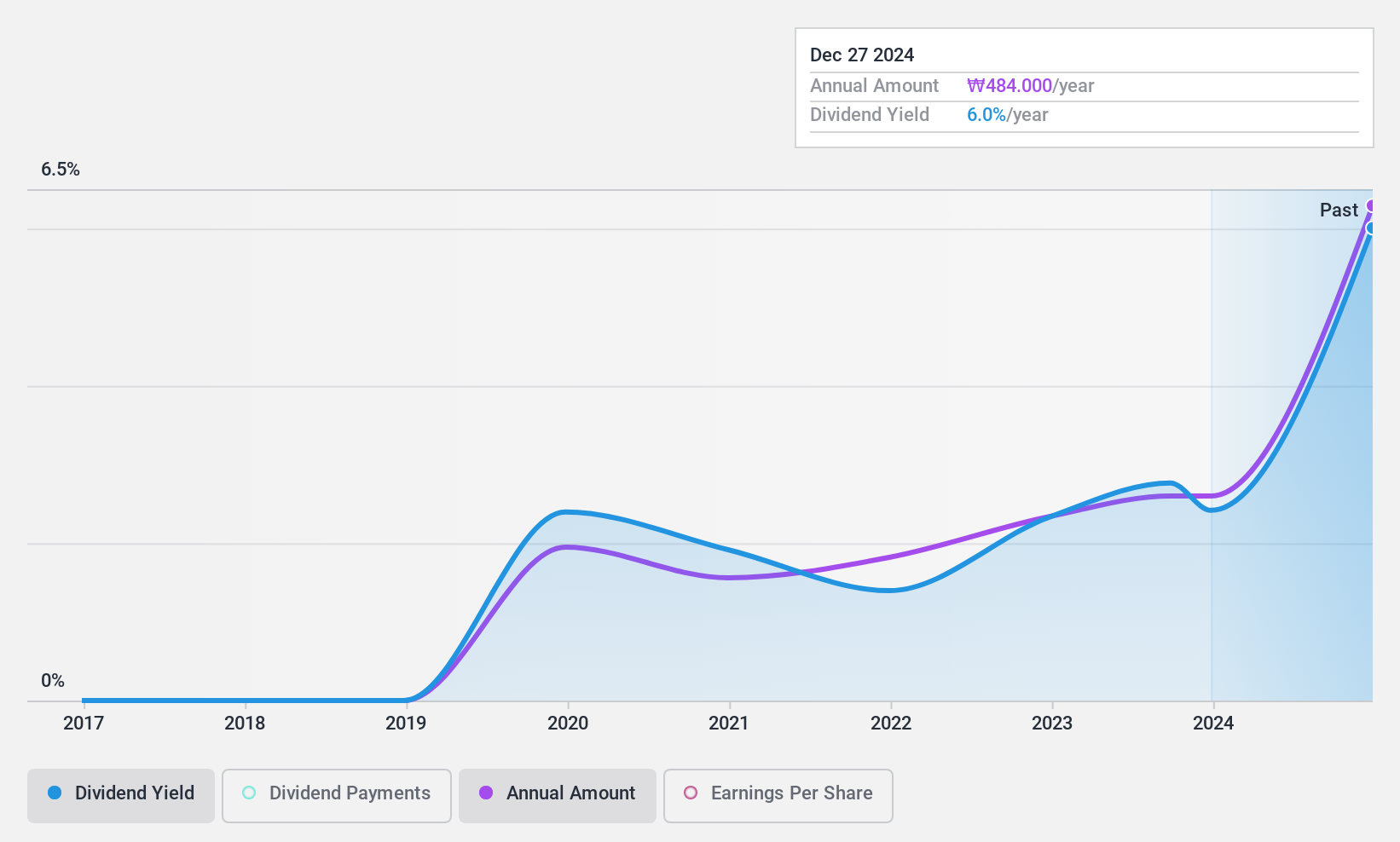

Asia Paper Manufacturing (KOSE:A002310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Paper Manufacturing Co., Ltd specializes in producing and selling industrial paper in South Korea, with a market cap of ₩304.08 billion.

Operations: Asia Paper Manufacturing Co., Ltd generates its revenue from the production and sale of specialized industrial paper in South Korea.

Dividend Yield: 6.4%

Asia Paper Manufacturing offers a dividend yield of 6.36%, placing it in the top 25% of dividend payers in the Korean market. The dividends are well-covered by earnings and cash flows, with payout ratios at 43.3% and 59.2%, respectively, although the company has an unstable track record over five years with volatility exceeding a 20% drop annually. Recent buyback activity aims to stabilize stock price and enhance shareholder value amidst declining profit margins from last year.

- Delve into the full analysis dividend report here for a deeper understanding of Asia Paper Manufacturing.

- Our comprehensive valuation report raises the possibility that Asia Paper Manufacturing is priced lower than what may be justified by its financials.

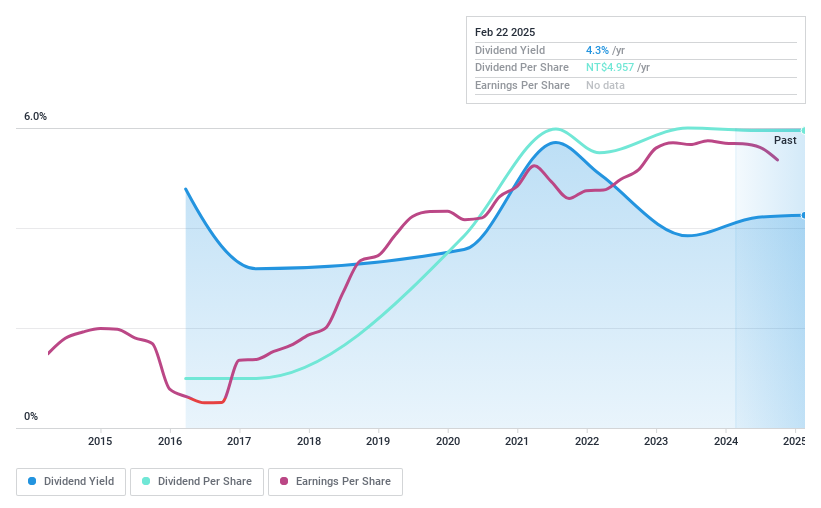

WITS (TPEX:4953)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WITS Corp., along with its subsidiaries, provides information technology services across Taiwan, Mainland China, Japan, the United States, and other international markets with a market capitalization of NT$7.66 billion.

Operations: WITS Corp.'s revenue is primarily derived from its Computer Services segment, which generated NT$9.99 billion.

Dividend Yield: 4.7%

WITS Corp. provides a dividend yield of 4.72%, ranking in the top 25% of TW market payers, with dividends well-covered by earnings and cash flows (payout ratios at 62.5% and 66.9%). Despite only nine years of payments, dividends have grown steadily with minimal volatility. The stock trades at good value, though recent earnings show decreased net income despite increased sales, highlighting potential challenges amidst high share price volatility over the past three months.

- Dive into the specifics of WITS here with our thorough dividend report.

- Our valuation report here indicates WITS may be undervalued.

