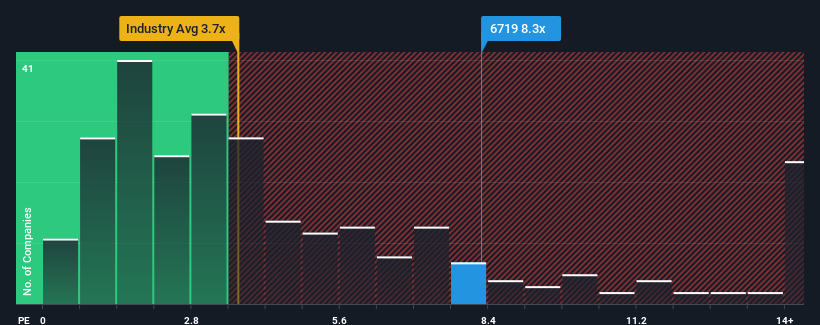

When close to half the companies in the Semiconductor industry in Taiwan have price-to-sales ratios (or "P/S") below 3.7x, you may consider uPI Semiconductor Corp. (TWSE:6719) as a stock to avoid entirely with its 8.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for uPI Semiconductor

What Does uPI Semiconductor's Recent Performance Look Like?

uPI Semiconductor could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think uPI Semiconductor's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For uPI Semiconductor?

uPI Semiconductor's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 36% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 27% as estimated by the six analysts watching the company. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that uPI Semiconductor's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting uPI Semiconductor's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for uPI Semiconductor that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if uPI Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6719

uPI Semiconductor

Primarily engaged in design, researching, developing, and selling of various integrated circuits in Taiwan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives