Should eCloudvalley Digital Technology (GTSM:6689) Be Disappointed With Their 41% Profit?

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the eCloudvalley Digital Technology Co., Ltd. (GTSM:6689) share price is 41% higher than it was a year ago, much better than the market return of around 19% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! eCloudvalley Digital Technology hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for eCloudvalley Digital Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

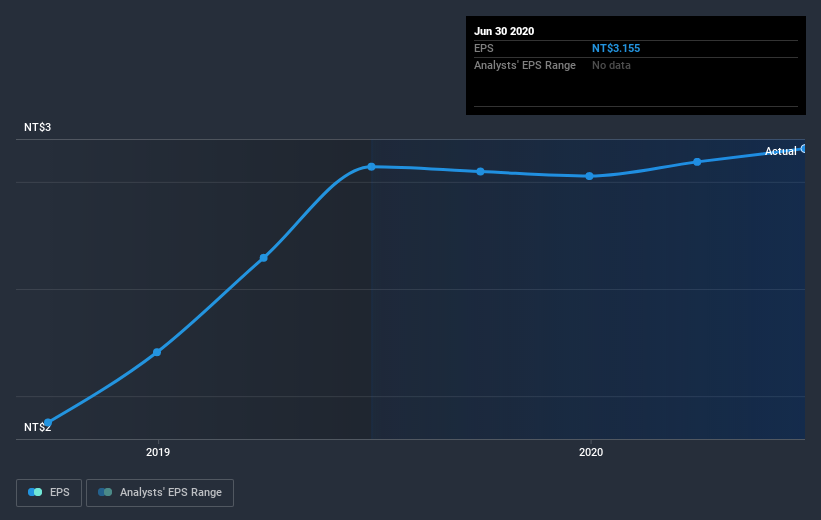

eCloudvalley Digital Technology was able to grow EPS by 2.8% in the last twelve months. This EPS growth is significantly lower than the 41% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago. The fairly generous P/E ratio of 53.88 also points to this optimism.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on eCloudvalley Digital Technology's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

eCloudvalley Digital Technology shareholders should be happy with the total gain of 41% over the last twelve months, including dividends. And the share price momentum remains respectable, with a gain of 15% in the last three months. This suggests the company is continuing to win over new investors. Before forming an opinion on eCloudvalley Digital Technology you might want to consider these 3 valuation metrics.

But note: eCloudvalley Digital Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade eCloudvalley Digital Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6689

eCloudvalley Digital Technology

eCloudvalley Digital Technology Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026