These 4 Measures Indicate That Interactive Digital Technologies (GTSM:6486) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Interactive Digital Technologies Inc. (GTSM:6486) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Interactive Digital Technologies

What Is Interactive Digital Technologies's Net Debt?

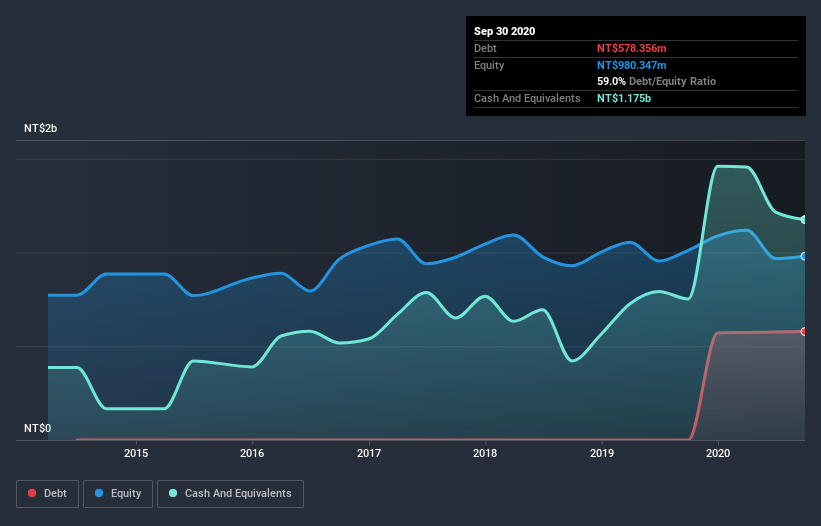

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Interactive Digital Technologies had NT$578.4m of debt, an increase on none, over one year. But on the other hand it also has NT$1.18b in cash, leading to a NT$597.1m net cash position.

How Healthy Is Interactive Digital Technologies' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Interactive Digital Technologies had liabilities of NT$1.21b due within 12 months and liabilities of NT$617.6m due beyond that. On the other hand, it had cash of NT$1.18b and NT$439.0m worth of receivables due within a year. So it has liabilities totalling NT$210.4m more than its cash and near-term receivables, combined.

Given Interactive Digital Technologies has a market capitalization of NT$2.89b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Interactive Digital Technologies also has more cash than debt, so we're pretty confident it can manage its debt safely.

The modesty of its debt load may become crucial for Interactive Digital Technologies if management cannot prevent a repeat of the 40% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Interactive Digital Technologies's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Interactive Digital Technologies may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, Interactive Digital Technologies recorded free cash flow worth 73% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Interactive Digital Technologies has NT$597.1m in net cash. The cherry on top was that in converted 73% of that EBIT to free cash flow, bringing in NT$68m. So we are not troubled with Interactive Digital Technologies's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Interactive Digital Technologies (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Interactive Digital Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6486

Interactive Digital Technologies

Provides telecom, media, information technology (IT) and cloud, and geographical information system related professional consulting and implementation services in Taiwan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion