- Taiwan

- /

- Semiconductors

- /

- TWSE:6239

Powertech Technology Inc.'s (TWSE:6239) Shares Bounce 28% But Its Business Still Trails The Market

Powertech Technology Inc. (TWSE:6239) shareholders have had their patience rewarded with a 28% share price jump in the last month. The annual gain comes to 114% following the latest surge, making investors sit up and take notice.

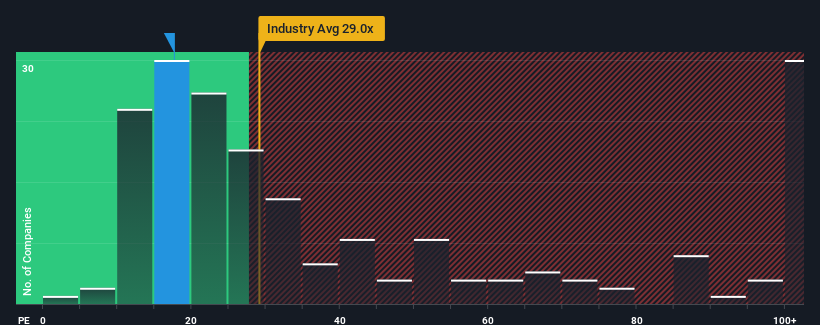

Even after such a large jump in price, Powertech Technology's price-to-earnings (or "P/E") ratio of 17.6x might still make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 23x and even P/E's above 39x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Powertech Technology has been doing a reasonable job lately as its earnings haven't declined as much as most other companies. It might be that many expect the comparatively superior earnings performance to degrade substantially, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. But at the very least, you'd be hoping that earnings don't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Powertech Technology

How Is Powertech Technology's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Powertech Technology's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 7.6% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings growth is heading into negative territory, declining 7.6% over the next year. Meanwhile, the broader market is forecast to expand by 23%, which paints a poor picture.

In light of this, it's understandable that Powertech Technology's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The latest share price surge wasn't enough to lift Powertech Technology's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Powertech Technology maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Powertech Technology that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6239

Powertech Technology

Researches, designs, develops, assembles, manufactures, packages, tests, and sells various integrated circuit (IC) products in Taiwan, Japan, Singapore, the United States, Europe, China, Hong Kong, Macao, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026