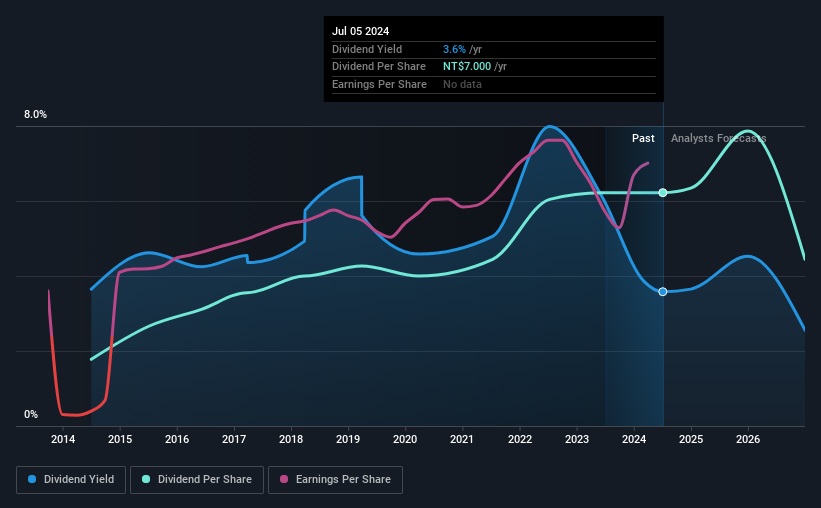

Powertech Technology Inc. (TWSE:6239) has announced that it will pay a dividend of NT$7.00 per share on the 5th of September. Based on this payment, the dividend yield will be 3.6%, which is fairly typical for the industry.

Check out our latest analysis for Powertech Technology

Powertech Technology's Dividend Is Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last dividend was quite easily covered by Powertech Technology's earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

The next year is set to see EPS grow by 54.8%. If the dividend continues on this path, the payout ratio could be 43% by next year, which we think can be pretty sustainable going forward.

Powertech Technology Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2014, the dividend has gone from NT$2.00 total annually to NT$7.00. This means that it has been growing its distributions at 13% per annum over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Has Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Powertech Technology has seen EPS rising for the last five years, at 8.4% per annum. The company is paying a reasonable amount of earnings to shareholders, and is growing earnings at a decent rate so we think it could be a decent dividend stock.

We Really Like Powertech Technology's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for Powertech Technology that investors should know about before committing capital to this stock. Is Powertech Technology not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6239

Powertech Technology

Researches, designs, develops, assembles, manufactures, packages, tests, and sells various integrated circuit (IC) products in Taiwan, Japan, Singapore, the United States, Europe, China, Hong Kong, Macao, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026