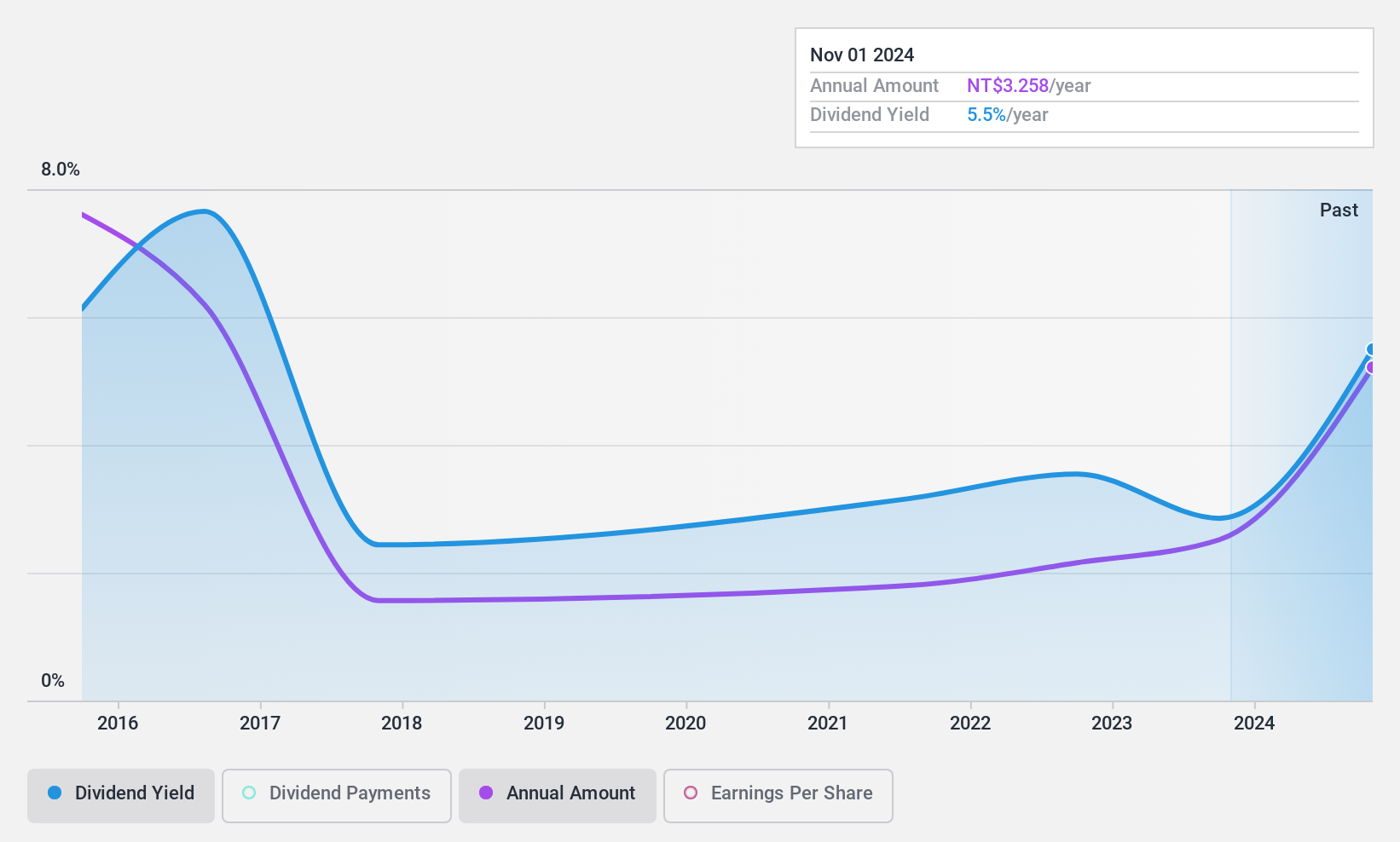

GeoVision (TWSE:3356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoVision Inc., along with its subsidiaries, operates as a digital and networked video surveillance company globally, with a market cap of approximately NT$3.98 billion.

Operations: GeoVision Inc.'s revenue is derived from several regions, with NT$591.95 million from Taiwan, NT$888.11 million from the United States, and NT$186.72 million from the Czech Republic.

Dividend Yield: 5.8%

GeoVision offers a dividend yield of 5.82%, placing it in the top 25% of TW market payers, with dividends covered by earnings (54% payout ratio) and cash flows (76.4% cash payout ratio). Despite high-quality earnings, its dividend track record is unstable and has been volatile over the past decade. Recent reports show decreased quarterly net income to TWD 13.28 million from TWD 30.31 million, though nine-month net income increased significantly to TWD 450.78 million.

- Click here to discover the nuances of GeoVision with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that GeoVision is trading beyond its estimated value.

Taking Advantage

- Unlock our comprehensive list of 1979 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WITS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4953

WITS

Provides information technology (IT) services in Taiwan, Mainland China, Japan, the United States, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives