- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3217

Hyundai Steel And Two Other Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across various sectors, with financials and energy shares gaining from deregulation hopes while healthcare faces setbacks. Amidst these fluctuations, dividend stocks remain a focal point for investors seeking stability and income in their portfolios. In this context, Hyundai Steel and two other prominent dividend-paying companies offer potential opportunities to consider as part of a diversified investment approach.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

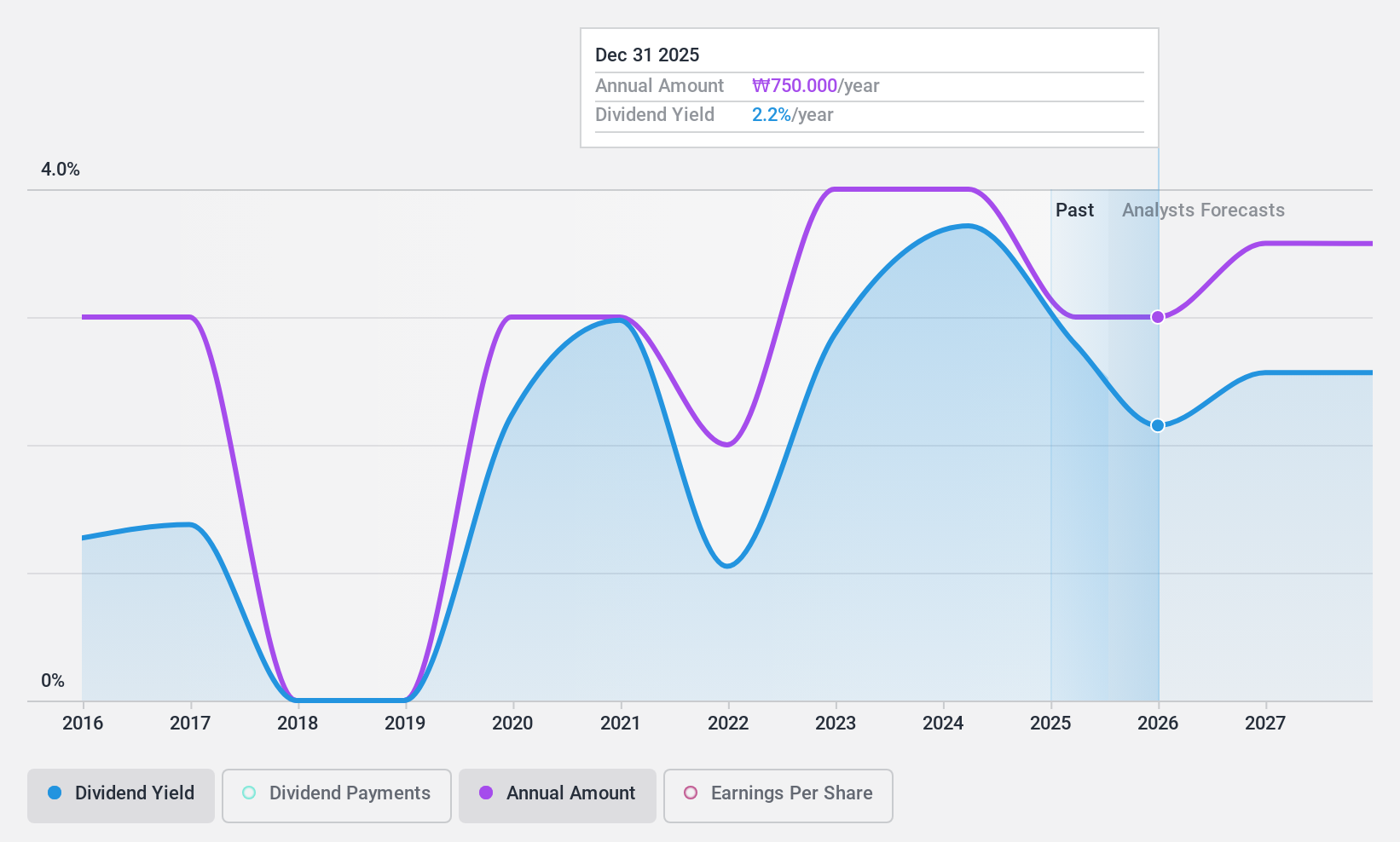

Hyundai Steel (KOSE:A004020)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Steel Company, along with its subsidiaries, manufactures and sells steel and other industrial metal products across Korea, the rest of Asia, the United States, and Europe, with a market cap of ₩2.87 trillion.

Operations: Hyundai Steel Company's revenue from its steel business amounts to ₩24.38 billion.

Dividend Yield: 4.6%

Hyundai Steel's dividend yield of 4.59% ranks in the top 25% in the KR market, yet its dividends are not covered by earnings and have been volatile over the past decade. Despite trading at a significant discount to estimated fair value, and having dividends well covered by cash flows due to a low cash payout ratio, the company's unprofitability raises concerns about dividend sustainability. Recent earnings calls may provide further insights into future performance.

- Take a closer look at Hyundai Steel's potential here in our dividend report.

- Our expertly prepared valuation report Hyundai Steel implies its share price may be lower than expected.

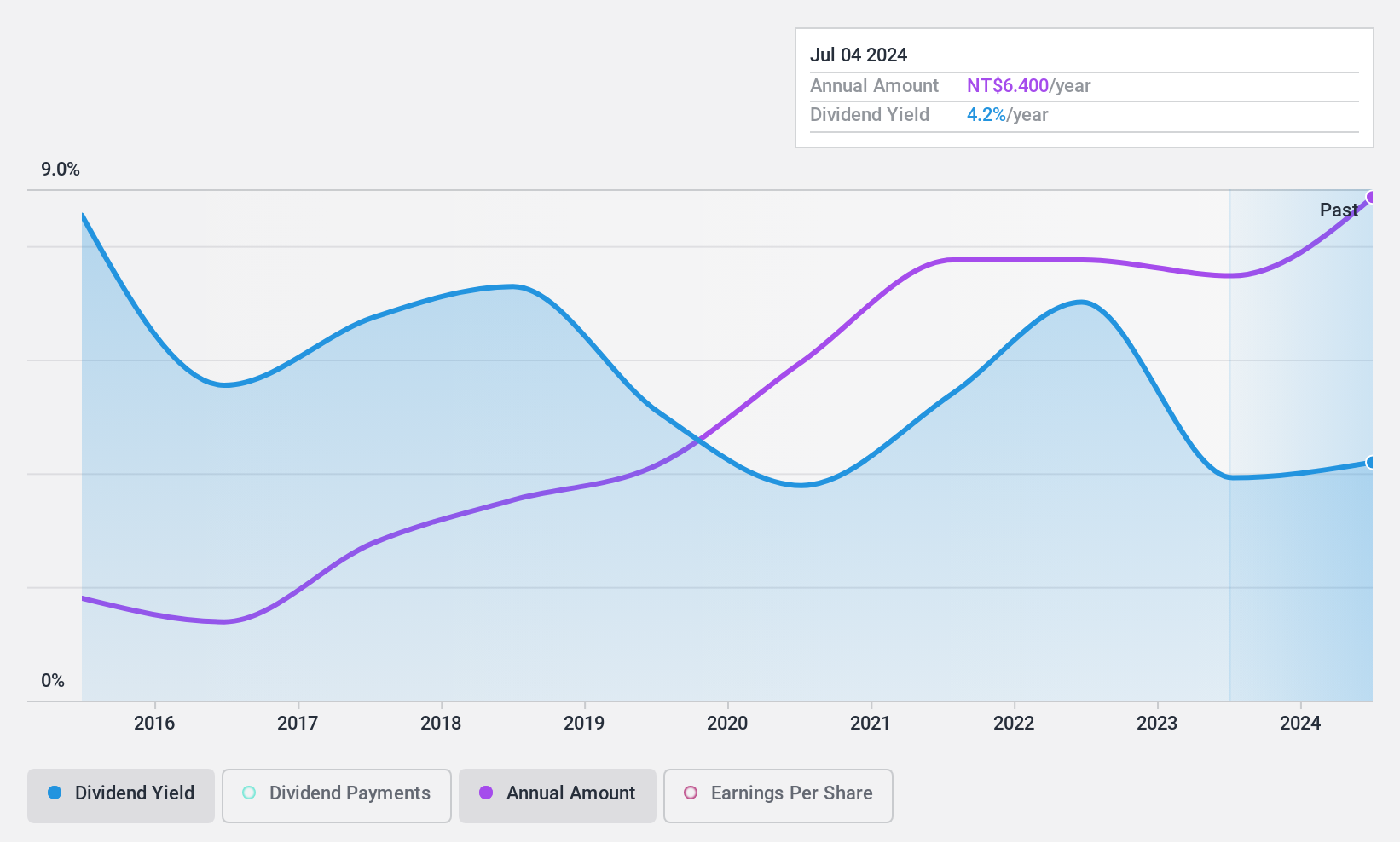

Argosy Research (TPEX:3217)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Argosy Research Inc. produces and sells electronic components, connectors, and system products across Asia, the United States, and internationally with a market cap of NT$13.65 billion.

Operations: Argosy Research Inc.'s revenue primarily comes from its manufacturing and sales of electronic component products, totaling NT$3.32 billion.

Dividend Yield: 4.2%

Argosy Research's dividends, despite increasing over the past decade, have been volatile and unreliable. The company's payout ratio of 64.2% suggests dividends are covered by earnings, while a cash payout ratio of 77.1% indicates coverage by cash flows. Recent earnings show strong growth with net income rising to TWD 314.74 million in Q3 2024 from TWD 286.59 million a year prior, potentially supporting future dividend stability amidst executive changes aimed at sustainable development.

- Click here to discover the nuances of Argosy Research with our detailed analytical dividend report.

- Our valuation report here indicates Argosy Research may be undervalued.

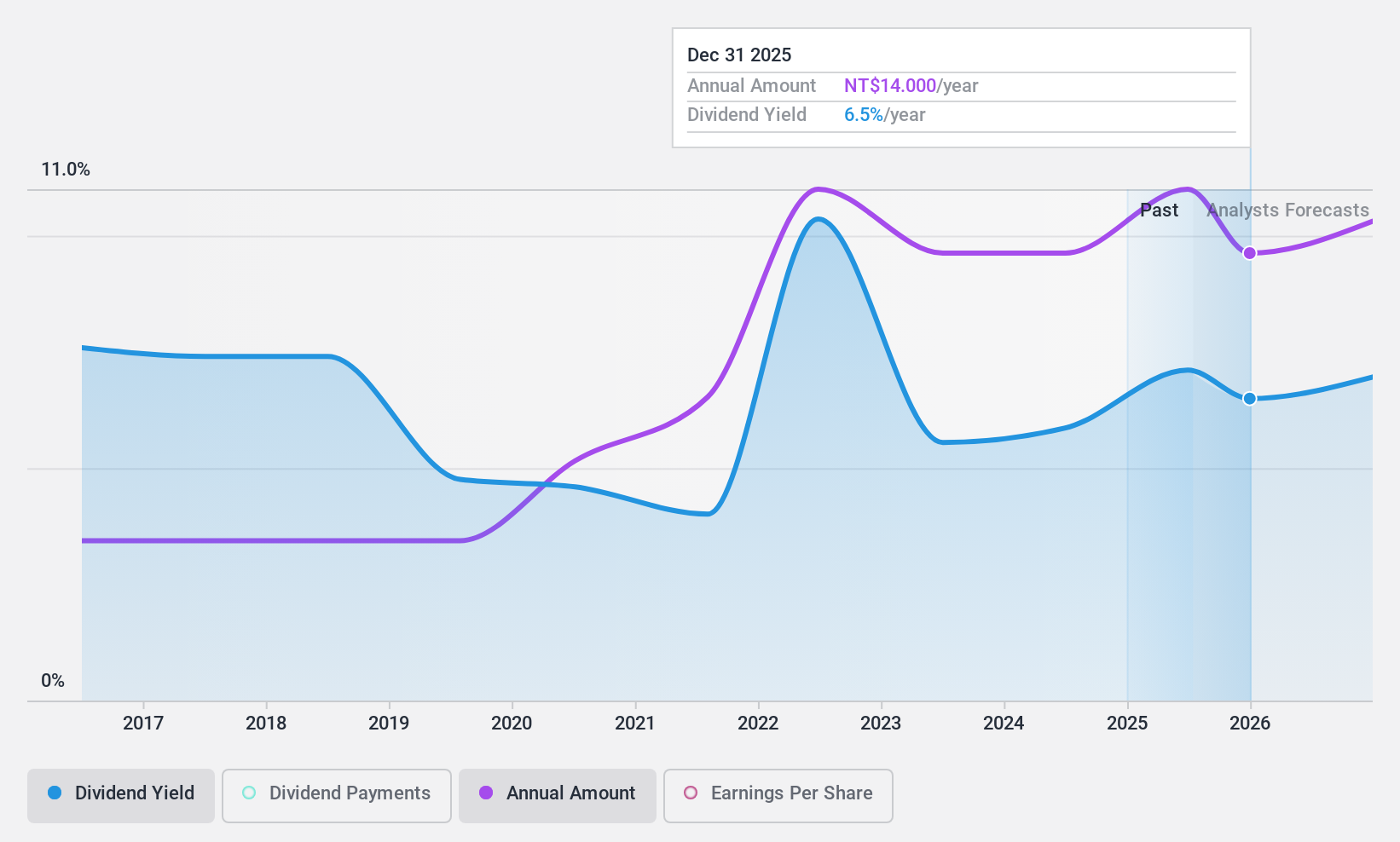

Global Mixed-Mode Technology (TWSE:8081)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Global Mixed-Mode Technology Inc. produces, manufactures, and sells digital and analog mixed integrated circuits in Taiwan and internationally, with a market cap of NT$19.67 billion.

Operations: Global Mixed-Mode Technology Inc. generates revenue from the production, manufacturing, and sales of digital and analog mixed integrated circuits both domestically in Taiwan and on an international scale.

Dividend Yield: 6.1%

Global Mixed-Mode Technology offers a high and stable dividend yield of 6.1%, ranking in the top 25% of Taiwanese dividend payers. The dividends are well-covered by earnings and cash flows, with payout ratios of 82.8% and 71.5%, respectively, ensuring sustainability. Despite recent declines in quarterly net income to TWD 414.17 million from TWD 521.79 million, the company maintains a favorable price-to-earnings ratio of 13.6x compared to the market average, supporting its value proposition for investors seeking reliable income streams.

- Unlock comprehensive insights into our analysis of Global Mixed-Mode Technology stock in this dividend report.

- The valuation report we've compiled suggests that Global Mixed-Mode Technology's current price could be quite moderate.

Where To Now?

- Explore the 1966 names from our Top Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3217

Argosy Research

Manufactures and sells of electronic components and connectors in Asia, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives