- Taiwan

- /

- Semiconductors

- /

- TWSE:6515

WinWay Technology Co., Ltd.'s (TWSE:6515) 29% Jump Shows Its Popularity With Investors

WinWay Technology Co., Ltd. (TWSE:6515) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 27%.

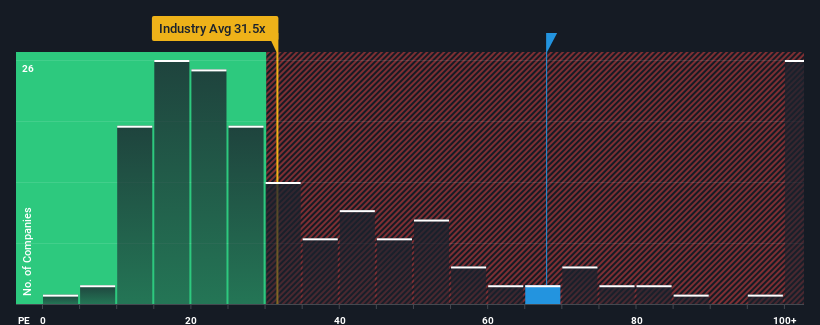

Since its price has surged higher, WinWay Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 67.8x, since almost half of all companies in Taiwan have P/E ratios under 23x and even P/E's lower than 15x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

WinWay Technology has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for WinWay Technology

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, WinWay Technology would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 58%. This means it has also seen a slide in earnings over the longer-term as EPS is down 23% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 108% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 25% growth forecast for the broader market.

With this information, we can see why WinWay Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

WinWay Technology's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of WinWay Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for WinWay Technology you should be aware of, and 1 of them is significant.

If these risks are making you reconsider your opinion on WinWay Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WinWay Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6515

WinWay Technology

Designs, processes, and sells optoelectronic product test fixtures, integrated circuit test interfaces, and fixtures and their components in Taiwan, the Americas, China, Asia, Europe, and Canada.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives