Otsuka Information Technology Corp.'s (GTSM:3570) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

It is hard to get excited after looking at Otsuka Information Technology's (GTSM:3570) recent performance, when its stock has declined 3.4% over the past three months. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. In this article, we decided to focus on Otsuka Information Technology's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Otsuka Information Technology

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Otsuka Information Technology is:

21% = NT$142m ÷ NT$668m (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.21 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Otsuka Information Technology's Earnings Growth And 21% ROE

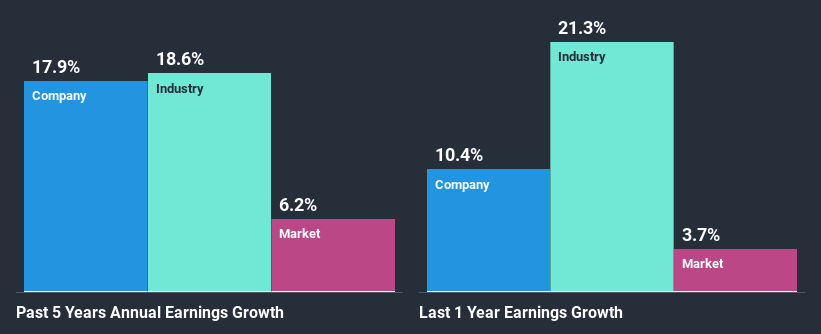

To begin with, Otsuka Information Technology has a pretty high ROE which is interesting. Second, a comparison with the average ROE reported by the industry of 17% also doesn't go unnoticed by us. This probably laid the groundwork for Otsuka Information Technology's moderate 18% net income growth seen over the past five years.

Next, on comparing Otsuka Information Technology's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 19% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Otsuka Information Technology fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Otsuka Information Technology Using Its Retained Earnings Effectively?

The high three-year median payout ratio of 63% (or a retention ratio of 37%) for Otsuka Information Technology suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Additionally, Otsuka Information Technology has paid dividends over a period of seven years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

In total, we are pretty happy with Otsuka Information Technology's performance. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Otsuka Information Technology and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you’re looking to trade Otsuka Information Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3570

Otsuka Information Technology

Designs, trades, maintains, imports, and exports hardware, software, computers, networks, and accessories in Taiwan and China.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives