- Taiwan

- /

- Semiconductors

- /

- TWSE:5434

Best Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate through uncertainties such as tariff tensions and fluctuating economic indicators, investors are increasingly seeking stability in their portfolios. Amid these conditions, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

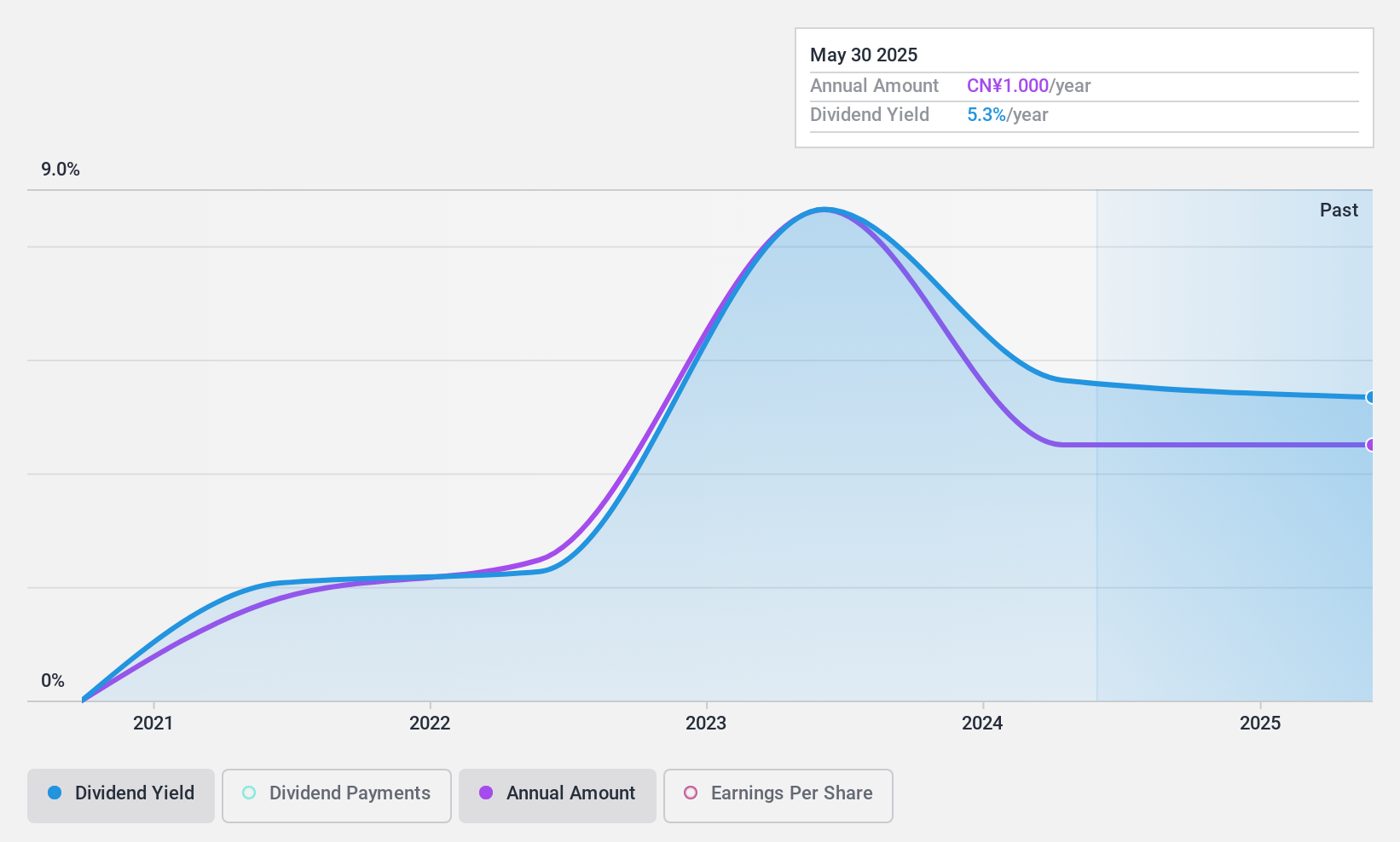

Zhejiang Jianye Chemical (SHSE:603948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jianye Chemical Co., Ltd. is involved in the research, development, production, and sales of fine chemical products in China with a market cap of CN¥3.01 billion.

Operations: Zhejiang Jianye Chemical Co., Ltd. generates its revenue through the research, development, production, and sales of fine chemical products within China.

Dividend Yield: 5.4%

Zhejiang Jianye Chemical's dividend yield is notable, ranking in the top 25% of CN market payers. The dividend is well-covered by earnings and cash flows, with payout ratios of 66% and 48.5%, respectively. However, the company's track record is unstable due to only four years of payments and volatility exceeding a 20% annual drop. Despite trading at a discount to its estimated fair value, investors should weigh these factors carefully when considering it for dividends.

- Dive into the specifics of Zhejiang Jianye Chemical here with our thorough dividend report.

- The valuation report we've compiled suggests that Zhejiang Jianye Chemical's current price could be quite moderate.

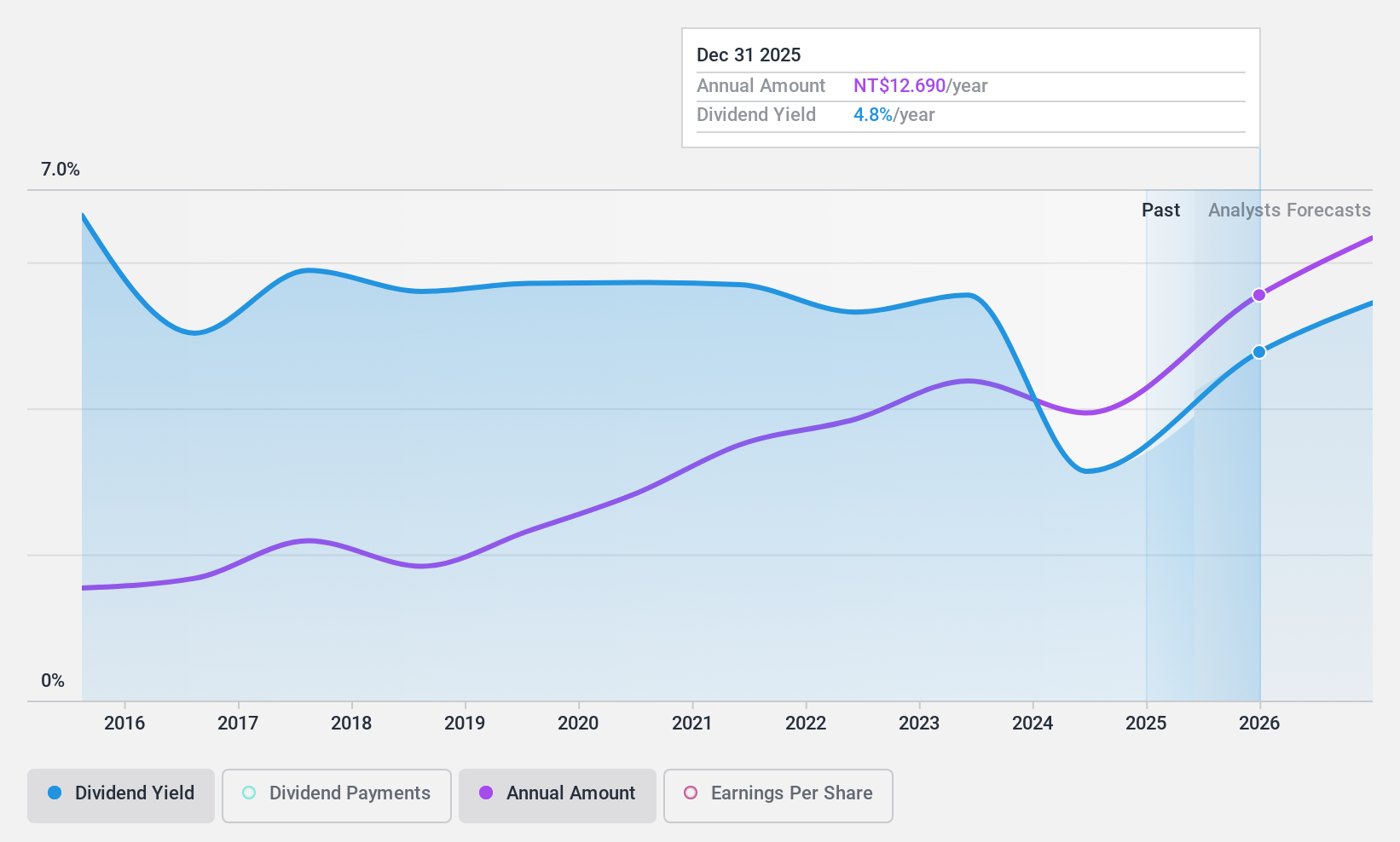

Topco ScientificLtd (TWSE:5434)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Topco Scientific Ltd. supplies precision materials, manufacturing equipment, and components to the semiconductor, LCD, and LED industries in Taiwan, China, and globally with a market cap of NT$55.21 billion.

Operations: Topco Scientific Ltd.'s revenue is primarily derived from its Semiconductor and Electronic Materials Business Department, which accounts for NT$45.70 billion, followed by the Environmental Engineering Division contributing NT$6.85 billion.

Dividend Yield: 3.1%

Topco Scientific Ltd. offers stable dividends with a history of growth over the past decade, though its current yield of 3.08% is below the top tier in Taiwan's market. While earnings cover dividend payments due to a reasonable payout ratio, high cash payout ratios indicate poor coverage by free cash flows, raising sustainability concerns. Despite these issues, the stock trades at a favorable value compared to peers and industry benchmarks.

- Click here and access our complete dividend analysis report to understand the dynamics of Topco ScientificLtd.

- The analysis detailed in our Topco ScientificLtd valuation report hints at an deflated share price compared to its estimated value.

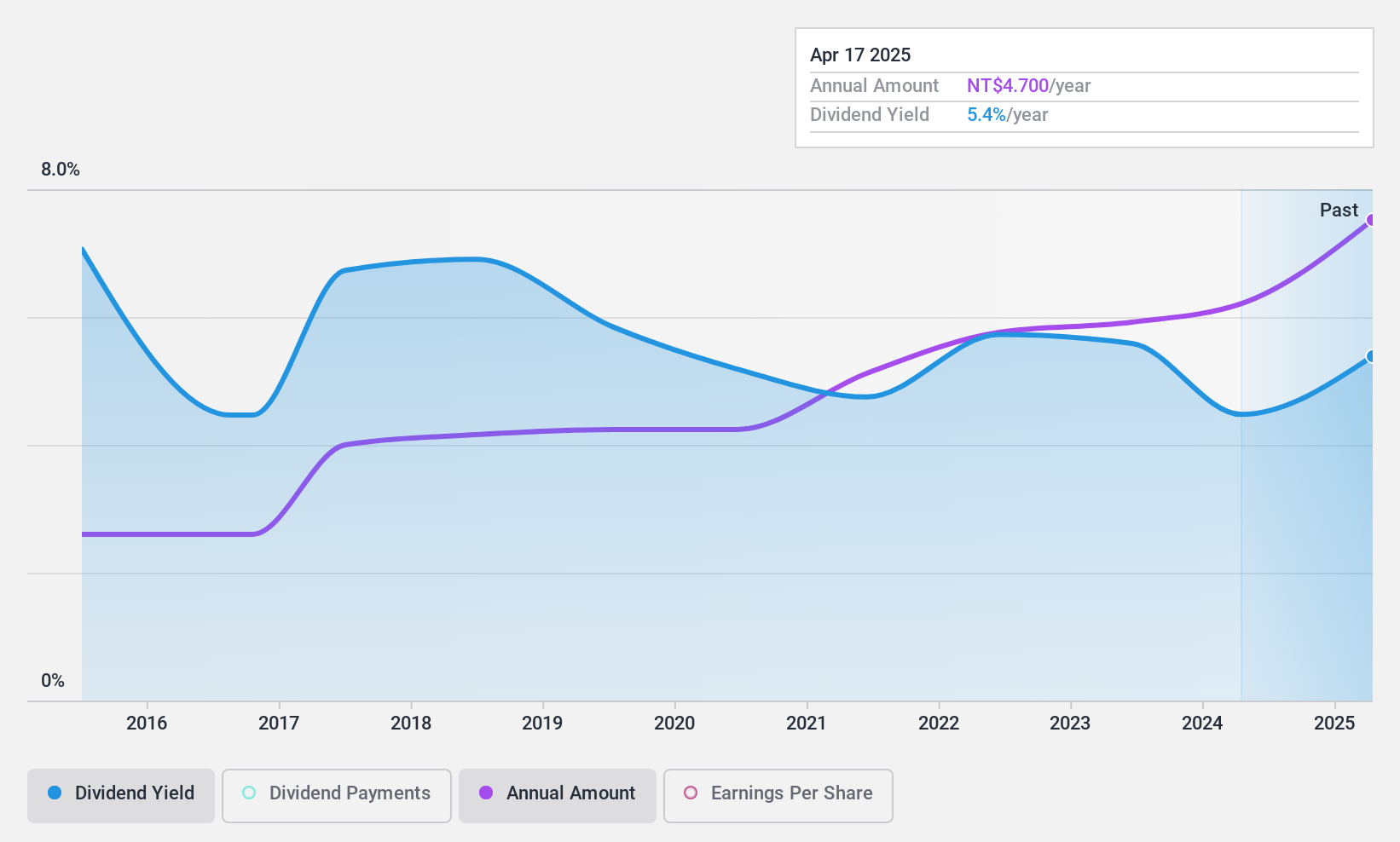

Taiwan Sakura (TWSE:9911)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Taiwan Sakura Corporation manufactures and sells kitchen appliances in Taiwan, with a market cap of NT$18.71 billion.

Operations: Taiwan Sakura Corporation generates revenue from its Kitchenware Division with NT$2.83 billion and Gas Appliance Division with NT$5.76 billion.

Dividend Yield: 4.5%

Taiwan Sakura Corporation's dividend yield of 4.53% is among the top 25% in Taiwan, with a stable and growing history over the past decade. Despite a reasonable payout ratio of 63.4%, dividends are not well covered by cash flows, indicating potential sustainability issues. The company's earnings have grown significantly by 35.1% year-on-year, and its price-to-earnings ratio of 14x suggests it is undervalued compared to the broader market at 21.1x.

- Navigate through the intricacies of Taiwan Sakura with our comprehensive dividend report here.

- Our valuation report here indicates Taiwan Sakura may be overvalued.

Make It Happen

- Discover the full array of 1960 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topco ScientificLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5434

Topco ScientificLtd

Provides precision materials, manufacturing equipment, and components worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives