- Taiwan

- /

- Semiconductors

- /

- TWSE:8104

Even after rising 11% this past week, RiTdisplay (TWSE:8104) shareholders are still down 18% over the past five years

While it may not be enough for some shareholders, we think it is good to see the RiTdisplay Corporation (TWSE:8104) share price up 15% in a single quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 35%, which falls well short of the return you could get by buying an index fund.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for RiTdisplay

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

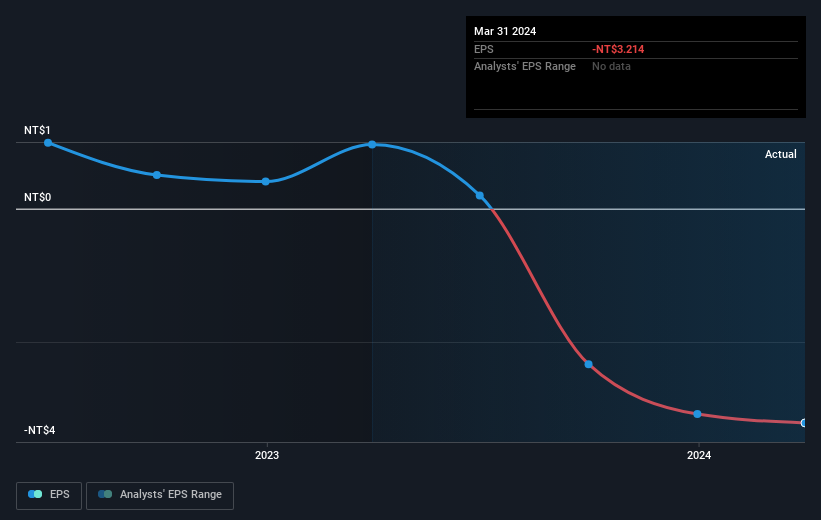

Over five years RiTdisplay's earnings per share dropped significantly, falling to a loss, with the share price also lower. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on RiTdisplay's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between RiTdisplay's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that RiTdisplay's TSR, which was a 18% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

RiTdisplay shareholders are down 2.5% for the year, but the market itself is up 38%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 3% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand RiTdisplay better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with RiTdisplay (including 1 which is concerning) .

We will like RiTdisplay better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8104

RiTdisplay

Engages in the research, development, and manufacturing of organic light-emitting diodes and related products in Taiwan and internationally.

Excellent balance sheet low.